STRONG TAILWINDS AHEAD FOR MULTIFAMILY SECTOR

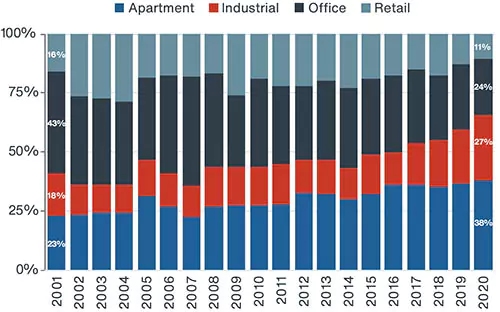

Over time, U.S. rental housing has consistently experienced increased demand from institutional real estate investors. Its positioning as an integral part of real estate investment portfolios is demonstrated by its current weighting of 26.8% in the open-end diversified core equity index (ODCE).1 It has also recently represented the largest share of annual investment sales volume among the core property types.2

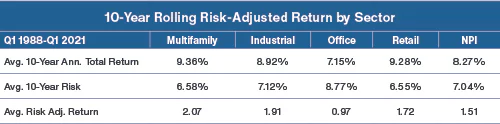

Since the NCREIF Property Index (NPI) was formulated in 1978, the multifamily property sector has had the highest risk-adjusted total returns on a 10-year rolling basis.3 For many years, it vied with the retail sector for top status, and more recently with industrial (given the e-commerce boom), but rental housing, a necessity, has been the most steady high-performing sector throughout the whole period, offering steady income growth and asset appreciation over the long term.

U.S. MULTIFAMILY LEADS IN INVESTMENT SALES

Source: Real Capital Analytics, Clarion Partners Investment Research, Q1 2021

NCREIF RISK-ADJUSTED RETURNS BY SECTOR SINCE INCEPTION

Source: NCREIF, Clarion Partners Investment Research, Q1 2021. Note: For the calculation methodology, refer to endnote 4.

After a brief downturn during the COVID-19 recession in 2020, multifamily fundamentals showed clear signs of recovery starting late 2020, strengthening into and through 2021 so far.

Clarion Partners believes that post-COVID job growth will be a strong driver of continued apartment demand growth.

Moody’s Analytics estimates that 12 million jobs will be created between 2021 and 2023.5 We are optimistic about the outlook for U.S. multifamily based on five additional factors:

- Pent-up household formation:

- Historically low for-sale and rental housing inventory;

- Record-high single-family home prices;

- A recent surge in construction costs, which will likely moderate the new supply pipeline; and,

- A rising interest rate (and inflation) environment where landlords may be able to adjust rates annually along with inflationary pressures.

