After lying dormant for nearly a decade, inflation resurfaced with a vengeance in 2021, fueled by pandemic-induced shortages in goods and labor. CPI inflation rose 5.4% year over year in June, the highest level since 1991.

Concerns exist about whether the recent surge may persist, but it has already refocused attention among investors on how well their portfolios may be positioned for a rising-price environment. For investors focused on income, the key question is how well yields and distributions will hold up as economic recovery continues to evolve.

AN INCOME SOURCE THAT KEEPS PACE WITH INFLATION

Against that backdrop, the durable income stream characteristic of commercial real estate earnings looks increasingly compelling.

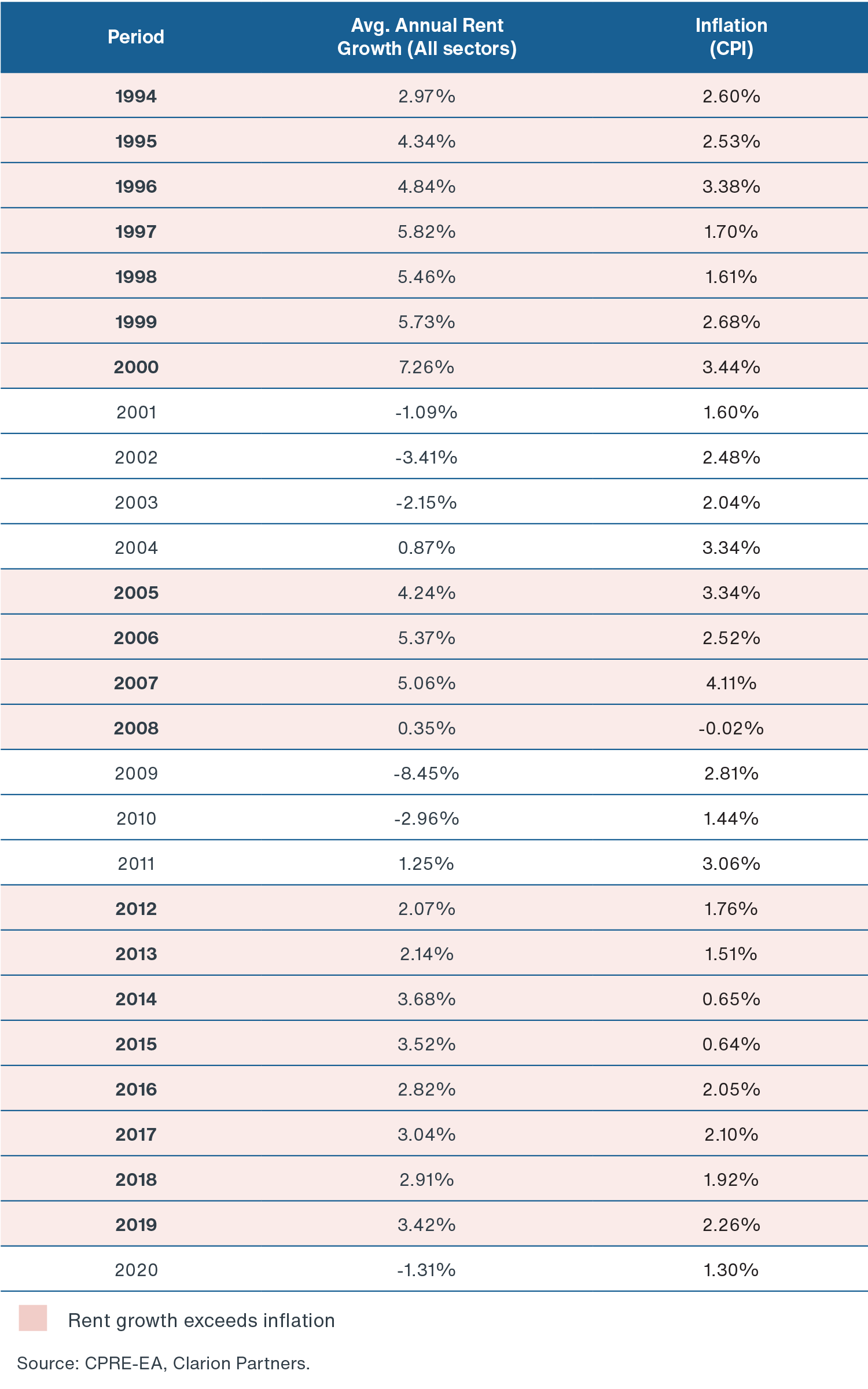

Those earnings are predicated in large part on ongoing cash flow from contractual rents and leases, which have provided a welcome bulwark against inflation over time. Clarion Partners analyzed CPRE market data on rent growth since its inception in 1994 and found commercial real estate rents outpaced inflation in 19 of the past 27 years (i.e. 70%). And over the course of the same period, rent growth kept pace with inflation, with each averaging an annual growth rate of roughly 2.1%.

