Commercial real estate demand and performance are driven by cyclical and structural factors. Cyclical factors, such as interest rates, consumer spending and employment, vary with economic cycles. Structural factors have a lasting impact on economic trends and offer real estate investors long-term opportunities for growth. Cyclical factors are more difficult to foresee and plan for; however structural factors, given their longer time frames and more observable patterns, can help investors make key strategic decisions.

Clarion Partners has identified demographics, innovation, globalization patterns, and housing as key themes that can help build resilient long-term real estate portfolios. These themes are powerful long-term catalysts for real estate demand and can offer investors a multitude of opportunities across different risk and return horizons. Importantly, we believe these themes harness some of the fundamental drivers of economic activity and will remain immutable as demand drivers for decades.

DEMOGRAPHICS: A FUNDAMENTAL DRIVER FOR REAL ESTATE

Demographics – population growth, age cohorts, and migration patterns – are important to the development of communities and economies and are a fundamental driver of commercial real estate demand. Trends in population growth, when combined with an analysis of different age structures, mobility and spending, allows real estate investors to identify current and future markets and property types with strong and resilient tenant demand characteristics.

Long-Term U.S. Population Dynamics Are Favorable

A key building block for commercial real estate is population growth and, in the U.S., the demographic outlook remains positive. The forecast for U.S. population growth indicates a continuation of the country’s steady but gradually slowing population increase. While the United States has historically experienced robust population growth, particularly in the 20th century, the pace is expected to moderate in the coming decades. Despite this deceleration, forecasts from the U.S. Census Bureau estimate the U.S. population will grow by 79 million people, or 19%, from 2020 to 2060, reaching 404 million by the end of the period. This growth is driven by both a natural increase and immigration. This makes the U.S. one of the rare, developed economies with a positively sloping population outlook, providing a favorable backdrop for commercial real estate investments.

The U.S. Has Distinct Demographic “Cohorts”

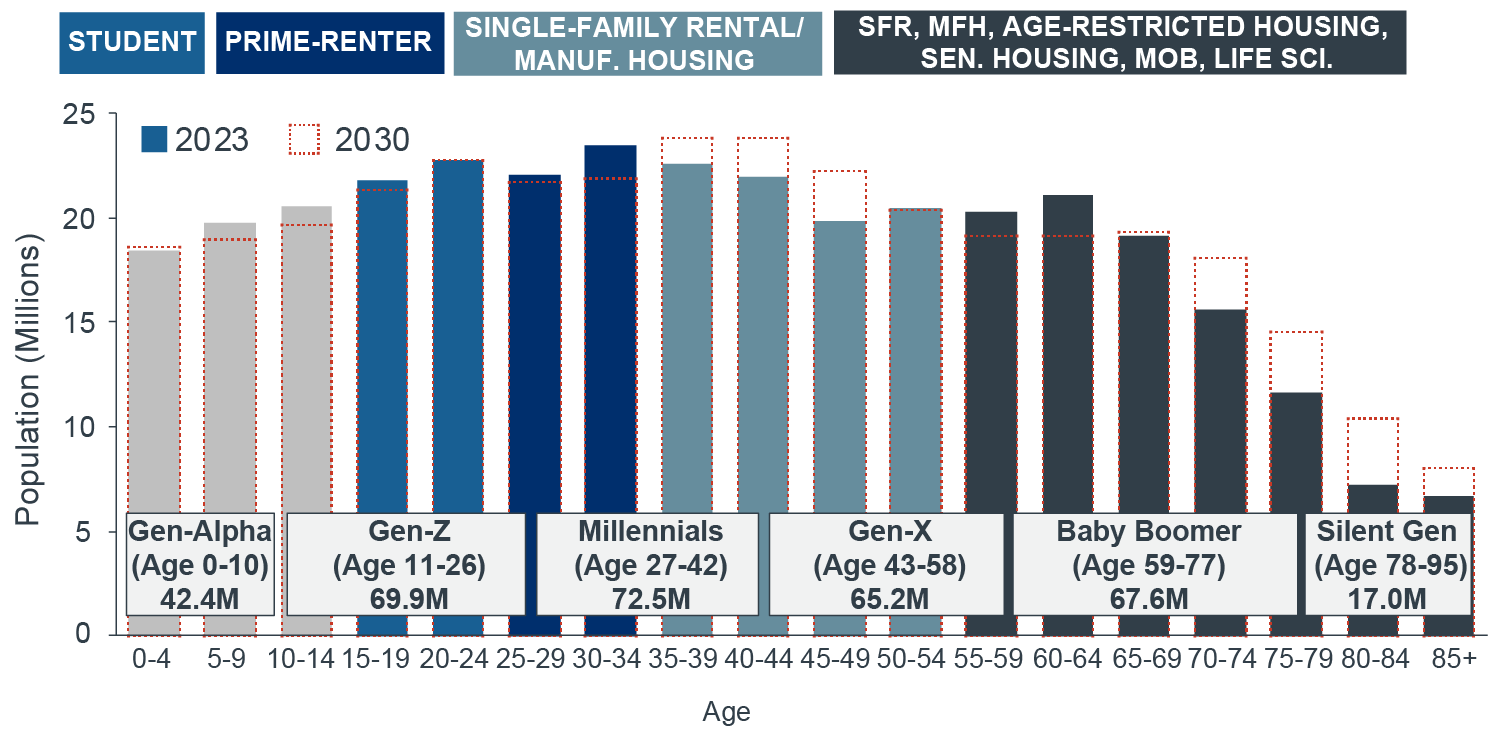

The U.S. demographic story can be seen through a lens of “cohorts,” offering distinct investment opportunities, which can combine to create a large and diverse opportunity set for real estate investors; all are driven by the underlying fundamental forecast that population will continue to grow.

One of the most significant cohorts is the “Baby Boomers,” those born between 1946 and 1964 who comprise a large and affluent group (approximately 73 million). The numbers of Baby Boomers are steadily declining due to aging and mortality (with forecasts indicating that the cohort could shrink to 20-30 million by 2050). Nonetheless, given their size and affluence the aging Baby Boomers will continue to remain a substantial demand driver for commercial real estate.

Following the Baby Boomers is the relatively smaller cohort Generation X (born 1965-1980) and then the larger Millennials (born 1981-1996). Generation X is estimated at 65 million and forecasted to decline to 50-60 million by 2050. Millennials are currently the largest age cohort (72.5 million), whose numbers are expected to remain relatively flat until 2050, remaining the most consistent segment in terms of size of the U.S. population. Millennials are also projected to become the largest generation in the U.S. workforce by 2030. Another large, but often overlooked cohort, is Generation “Z”, which is another 70 million currently and also expected to remain relatively stable until 2050. It should also be noted that immigration is projected to be a key driver of U.S. population growth in the coming decades.

Demographic Cohorts Can Help in Developing Real Estate Strategies

The varying demographic cohorts in the U.S. create different patterns of income, spending and demand, which can be utilized in assessing and creating real estate investment opportunities. Different age groups have distinct live, work, and play needs. While the Baby Boomer generation shrinks, Millennials and a more diverse younger population are poised to take center stage, which has important implications for the nature and use of real estate going forward. Young professionals may prioritize affordability and proximity to job centers, making studios or one-bedroom apartments in walkable areas attractive investments. Conversely, families with children might seek larger living spaces in suburban areas with good schools, suggesting opportunities in single-family homes or townhouses. By breaking the U.S. population into cohorts, we can create an investment opportunity set that can map to generational preferences (Figure 1).

