Executive Summary

-

Emerging New Cycle in Commercial Real Estate: Core real estate has posted five consecutive quarters of positive returns, driven by consistent income returns and flat to modestly positive appreciation returns.

-

Solid Fundamentals Underpin NOI (Net Operating Income) Growth: Occupier demand remains resilient in most asset types and new supply is falling materially. Together, this should lead to declining vacancies and positive rent growth, supporting NOI expansion.

-

Structurally Driven Property Types are Expected to Outperform: Sectors driven by demographic shifts and innovation, particularly housing, industrial, and alternative sectors, are positioned for above-average performance; more differentiated performance by property type and geography should continue, signaling a more nuanced cycle going forward.

-

Public Market Pricing Support: The valuations of public REITs, which have often served as an early indicator for private commercial real estate trends, support a commencing cycle.

-

Resumption of Fed Rate Cuts Expected to Support Liquidity & Overall Economy: Easing by the Federal Reserve should lower borrowing rates and benefit investment returns which we expect to increase transaction volume.

-

Structural Benefits of Core: Core private real estate should serve as the foundation of investors’ portfolios, given its lower risk profile and strong risk-adjusted returns.

INTRODUCTION: A NEW, MORE NUANCED CYCLE HAS STARTED

Clarion believes that the U.S. commercial real estate market is embarking on a new cycle. Following a phase of re-pricing and adaptation to elevated interest rates, private real estate, as represented by the national NCREIF property index (NPI), has posted multiple consecutive quarters of stable values and positive investment performance driven by income. The cycle is underpinned by, on one hand, a potentially more favorable outlook for capital markets, as the Federal Reserve has resumed interest rate reductions. On the other hand, stabilizing and strengthening demand fundamentals, along with diminishing supply-side constraints, should further support the new cycle. Liquidity has returned to the debt markets, and investor sentiment appears to be improving, especially for the sectors that continue to demonstrate operating solidity and strength. Recent transaction trends indicate that institutional investment activity has improved, though only modestly so far, prompted by stabilized valuations, and debt availability.

Unlike previous recoveries that were broadly synchronized across property types and markets, this cycle is likely to be one of more meaningful divergence. Most office and many retail types face persistent weak demand and potential obsolescence, while housing (broadly), logistics, necessity-oriented retail, and healthcare sectors are benefiting from secular tailwinds like demographic shifts, a persistent housing shortage with poor affordability, the pace of innovation, and an evolving, more geographically dispersed knowledge economy. Investor behavior is shifting, with capital increasingly targeting sectors that demonstrate long-term thematic growth (many of which are alternative sectors).