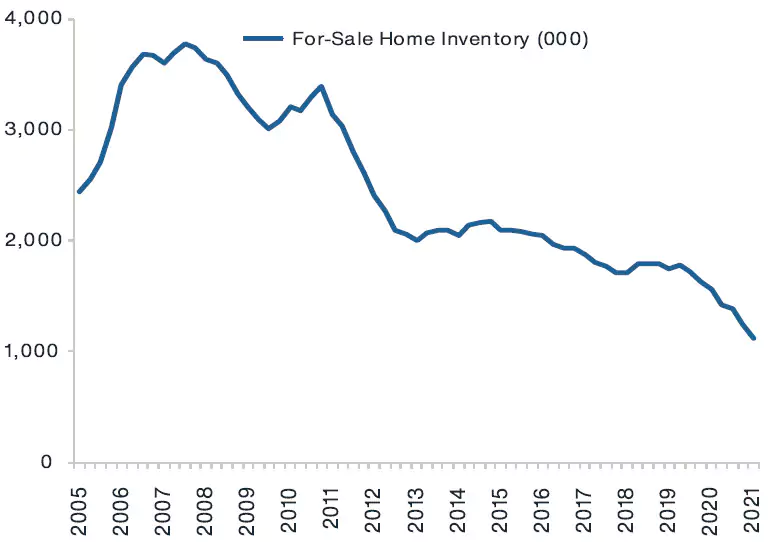

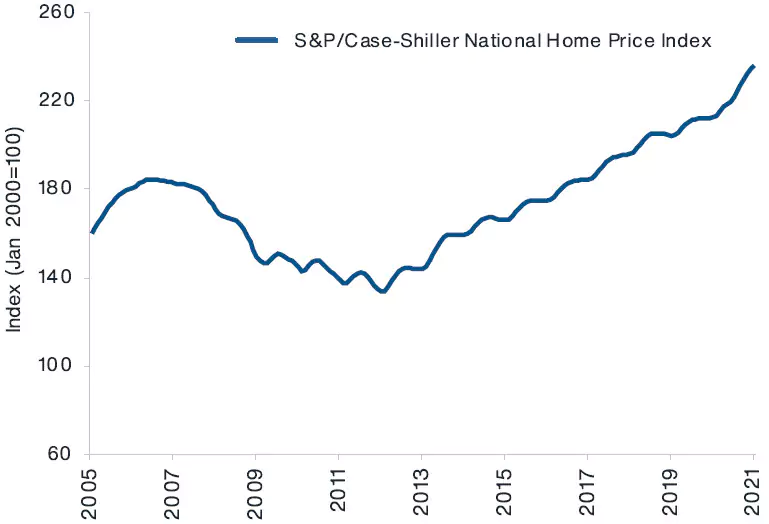

ACUTE HOUSING SHORTAGE & AFFORDABILITY CHALLENGES

Current U.S. housing inventory and affordability factors bode well for future multifamily rent growth. In recent years, demand for all forms of housing has surged along with a rise in household formation, which paused briefly during the pandemic. Overall, for-sale and rental housing inventory is near historic lows and prices are near a two-decade high in most U.S. markets.6 The situation of low affordability has been exacerbated by rising building costs and a slower pace of new development.

A few recent statistics highlight these ongoing challenges:

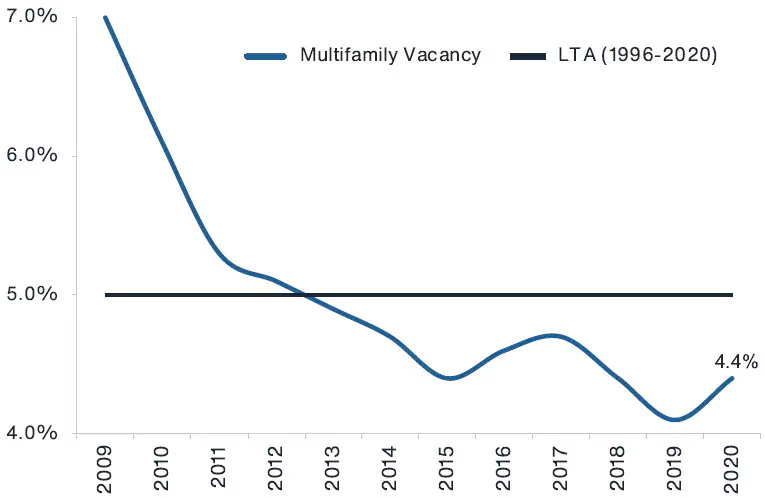

- In 2020, U.S. average apartment vacancy was still near the all-time low of 4.4%, while the national homeownership rate remained near the 50-year low;7

- The median U.S. home price accelerated by 12% in 2020, the highest pace in 15 years, reaching $307,000.8

- In top employment hubs, it is much greater. For instance, San Francisco = $1.7 million, Manhattan = $1.0 million Los Angeles = $652,070, Boston = $568,130; and Seattle = $547,114;9

- Nearly half of the approximately 45 million renters remain cost-burdened, paying more than half of their monthly income on housing;10

- According to a recent National Association of Realtors report, the U.S. housing market has a reported 5.5 million unit housing deficit due to a two decade lag in new residential construction. The 5.5 million-unit deficit includes about two million single-family homes, 1.1 million units in buildings with two to four units, and 2.4 million units in buildings of at least five units.11

- And lastly, as of April 2021, construction costs surged by 19.1% year-over-year.12

LOW FOR-SALE AND RENTAL HOUSING INVENTORY AMIDST RECORD HIGH PRICES

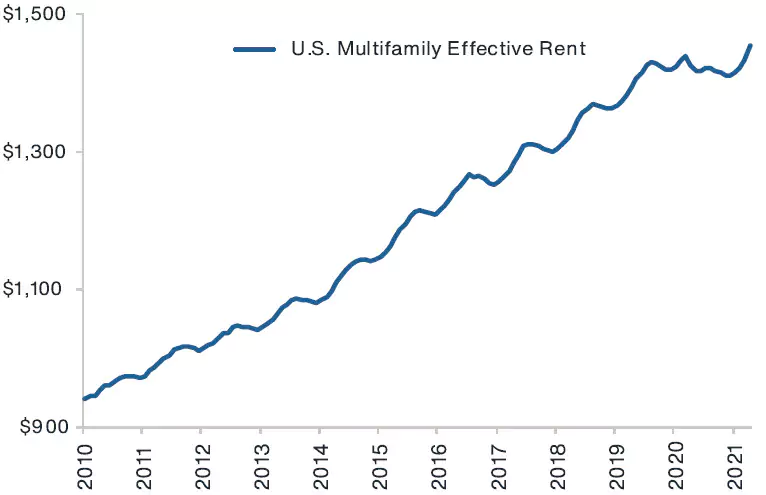

Source: Moody’s Analytics, S&P Case-Schiller, CBRE-EA, RealPage, Clarion Partners Investment Research, May 2021. Notes: 1) S&P Case-Shiller data through April 2021. 2) Long-term average = LTA. 3) U.S. multifamily rent is from RealPage, captures 150 markets, and is on a monthly frequency.