FIGURE 1: U.S. POPULATION BY AGE & GENERATION CAN HELP TARGET REAL ESTATE INVESTMENT OPPORTUNITIES

Source: U.S. Census Bureau, Moody’s Analytics, Clarion Partners Investment Research, April 2024.

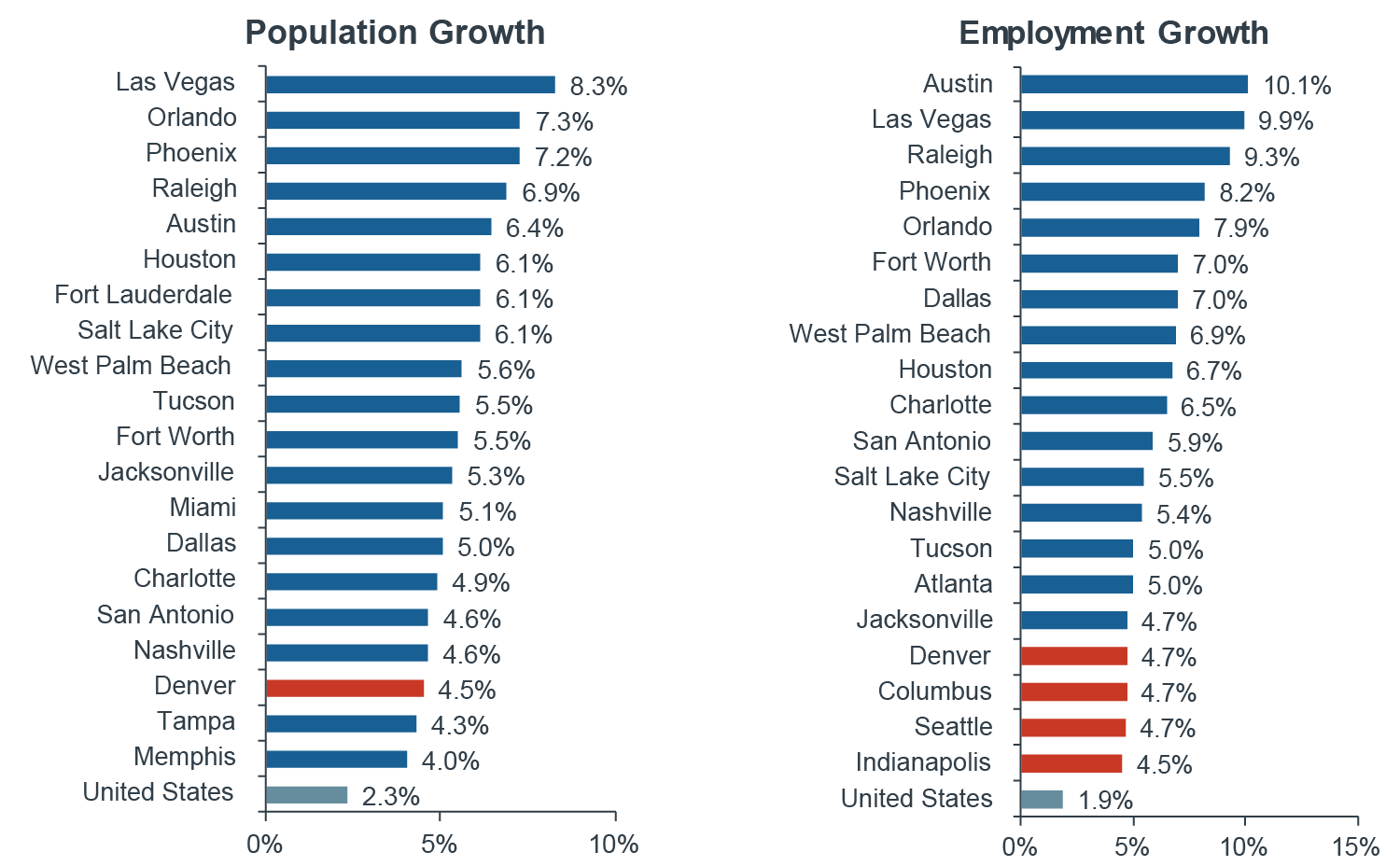

Migration Patterns of Demographics

A key driver of population shift is migration; identifying areas or regions where populations are growing faster can be a good way of predicting demand for real estate. In the U.S., the last two decades have witnessed relatively high population and employment increases in the Sun Belt and Southern markets, which are also forecast to enjoy very strong gains in the future (Figure 2). Several factors, including relative cost of living, ability to work remotely, and quality of life, have attracted a large migratory pool to these regions creating large and vibrant real estate markets.

FIGURE 2: SUN BELT MARKETS’ OUTLOOK STRONGEST: TOP 20 MARKETS FOR TOTAL POPULATION & JOB GROWTH (2024F-2028F)

Source: Moody’s Analytics, Clarion Partners Investment Research, April 2024. Note: Blue bar = Sun Belt and red bar = non-Sun Belt. Forecast cumulative data from Q2 2024 to Q4 2028.

Making Demographics Work for Investors

In the U.S. the shifting patterns of domestic migration, when combined with the overall positive but slowing population growth, have important investment implications for investors. While coastal markets have historically been the largest and most vibrant metros in the U.S., with their large pools of talent and high cost of living, the ability to work remotely for many white-collar professions has led to a large exodus of households into the suburbs and more desirable secondary metros. This has important implications for investors as these smaller markets have seen an outsized increase in population. However, given the strong infrastructure around major markets with their large population centers, investors need to carefully create a blend of strategies that can harness the different drivers of demand that can be found in the diversity of the population mix in the U.S. By understanding population trends, age distribution, household composition, income and spending differences, investors can tailor their strategies to meet the evolving needs of diverse demographic groups, helping to build resilient, durable portfolios.