COMMERCIAL REAL ESTATE VALUES HAVE STARTED TO RECOVER

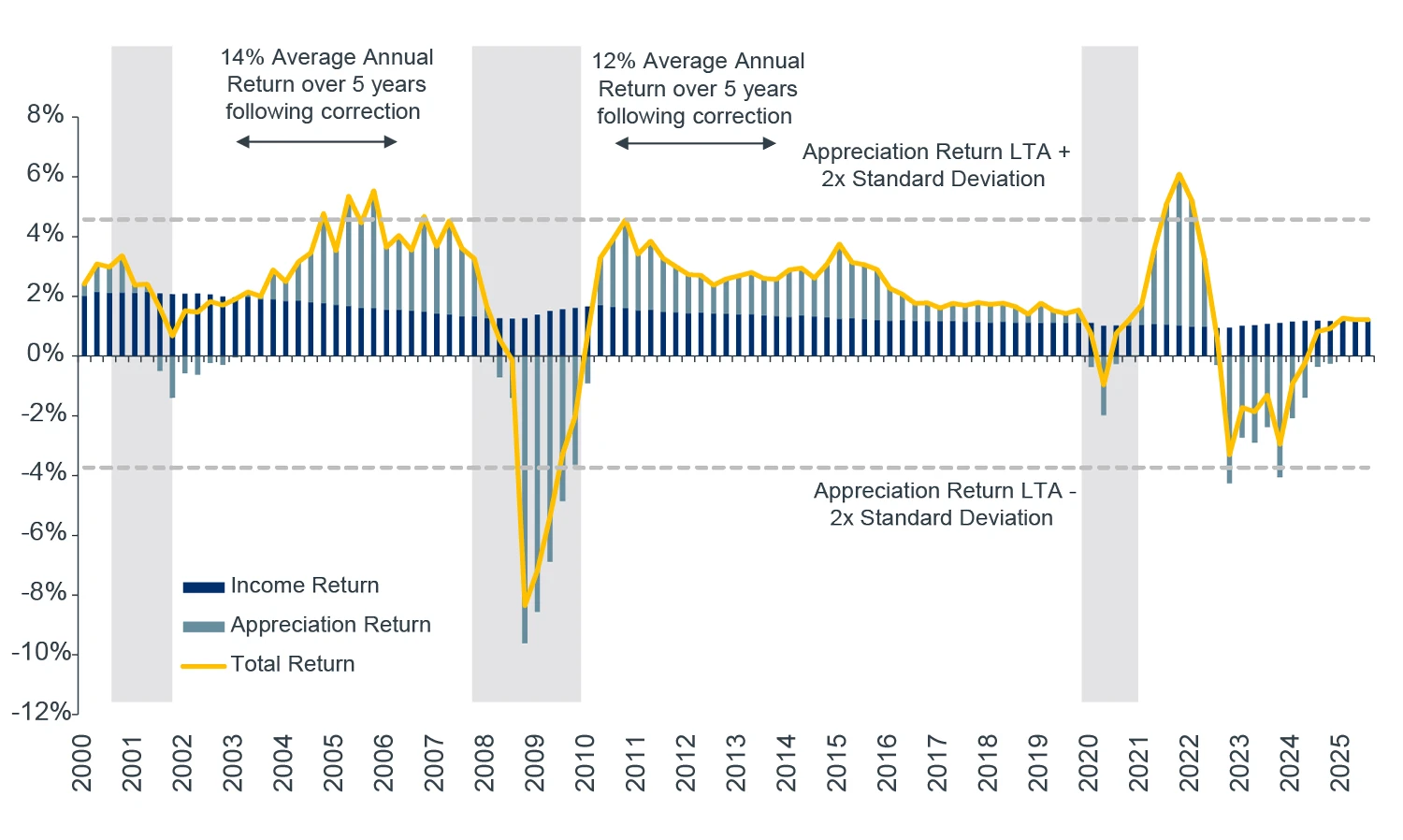

Following a cumulative value decline of 18.7% from peak to trough, property values in the Expanded NPI have stabilized, and total returns have been positive for five consecutive quarters through 3Q 2025. This has been driven primarily by income returns, with capital appreciation turning in flat to slightly positive returns (Figure 1).

FIGURE 1: NCREIF PROPERTY INDEX TOTAL RETURN BY QUARTER

Source: Moody’s Analytics, NCREIF, Clarion Partners Global Research, 3Q 2025. The Expanded NPI includes all NPI properties and all qualified alternative assets.