The diversity of property types in commercial real estate helps to support this broad trend. Leadership in rent growth has regularly shifted between 4 key sectors over time. For example, Industrial and Office properties each led the way in rent growth in 9 of the 27 years. Retail properties took the lead in 5 of those years and Apartment buildings in 3 of those years.

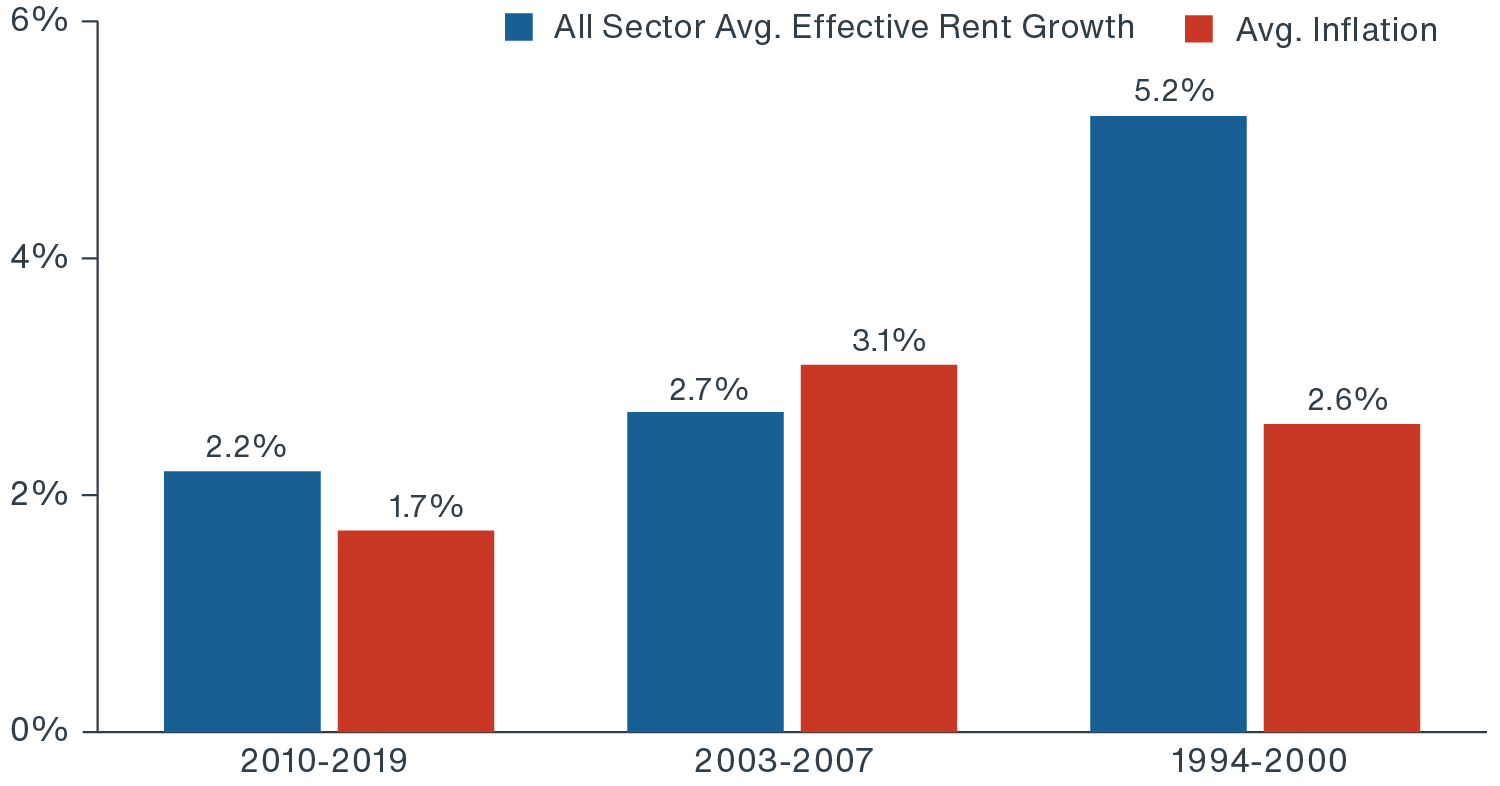

Another way to view the inflation story is to look at rent growth during recent periods of economic expansion, which all had different economic dynamics. Rents comfortably outpaced inflation in two of those three periods, and closely tracked them in the third.

EFFECTIVE RENT GROWTH VS CPI INFLATION IN PAST 3 ECONOMIC EXPANSIONS

Source: CBRE, Bureau of Labor Statistics, Clarion Partners Investment Research. Inflation based on CPI (Consumer Price Index).

Effective rents are rents after concessions.

CRE RENT GROWTH AND INFLATION, 1994-2020

WHY RENTAL INCOME IS INFLATION-RESISTANT

There are several reasons rental income has held its own against inflation over time. First, prices tend to rise during periods of economic growth, when tenants can afford to spend more and rent increases are easier to negotiate. What’s more, many lease agreements include an inflation clause that may escalate rents in response to higher prices. Landlords also benefit when a lease calls for tenants to shoulder a property’s operating expenses, since this insulates them from impact of higher utility and maintenance costs.