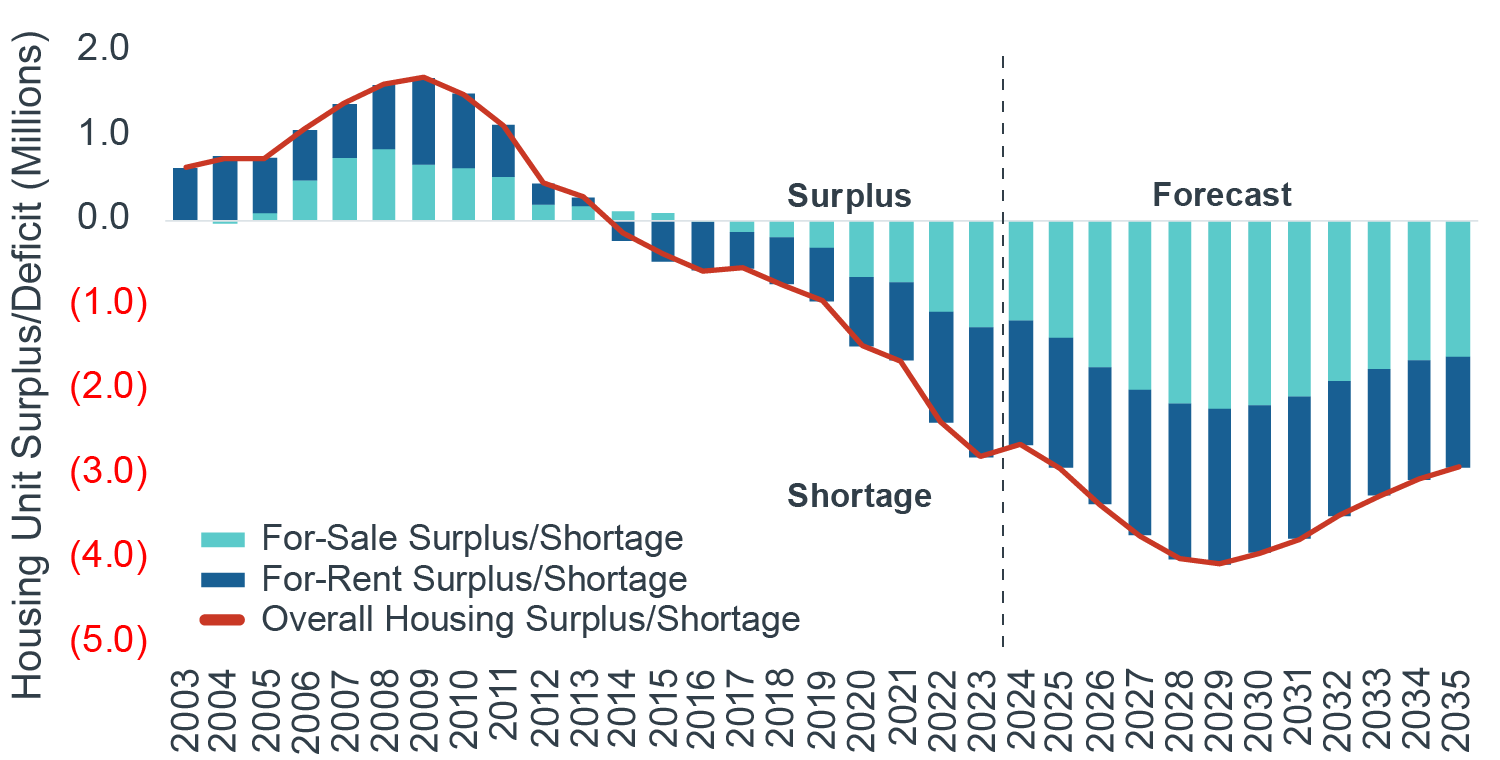

HOUSING: A STRUCTURAL DEFICIT CREATES LONG-TERM OPPORTUNITIES

Housing is a substantial beneficiary of the favorable population growth forecast, as well as forecast demographic shifts within the U.S., and should be a strategic theme for investors to consider. Shelter is a basic need and the availability, or lack thereof, has become an increasingly important determinant of where population growth is occurring in the U.S. While the U.S. historically has been a relatively balanced housing market, the global financial crisis led to a dramatic curtailment of new residential construction, which laid the seeds of a substantial structural shortage of housing. Over the past 15 years, while the population and economy have grown significantly, the housing shortage has been exacerbated with new construction failing to keep pace. The result is a chronic housing shortage, which is particularly acute in many high-cost, coastal markets but also increasingly becoming more widespread in smaller markets, where migration and mobility have led to an explosive growth in population.

A Structural Shortage of Housing in the U.S.

Housing shortages have long been a discussion in the nation’s largest cities but shifting demographics and migration patterns have caused secondary markets, suburbs, and even rural communities to feel the impact. Several factors have coalesced to create this persistent housing gap, which has become an especially acute problem particularly in coastal markets with limited land. Key reasons behind the structural deficiency in the U.S. housing market include:

• Population Growth Outpacing Supply. Housing construction has not kept pace with population growth, resulting in a widening supply-demand gap. Rapid urbanization has exacerbated housing shortages in metropolitan areas, where demand for housing is most acute.

• Regulatory Barriers and Zoning Restrictions. Zoning and often lengthy permitting processes are key contributors to shortages across geographies as they prevent or slow down housing development in certain locations. Zoning laws often favor single-family housing and limit density, constraining the supply of multifamily and affordable housing options. Many jurisdictions strive to keep out development with a “not in my backyard” mentality, which has exacerbated the housing shortage in coastal markets.

• Rising Costs and Affordability Challenges. Escalating construction costs, including land acquisition, labor, and materials, have inflated housing development expenses.

• Lack of Investment in Infrastructure. Insufficient investment in infrastructure, including transportation, utilities, and public amenities, has constrained housing development.

• Demographic Shifts and Changing Housing Preferences. Demographic changes, such as the aging population and millennial household formation, are reshaping housing demand by property type preferences and markets.

The result is a structural housing gap (comprising both single family and multifamily housing) that we currently estimate to be approximately 3 million units (Figure 3). Increasing household formation driven by cohorts moving into peak Millennial and Generation Z years, as well as strong immigration in recent years is expected to put additional pressure on the housing deficit. Consequently, we expect this housing gap to worsen and reach almost 4 million units as new construction remains relatively muted. The combination of elevated costs, restrictive zoning restrictions, political opposition and continued household formation suggests that the U.S. will struggle to close the housing gap, leading to a structural shortage of shelter.

FIGURE 3: ESTIMATE OF THE U.S. HOUSING SHORTAGE

Source: U.S. Census Bureau; Moody’s Analytics, Clarion Partners Investment Research, April 2024.1