CYCLE WILL BE SUPPORTED BY STRONG FUNDAMENTALS & NOI OUTLOOK

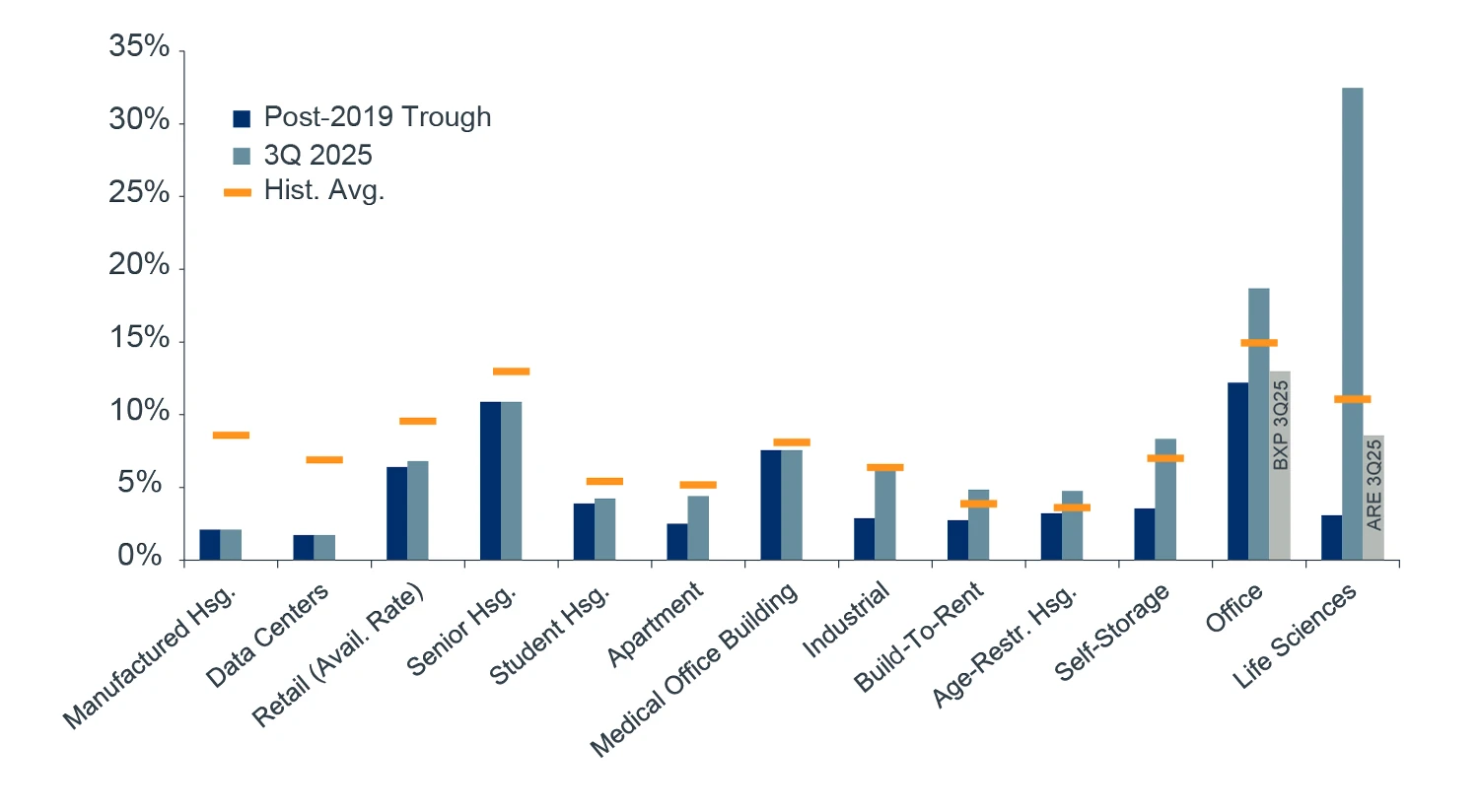

Notwithstanding a somewhat ambiguous economic backdrop and outlook, occupier demand remains resilient across most commercial real estate sectors, now further supported by a sharp pullback in new supply. Developers have sharply curtailed pipelines after the 2021–23 surge, while demand has remained resilient. The result is a backdrop in which occupancy levels are generally strong across most property types (Figure 2).

FIGURE 2: VACANCY RATE BY PROPERTY SECTOR

Source: CBRE-EA, Yardi Matrix, RealPage, NIC MAP, JLL, RevistaMed, CBRE, various REIT financial supplements, Clarion Partners Global Research, as of 3Q 2025. Note: Overall life sciences is limited to Boston, the Bay Area, and San Diego, data centers is limited to CBRE’s primary markets and is as of H1 2025, manufactured housing is limited to Sun Communities, and self-storage is limited to EXR, PSA, NSA, and CUBE. The current student vacancy rate is an estimate for 2024.

The interplay of resilient occupier demand with a notable pullback in new supply is creating a foundation for sustained positive NOI growth. And the NOI growth outlook looks particularly bright for sectors that are driven by structural demand shifts and are less vulnerable to cyclical ebbs and flows in the economy.