Landlords are also in position to adjust the pace of investment in new properties in response to inflation. If they see that building costs are rising faster than rents, they can opt to delay or cancel projects – which tends to support prices on existing properties.

WHAT IT MEANS FOR INVESTORS

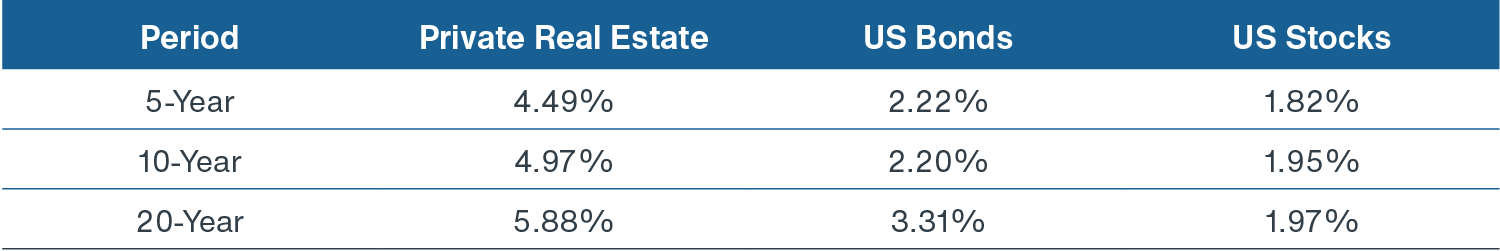

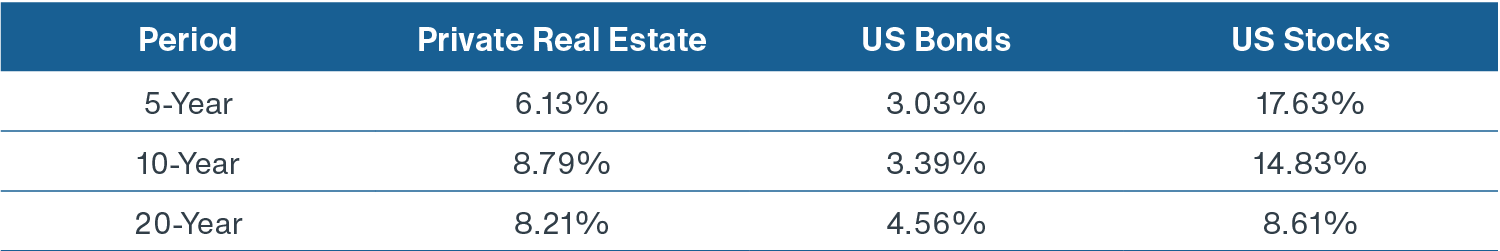

Commercial real estate rents are an important component of yield and return for private investors. Competitive growth in rents relative to inflation has certainly helped to underpin the asset class’ solid level of yield over the last two decades, with an average one-year income return for the period of 5.88%, notably higher than what either US bonds or stocks delivered over the same period. That yield did not come at the expense of substandard returns; indeed, the annualized total return of 8.21% for the 5-, 10- and 20-year periods ending 6/30/21 exceeded what the bond market has delivered, was close behind the 8.61% that stocks have delivered over the 20-year period.

AVERAGE ONE-YEAR INCOME RETURN/DIVIDEND YIELD

Source: Clarion Partners Investment Research, NCREIF, REIT.com, S&P, Bloomberg, as of Q2 2021. Note: 5-Year Avg., 15-Year Avg. and 20-Year Avg. are calculated based on historical trailing 12-month income return/dividend yield as of 6/30/21. US Bonds are represented by the Bloomberg Barclays US Aggregate Bond Index. US Stocks are represented by the S&P 500. Indexes are not available for direct investment. Unmanaged index returns do not reflect any fees, expenses or sales charges. Past performance is no guarantee of future return.

CRE RENT GROWTH AND INFLATION, 1994-2020

Source: Clarion Partners Investment Research, NCREIF, REIT.com, S&P, Bloomberg as of Q2 2021. Quarterly results are geometrically chain linked to produce cumulative results and results are shown annualized for periods of 5-year, 10-year, and 20-year. Private real estate is represented by the NPI NCREIF Index. US Bonds are represented by the Bloomberg Barclays US Aggregate Bond Index. US Stocks are represented by the S&P 500. Indexes are not available for direct investment. Unmanaged index returns do not reflect any fees, expenses or sales charges. Past performance is no guarantee of future return.

IN CONCLUSION…

As a tangible asset that generates ongoing cash flow, with a history of rents keeping up with inflation over time and contractual provisions that allow landlords to partially compensate for rising prices, commercial real estate can provide a useful complement to equities and bonds in a diversified portfolio.