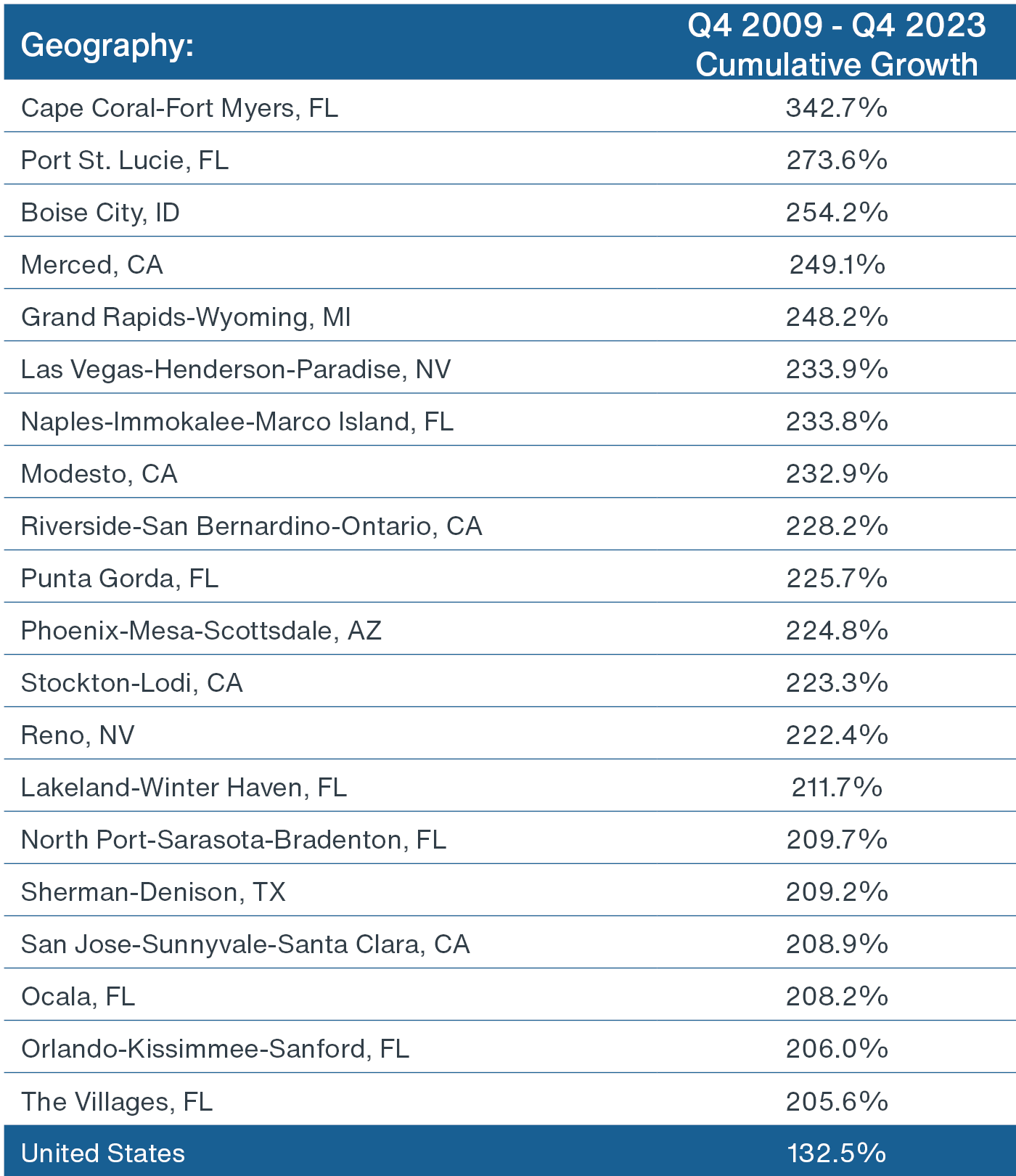

Housing Shortage is Exacerbated by Increasingly Unaffordable Single-Family Ownership

The deficit of housing has been exacerbated by increasingly unaffordable home ownership across the U.S. At the heart of the unaffordability issue is the substantial increase in home prices as supply has lagged demand materially over the past decade. The shortage has led to a strong increase in U.S. home prices - over 132% since 2009 (Figure 4). The increase in home prices has become particularly acute in high-growth markets where appreciation levels have rendered most homes unaffordable for families in their peak household formation years. As a result, most middle-income households have little option but to find options in the rental housing market, which now offers an increasingly diverse variety of options. The housing affordability conundrum has been exacerbated since the Federal Reserve began to raise interest rates, resulting in a sharp increase in mortgage borrowing costs, which now exceed levels not seen in over 30 years. As home ownership has become increasingly more difficult, demand for rental housing has intensified, creating affordability issues in some rental markets.

FIGURE 4: HOUSE PRICE APPRECIATION, 2009-2023

Source: Moody’s Analytics, Clarion Partners Investment Research, April 2023.

Housing Is a Structural Opportunity Set

A growing population, when combined with limited rental supply and affordability challenges in owner-occupied housing, has set in motion a housing deficit with few short-term solutions. Many discouraged would-be homeowners are turning to rental housing. Those who can afford homes are looking to downsize because of demographic shifts. Depending on the region, some are finding it difficult to sell their homes because of the high cost of borrowing and the surge in values; making affordability very challenging; particularly for cohorts entering peak household formation years. The result is, we believe a long structural tailwind for rental housing that ranges across the spectrum from affordable multifamily units to build-to-rent homes to senior and assisted living across different cohorts of the population. The housing problem in the U.S. is complex and multifaceted and will not be resolved quickly. For real estate investors, it offers a broad and resilient opportunity set in addressing a fundamental issue that the U.S. will continue to grapple with in years ahead.

INNOVATION: THE NEW LANDSCAPE OF GROWTH

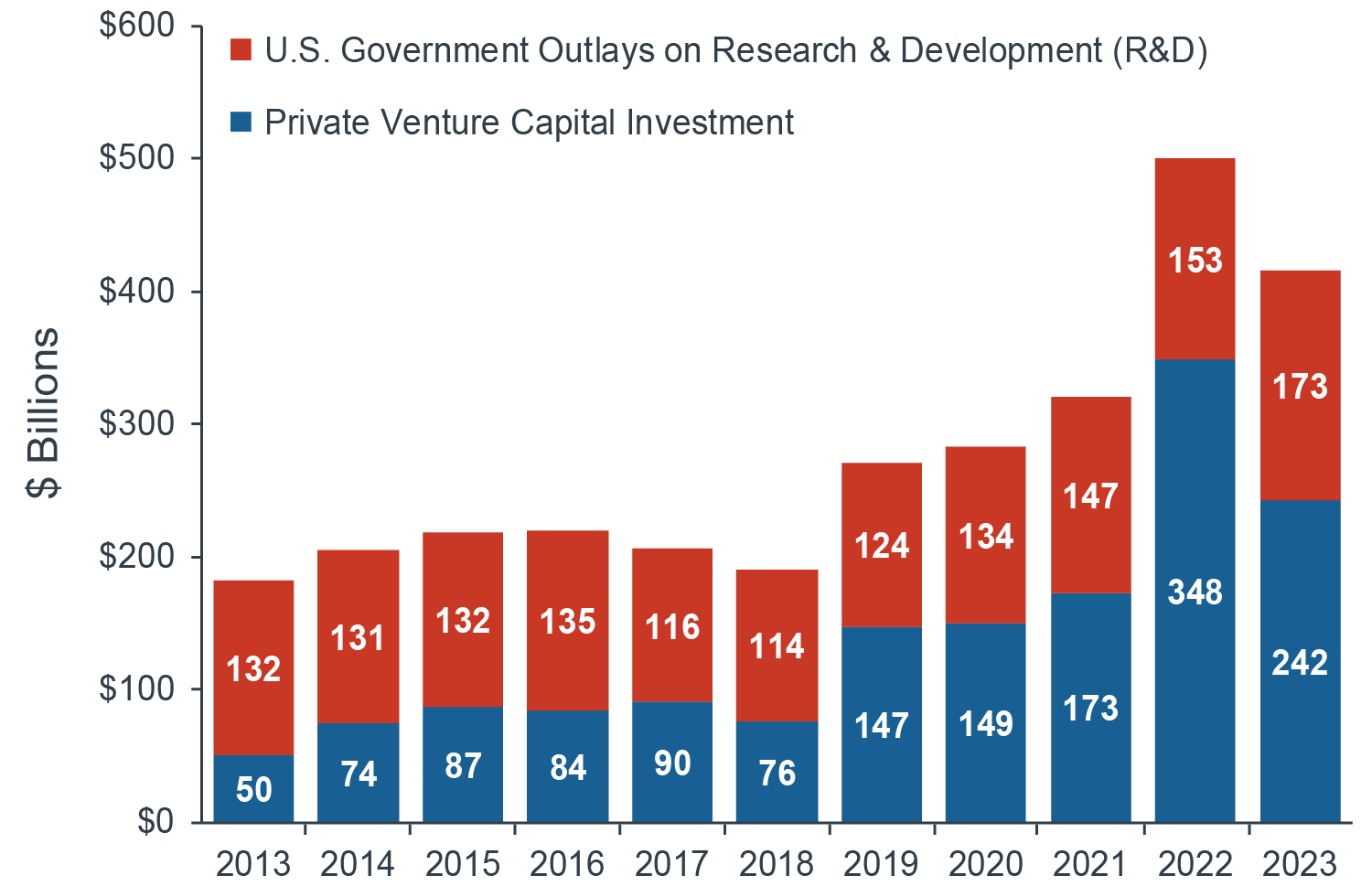

Our third theme focuses on innovation and the substantial growth it has generated and will continue to generate going forward. At its heart, the innovation economy encompasses industries that heavily rely on research and development (R&D), creativity, and intellectual capital to drive growth and create value. In the U.S., innovation-led industries have transformed the economy, driving growth, productivity gains, and transformative change across many regions of the country. Globally, the U.S. ranks #3 out of the Organization for Economic Co-operation and Development (OECD) countries for R&D spending as a share of national GDP reflecting the importance of the innovation economy to the country.2 Public and private investment in R&D has risen to record highs, reaching a combined $415 billion (Figure 5).