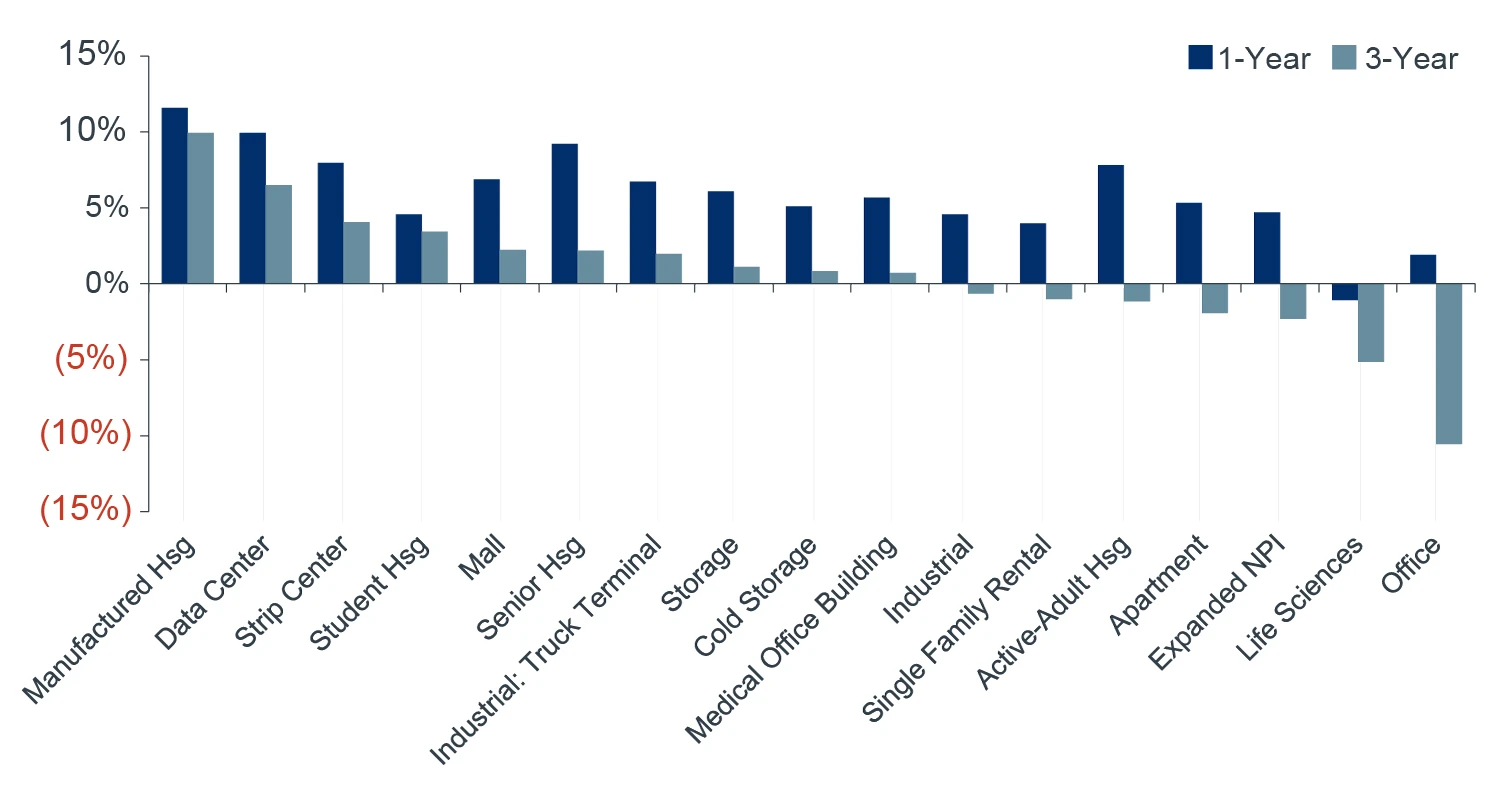

DIFFERENTIATED PERFORMANCE BY PROPERTY TYPE

Since 2017, there has been very significant variation in performance across property sectors with industrial and multifamily apartments vastly outperforming office and retail. In addition, over the past three years, the alternative sectors have, generally, outperformed traditional sectors, reinforcing their increasing strategic importance in institutional portfolios. Manufactured housing, data centers, senior housing, self-storage, and student housing have led the pack on a trailing one-year basis, while traditional office assets have continued to post negative returns (Figure 3). In our view, this reflects investor preference toward sectors that have benefited from structural tailwinds (demographics, innovation, and housing shortages) that are also likely to be at the forefront of the burgeoning cycle.