Given these factors, housing affordability is likely to remain a significant headwind for the 154 million Millennials and members of Gen Z, a huge positive for future rental housing demand. Furthermore, during COVID, millions of young adults moved in with family, which may indicate strong pent-up demand for apartments.13 Downsizing retirees make up a growing share of the renter-pool as well. All in all, long-term demographic tailwinds appear to be a stable demand driver over the long run.

BROAD-BASED STRENGTHENING OF MULTIFAMILY FUNDAMENTALS Q2 2021

The multifamily sector has remained remarkably resilient in part due to the need for housing, even during this recent downturn. While there were short-term shifts in living arrangements, which varied considerably by location, overall rental housing demand remained relatively robust in most markets in 2020. Recent real estate fundamentals’ performance below highlights the sector’s strength.

- Multifamily rent collections remained over 93% during the peak pandemic months;14

- Forty-five out of 70 tracked markets reported positive annual rent growth;15

- Overall net absorption also remained positive each quarter nationwide in 2020.16

- At the same time, top ranking target markets for effective rent growth were mainly in Texas, Florida, Georgia, North/ South Carolina, Colorado, and California.

Year-to-date in 2021, demand has turned the corner. U.S. effective rent growth has rebounded and improved each month from January through May 2021.17 Moreover, backed by Government Sponsored Enterprises (GSEs), multifamily financing rates are already below pre-COVID levels, and lenders are competing for high-quality deals.

MULTIFAMILY SECTOR MAY OFFER ATTRACTIVE INVESTMENT OPPORTUNITIES

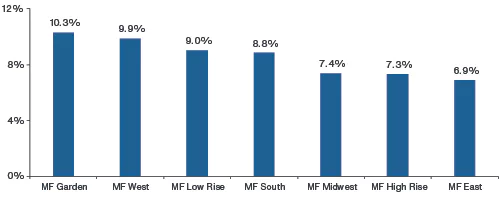

Clarion Partners expects trends that were well underway pre-COVID, and during the pandemic, to endure in the coming years. More specifically, Sun Belt states, low-cost metros, most tech hubs, select suburban submarkets, and garden-style formats have all had strong performance. NCREIF total returns also show that the top-returning multifamily segments have been garden-style, low-rise, and the South and West regions over the past 10 years.18

Work-from-home may accelerate existing net migration patterns, which should benefit some metros at the expense of others. Single-family rentals (SFRs) have also performed exceptionally well over the past year with high occupancy and rent growth. Looking ahead, we anticipate faster population and job growth in low-tax and business friendly states. Build-to-core multifamily investments in these markets may offer attractive returns on a relative basis.

MULTIFAMILY 10-YEAR NCREIF TOTAL RETURNS BY SUBTYPE (AS OF Q1 2021)

Source: NCREIF, Clarion Partners Investment Research, Q1 2021.

A POTENTIAL HEDGE AMIDST RISING INFLATION

As more and more Americans are vaccinated, and the U.S. economy continues to reopen, we anticipate an even more broad-based strengthening of multifamily fundamentals. At the same time, coastal CBDs have shown clear signs of recovery, as many office buildings are reopening and young people are returning to the largest U.S. cities.

Potential risks include new COVID variants, a sharp rise in interest rates, a more meaningful increase in homeownership rate, and slower than anticipated job growth, which would negatively impact the multifamily upswing underway.

Nevertheless, Clarion Partners maintains a high conviction that demand for institutional-quality multifamily will continue to be robust due to various significant demographic and socioeconomic drivers in large U.S. employment hubs over the long term.

Finally, multifamily has historically tended to have superior investment performance after recessions because leases are typically one year in length, meaning that landlords can adjust rents more quickly than in other sectors. Therefore, multifamily investment can potentially serve as a hedge against rising inflation, a highly desirable characteristic in today’s inflationary environment. As construction costs continue to rise, we believe greater multifamily rent growth and asset appreciation are likely.