FIGURE 5: PUBLIC & PRIVATE INNOVATION FUNDING (2013-2023)

Source: Congressional Budget Office, Clarion Partners Investment Research, April 2024.

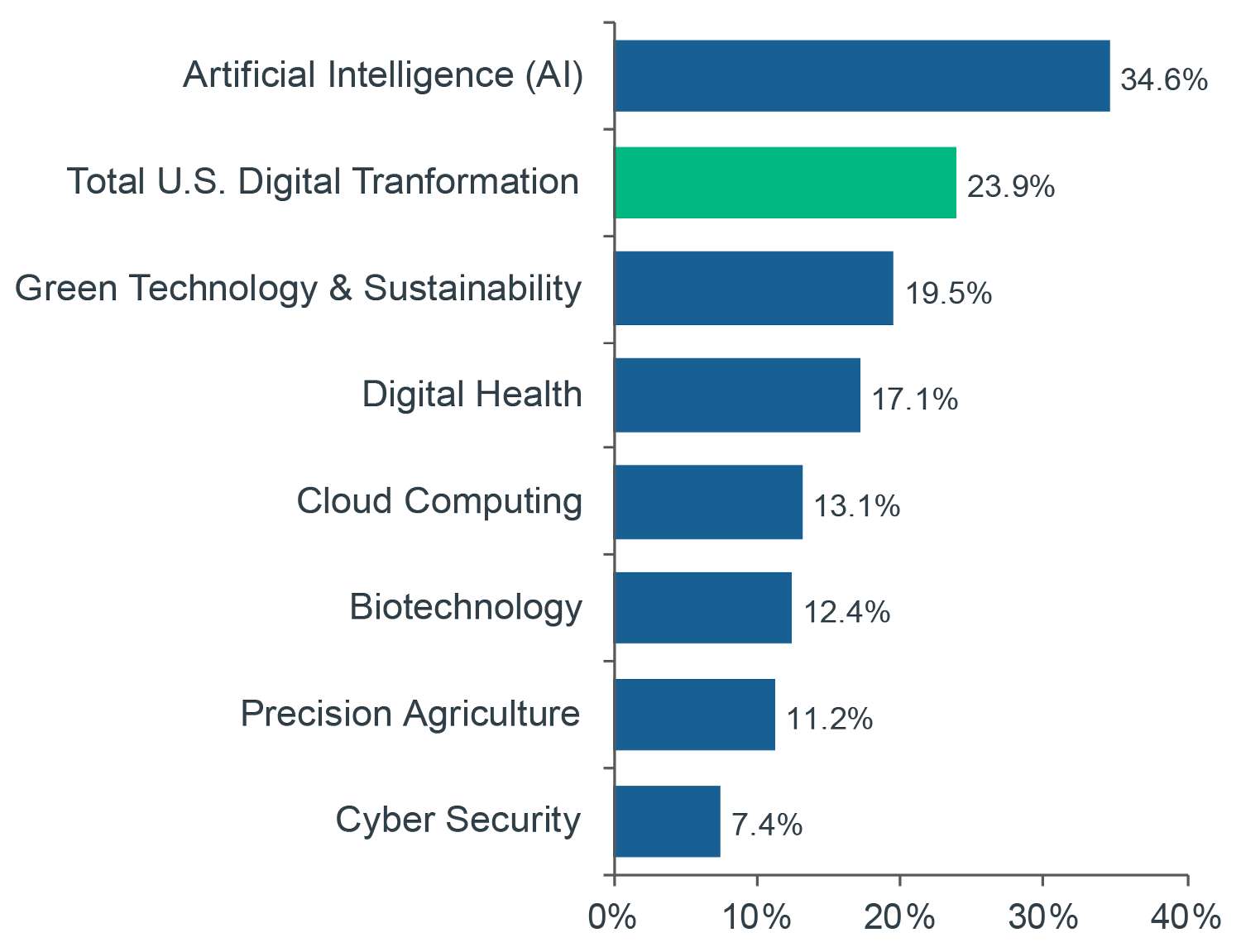

Key Innovation Drivers Include Software, Pharma and Biotech, and Other Knowledge Industries

Key sectors within the innovation economy include technology, biotechnology, pharmaceuticals, advanced manufacturing, renewable energy, and other knowledge-based industries (Figure 6). We expect the ongoing high tech and digital revolution to continue to transform all industries and power future economic development. Artificial intelligence (AI), green technology and sustainability, digital health, cloud computing, biotechnology, precision agriculture, and cybersecurity are just a few high-growth segments that will continue to generate significant economic benefits and long-term demand for a variety of real estate sectors, such as life sciences, data centers, and cold storage.

FIGURE 6: MARKET SIZE SECTOR CAGR FORECAST (2023F-2032F)

Source: 1) PitchBook, Clarion Partners Investment Research, Q4 2023. 2) Grand View Research, Clarion Partners Investment Research, March 2024. Note: Forecasts from Grand View Research are from varying 10-year timeframes from 2020 to 2034.