FIGURE 3: EXPANDED NPI HISTORICAL ANNUALIZED TOTAL RETURNS BY SECTOR

Source: NCREIF, Clarion Partners Global Research, 3Q 2025.

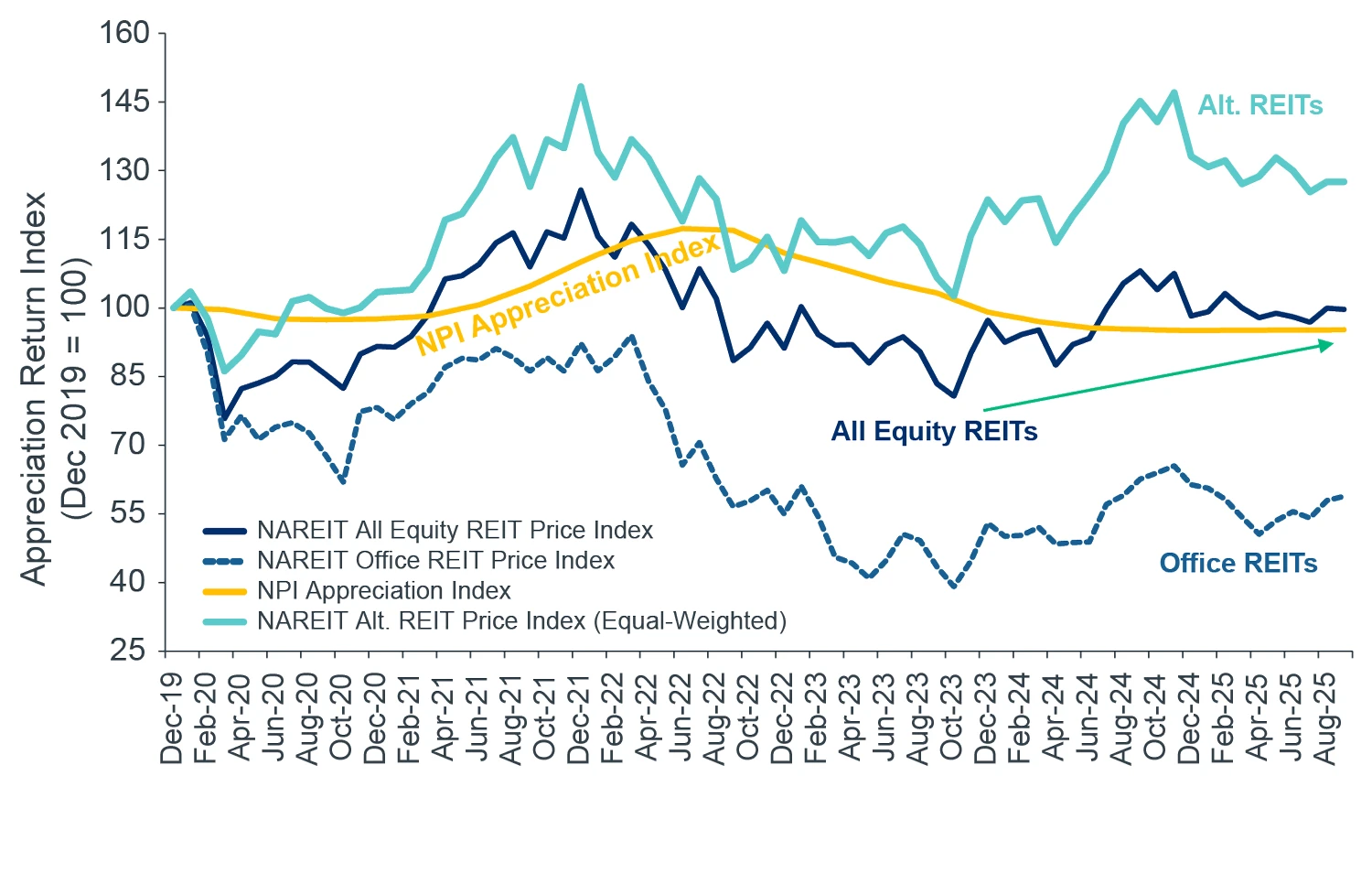

REIT MARKETS OFFER MORE EVIDENCE OF NEW CYCLE

The perspective that a new cycle is developing is further substantiated by recent performance trends among public REITs. Often serving as a leading indicator for valuations within private real estate, publicly traded REITs continue to post gains from post-pandemic lows. Historically, shifts in the public market are reflected in private CRE valuations with a two-to-three-quarter delay, and as Figure 4 shows, private values are trending upwards but still lag those of the public markets. The positive momentum observed in public REITs suggests that private CRE markets are recovering and should narrow the gap in the coming quarters.