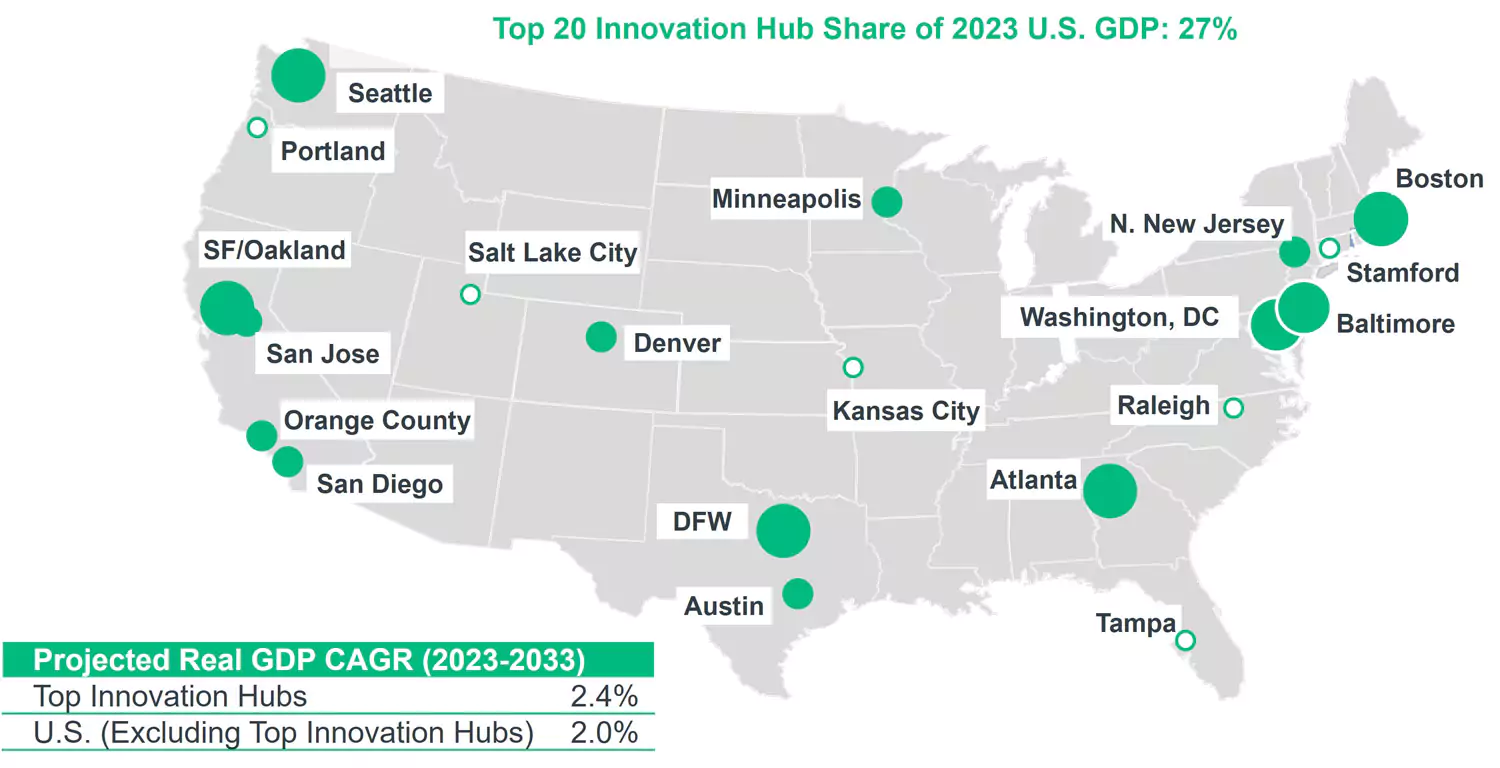

Innovation “Clusters” Are Creating Strong Economies and Demand for Real Estate

While the innovation economy differs by sector and region, there are some shared trends that connect innovation-led demand to the creation of dominant clusters. These areas have seen disproportionate employment, income, and GDP per capita growth, as well as outsized home appreciation, especially over the long term. These clusters will continue to be global centers of innovation in the years ahead. However, coincident with the movement of labor, we are seeing new markets and regions emerge as knowledge clusters. We estimate there to be about 20 such “innovation” hubs, which accounted for 27% of U.S. GDP in 2023 and are set collectively to remain a powerful economic driver nationwide (Figure 7).3

FIGURE 7: MAP OF TOP 20 U.S. INNOVATION CLUSTERS

Source: U.S. Bureau of Labor Statistics, Bureau of Economic Analysis, Moody’s Analytics, Clarion Partners Investment Research, Q4 2023. Note: Innovation hubs are major markets with the 20 highest high-tech employment location quotients. Bubble size corresponds with the market’s 2023 gross metro product. All gross metro product data are chained to 2017 dollars.

How Innovation is Fueling Demand for Commercial Real Estate

Innovation industries are the engines of the new economy and are at the forefront of driving demand for commercial real estate, reshaping urban landscapes, and fueling economic growth. Innovation-driven demand encompasses a diverse range of property types and asset classes, from technology startups and R&D facilities, to lab space, to data centers, to corporate campuses and logistics infrastructure. Given the emphasis on talent, infrastructure, innovation-led markets are reshaping the use of traditional space formats with much of the real estate in these hubs providing state of the art, modern environments to accommodate the growing use of data and computing power by human talent. Many of the largest R&D hubs have large inventories of specialized purpose-built facilities, along with especially high concentrations of research institutions, advanced industries, educated work forces, and capital funding. The resources that continue to be deployed into knowledge and innovation driven industries and their growing strategic importance to businesses and individuals as well as the federal government places this driver firmly into the strategic category for commercial real estate. We believe investors should target these large and increasingly diverse innovation markets to deliver real estate solutions to meet the growing need of the knowledge sector. Innovation industries are shifting the structure of the U.S. economy and creating a source of tremendous long-term real estate investment opportunity.

GLOBALIZATION: SHIFTING PATTERNS SUGGEST A BROADER OPPORTUNITY FOR REAL ESTATE

For over four decades, the U.S. and world economy has been transformed by globalization and the increase in international trade that has accompanied it. Trade volumes have risen significantly, and in the case of the U.S., imports have surged. For the U.S., globalization of goods and services has been transformative for growth, allowing businesses and consumers to benefit. In the case of commercial real estate, warehouses and logistics properties became an integral part of global and domestic supply chains, with globalization requiring a growing logistics footprint. The advent of e-commerce from the early 2000s was an additional game changer for the global economy as goods could be sold over the internet which required an even greater need for logistics from warehouses to distribution centers. As a result, the industrial sector has become an investor favorite (because of its strong performance) over the past 15 years.