FIGURE 4: PUBLIC REIT VS. PRIVATE MARKET PRICING INDEX

Source: NCREIF, NAREIT, Clarion Partners Global Research, 3Q 2025.

FED EASING SHOULD PROVIDE ADDITIONAL SUPPORT FOR THE CYCLE

After holding rates steady for several months, the Federal Reserve lowered benchmark interest rates in 2025 by 50 bps as of November 2025. Recent comments by Chairman Powell have reduced the probability for a third consecutive rate cut following the December FOMC meeting. However, market expectations are for an additional 25 bps cut before year-end and another 50 bps in 2026, implying that the federal funds rate stabilizes at around ~3−3.5% in the longer run.

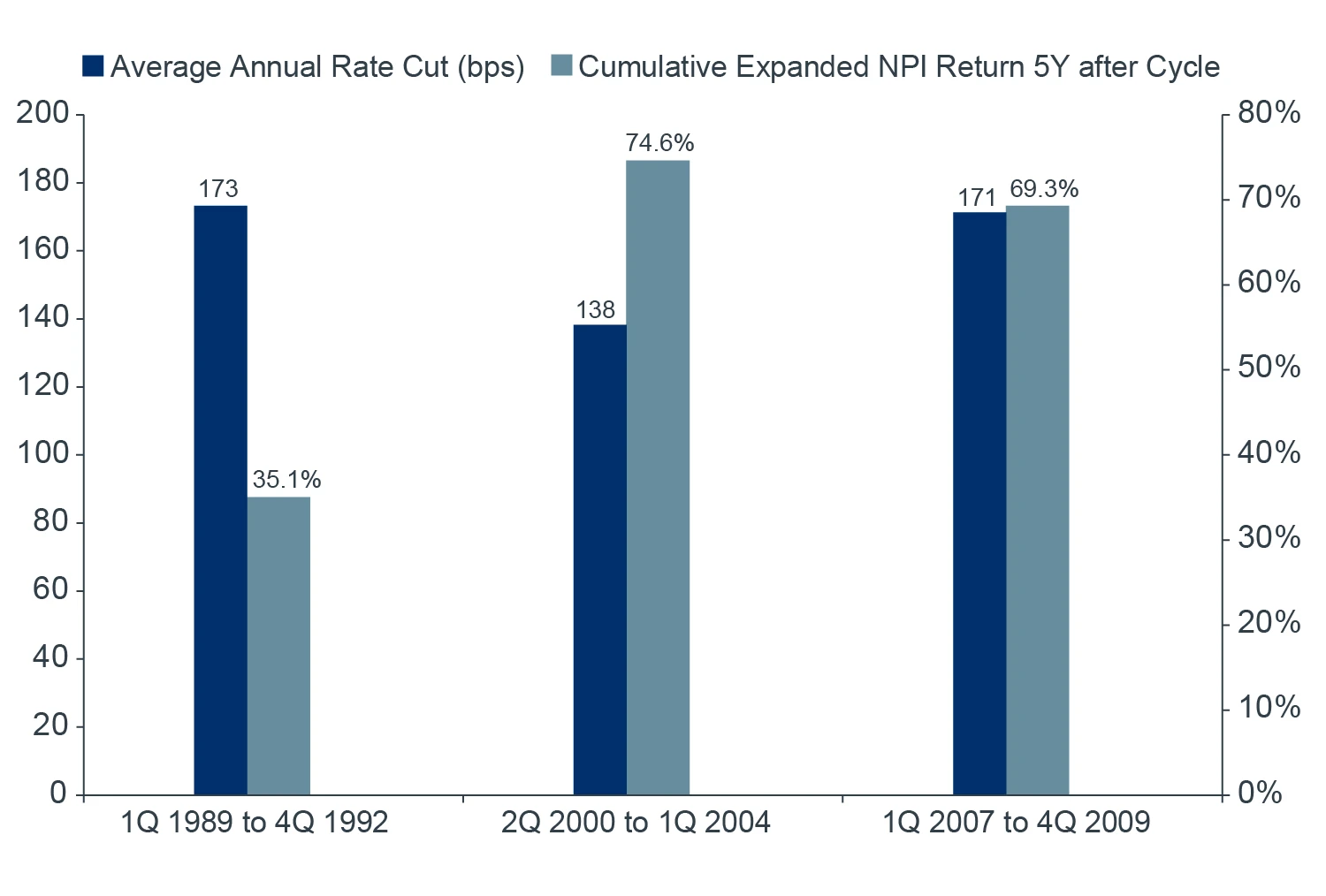

Major Fed rate-cutting cycles in the past 35 years offer perspective as to how CRE reacts once monetary policy turns accommodative. Generally speaking, in recent decades, core real estate has tended to respond positively after policy rate cuts (Figure 5).

FIGURE 5: EXPANDED NPI TOTAL RETURNS 5Y AFTER FED RATE CUTTING CYCLE

Source: NCREIF, St. Louis FRED, Clarion Partners Global Research, 3Q 2025. Note: Rate Cuts are based on Effective Federal Funds Rate; Total Returns 5Y after Fed Rate Cutting Cycle begins in the last quarter of the rate cutting cycle.

Past rate cutting cycles underscore two key themes: (1) lower interest rates ultimately unlock investment demand for real estate, but (2) the positive effects often lag the policy change and depend on economic conditions. On the latter, rate cuts could help alleviate some of the economic uncertainty that has resulted from weakening labor markets and growing consumer strain in light of higher inflation.

RATE CUTS COULD ALLEVIATE SOME UNCERTAINTY AND SUPPORT THE ECONOMY

Lower policy rates would likely ease overall financial conditions at a time when higher tariffs are increasing economic uncertainty, pushing up costs, and threatening household purchasing power. Cheaper credit could also cushion consumption by lowering interest expenses on variable-rate debt (e.g., credit cards, some auto and small business loans) and by lowering market rates tied to mortgages, which could help revive the stalled housing market. On the business side, rate cuts could reduce working capital and inventory financing costs precisely when input prices are rising, helping firms avoid abrupt cutbacks in hiring or production. A softer dollar that often accompanies rate cuts could also shift demand toward domestically produced goods by improving export competitiveness, partially offsetting the drag from more expensive imports.