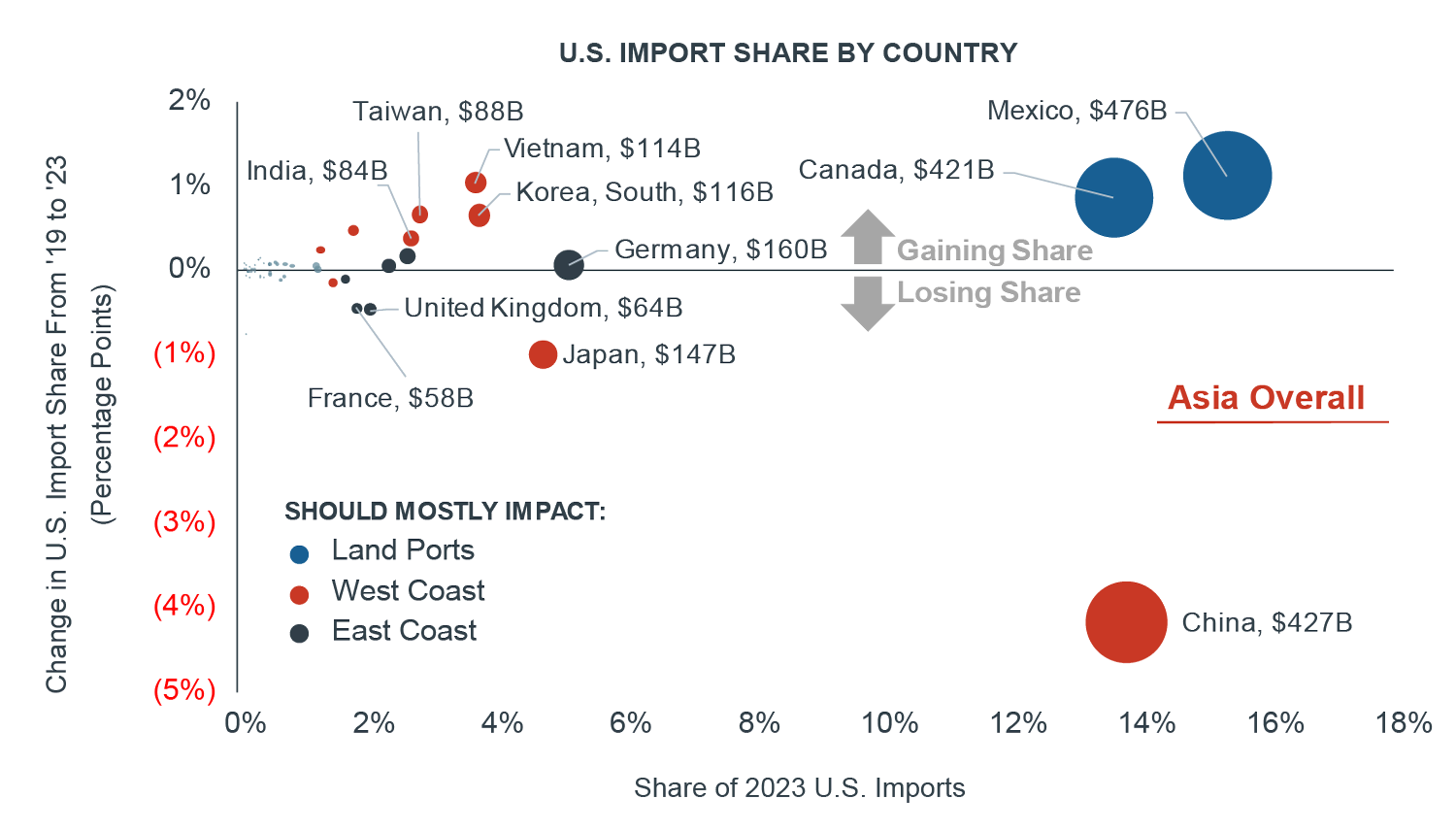

Globalization Patterns are Shifting, Not Declining

In recent years, however, traditional global patterns of trade and commerce have started to shift because of heightened geopolitical tensions and supply chain disruptions. Over the past 30 years, China emerged as the preeminent global manufacturing hub, producing almost 20% of global manufacturing output, a three-fold jump from 2005.4 In recent years, partly due to national security issues and partly to diversify supply chains, there has been a concerted effort by U.S. and European corporations to diversify their trading partners, as well as strengthening local production and distribution to create a more varied and resilient network. For the U.S., it has meant growing trade levels with Mexico, Canada, and Southeast Asia in recent years. Consequently, as a share of U.S. imports of goods in dollars, these regions are the fastest growing, while the share of China is declining (Figure 8).5 The re-orientation of manufacturing supply chains has also been accompanied by an increased focus on bringing back or “onshoring” more strategic manufacturing industries to the U.S.

FIGURE 8: U.S. GLOBAL TRADE CONTINUES TO EXPAND;

HOWEVER, TRADE HAS SHIFTED BY REGION

Source: 1) U.S. Census Bureau, Clarion Partners Investment Research, April 2024. 2) Moody’s Analytics, U.S. Bureau of Economic Analysis, Clarion Partners Investment Research, April 2024. Note: Forecast is based on Moody’s baseline scenario.

What Can Shifting Globalization Mean for Real Estate?

Shifting gears of global trade can reshape the key routes and markets that are involved in the facilitation of the movement of goods. They also can create or reduce demand for logistics and warehouse properties that are vital cogs of the global supply chain infrastructure. In the case of the U.S., some implications for the pattern of shifting trade and supply chains are:

- Growing Demand in U.S. Border Industrial Markets in Texas, Arizona, and California as Trade With Mexico Increases. The greater Southern California area, Dallas/Fort Worth, and Phoenix will remain top distribution hubs for goods crossing the southern border.6 We expect that Los Angeles will remain a key point of entry because of its unparalleled infrastructure, large regional population base, and increasing imports from Southeast Asia. At the same time, Houston, Charleston, Savannah, and Virginia have reported the most significant growth in cargo volumes in recent years and are likely to become even more important in the U.S. supply chain with more manufacturing targeted in the Sun Belt and Southern states.7

- A Domestic Manufacturing Recovery. The federal government and corporations are investing heavily in more domestic factory production to reduce U.S. supply chain dependence on China. An increasing number of high-value industries are bringing production facilities (“on-shoring”) back to the U.S. Recent estimates suggest that U.S. companies have so far announced nearly $700 billion in commitments toward domestic manufacturing projects involving heavy industry, semiconductors, energy, electric vehicles, and biomanufacturing.8 We anticipate that near-term manufacturing space demand could tally approximately 100 million SF nationally, plus generate additional demand for supporting logistics space.9

- Last-Mile Distribution Properties Become a Strategic Resource. At the same time, as U.S. import and export volumes continue to rise, e-commerce growth will benefit. Consumer expectations for greater product variety, fast delivery speed, and convenience should keep driving innovation and an overarching need for better-located, efficient industrial real estate. Last-mile properties have become a strategic resource for logistics users and can often add value by mitigating exposure to high-cost operating factors, such as transportation and labor. It is estimated that e-commerce users typically require about three times as much warehouse space as traditional retailers, and that every $1 billion of new e-commerce sales growth requires 1.0 million sf of additional warehouse space.10 Therefore, an estimated 340 million sf of new space will be needed over the next five years to accommodate e-commerce expansion alone.

Globalization Is Not Receding; It is Shifting

This shift in patterns of globalization is likely at an early stage, and global supply chains are likely to re-orient but not diminish. Forecasts indicate that global trade levels will continue to rise and drive ongoing industrial warehouse demand. All else being equal, a 1% rise in U.S. imports is associated with an approximately 5% rise in net absorption.11 While we expect trading partners to shift because of evolving political situations, we continue to believe that global movement of goods and trade will not diminish and remain a structurally important driver of U.S. economic growth and demand. As patterns of trade and goods shift, the relative importance of markets may alter and offer investors additional opportunities to build strategies around the path of growth.

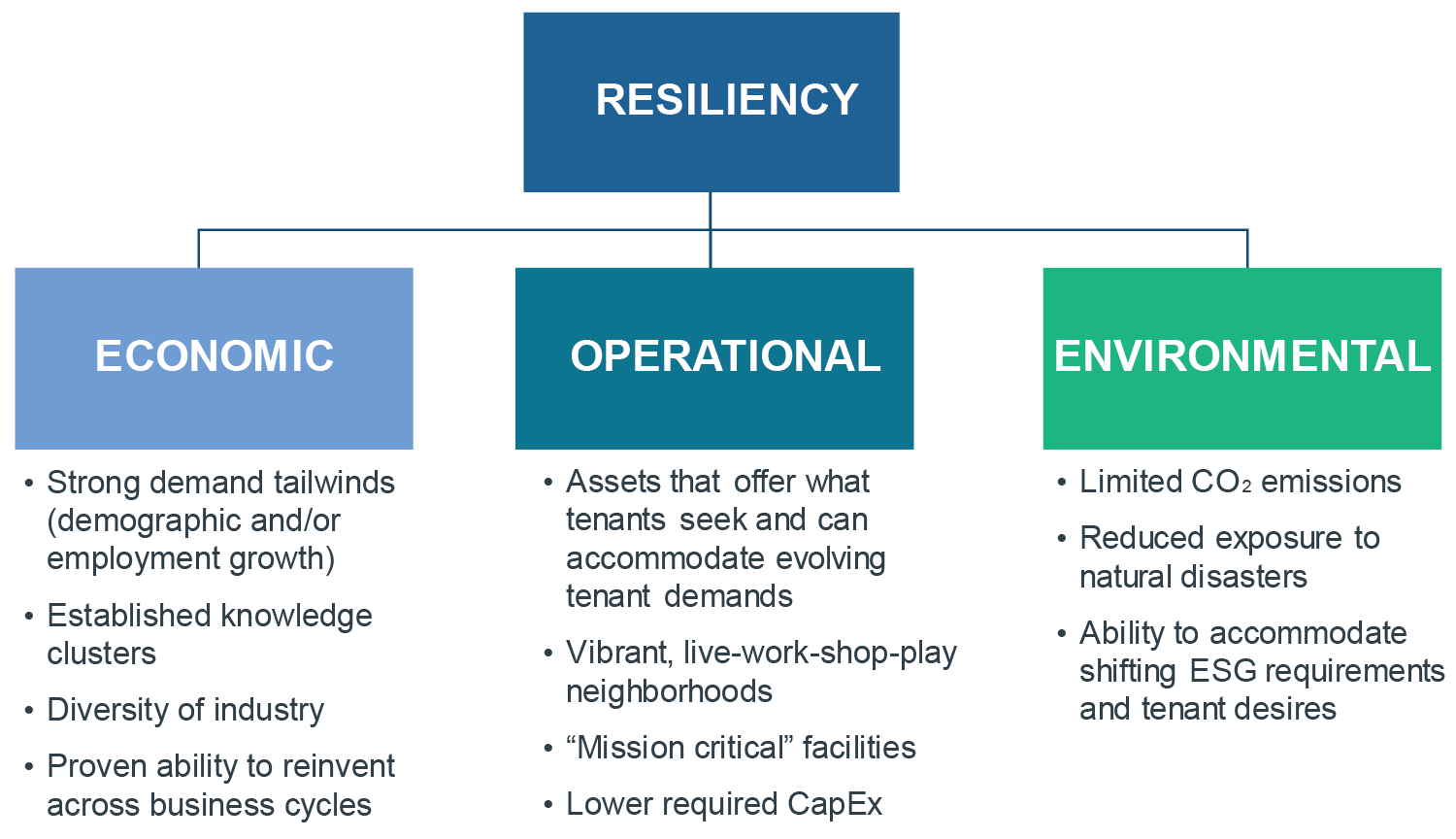

RESILIENCY: BUILDING DURABLE, LONG-TERM REAL ESTATE PORTFOLIOS

Commercial real estate portfolios are subject to myriad risks, ranging from economic downturns and operational challenges to environmental, social, and governance (ESG) factors. We believe our thematic approach build resilience in commercial real estate portfolios by identifying those drivers that can improve and enhance economic, operational, and ESG considerations at market and asset level. Our themes are aimed at building lasting and resilient portfolios that can weather cyclical changes and take advantage of long-term structural demand drivers, allowing investors to benefit from consistent and repeatable cashflows (Figure 9).

FIGURE 9: RESILIENCY UNDERPINS MARKET AND ASSET SELECTION

Source: Clarion Partners Investment Research, April 2024.

Economic Resilience. Economic resilience is the proven ability for a market or asset to endure over business cycles. This typically occurs when there are strong regional demand tailwinds, such as robust employment growth, established knowledge clusters/innovation hubs, and industry diversity. Long-term demand identified through an analysis of our key themes should allow investors to create economically resilient strategies.

Operational Resilience. Operational resilience often refers to a building’s level of energy efficiency, modern infrastructure, ability to meet evolving tenant requirements, or ability to house “mission critical” facilities. A high performing “green” building can also lower capital expenditures, which can improve asset values. It can also refer to the vibrancy of a live-work-shop neighborhood.

ESG Resilience. Environmental, Social, and Governance (ESG) resilience at the asset level is increasingly important. In recent years, global and U.S. financial regulation around ESG has increased rapidly, prompting most large public and private companies to start to comply with ESG guidelines in portfolio management practices. It generally involves prioritizing sustainability, enhancing operational efficiency, and reducing vulnerability to environmental risk, such as natural disasters. Many of our structural themes contribute to improving ESG resilience.

Resilient real estate portfolios are essential for investors seeking to navigate through macroeconomic uncertainties, market fluctuations, and unforeseen disruptions. In today's dynamic landscape, building resilience requires a proactive approach that encompasses risk management, diversification, sustainability, and operational excellence. Our themes identify some strategic long-term drivers that can help investors construct portfolios that can better weather economic, operational and ESG challenges and opportunities.

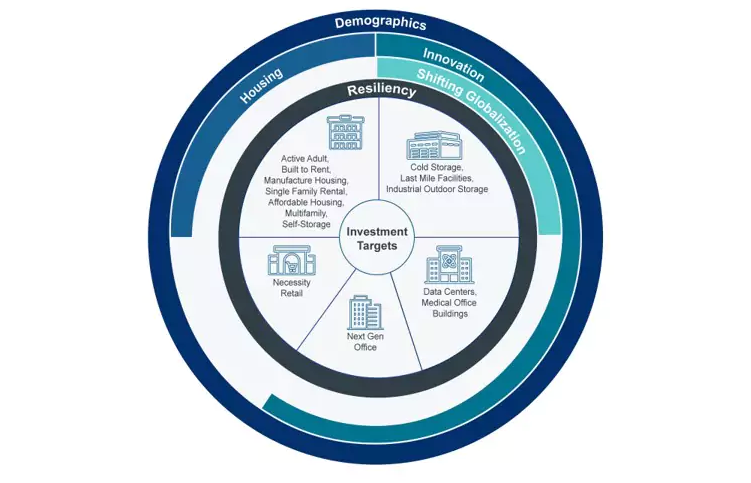

CONCLUSION: OUR INVESTMENT THEMES ALLOW INVESTORS TO BUILD RESILIENT LONG-TERM STRATEGIES

In an evolving and shifting world economy, investors need to identify long term drivers that can capture tenant demand and deliver resilient investment performance. They need to separate the long-term signals that strategic themes can generate from the short-term and cyclical noise of economic and capital market cycles. In this paper we identify key signals – demographics, housing, innovation, globalization, and resiliency – as long-term themes that can help investors construct resilient investment strategies. These are actionable themes: as (Figure 10) shows, our themes have direct applicability to a large and growing set of property types, which can be pursued by investors in their long-term investment strategies.

FIGURE 10: LONG-TERM THEMES CAN IDENTIFY A WIDE REAL ESTATE OPPORTUNITY SET

Many of our themes will be most relevant to “alternative" property types, which are increasingly tied to some of the structural shifts underway in the U.S. Going forward, we expect alternatives to be a much larger part of the real estate investment landscape, another critical shift being driven by our investment themes. We believe our thematic approach can not only help investors identify and act upon meaningful long-term drivers of real estate growth but also enhance their investment set as a large and growing set of property types enters the investment universe.

To learn more about the latest Trends in Commercial Real Estate, please click here to watch our Clarion Calls video series.