That said, the Fed’s dual mandate will likely require it to balance supporting economic growth against upward inflationary pressure from tariffs. The easing process will work best if medium-term inflation expectations remain anchored and the cuts are instead framed as insurance against weaker demand. In short, judicious rate reductions could help to smooth the business cycle impact from tariffs, limit second-round damage to employment and investment, and, in the current context, provide a very helpful bulwark against potentially slowing growth.

IMPLICATIONS AND THE ROAD AHEAD

Historically, factors such as stabilizing values, restricted supply, and strengthening fundamentals have indicated the beginning of a new commercial real estate cycle — all factors that we believe are visible in the market today. The consistently positive total returns observed over the last five quarters, along with encouraging indicators from the public markets, further substantiate that a new cycle is commencing. Considering the varied impact of structural trends by property type, differentiated performance between sectors, as well as an evolving and uncertain policy environment, the recovery and growth trajectory will likely differ from previous cycles. Sectors within the housing, logistics, and healthcare umbrellas, in particular, (many of the alternative real estate sectors that are benefiting from secular tailwinds like demographic shifts, innovation, and the rise of the knowledge economy), should garner the strongest investor response.

Investors who identify and respond to these structural changes should be well positioned to achieve outperformance.

In a recovering real estate cycle, core private real estate should serve as the foundation of investors’ portfolios. As demonstrated in Figure 1 earlier in the paper, core real estate has repeatedly delivered attractive total returns, benefiting from rising occupancies and growing income streams coming out of downturns. Indeed, recent PREA research highlights the reliable performance of core real estate across market cycles.1 By anchoring real estate allocations to core strategies, investors have the platform to build resilient allocations to the sector and derive the holistic benefits of the asset class.