Executive Summary

-

Short-term uncertainty but long-term strength: Moderate near‑term net absorption and falling industrial rents in some markets as macro uncertainty delays new leasing and excess vacancy is absorbed.

-

Structural tailwinds intact:

- Continued growth in e‑commerce’s share of retail sales as consumers demand greater variety and faster fulfillment of deliveries;

Supply‑chain reconfiguration (nearshoring, friendshoring, and domestic regionalization) supports additional space needs; and

Obsolescence of legacy product (low clear heights, insufficient dock ratios, power), concentrating demand in “modern” Class A.

-

Longer-term positioning: With industrial now making up about 33% of the expanded NPI, investors are scrutinizing cyclicality. Our view is to maintain core allocation, and tilt to modern product and locations supported by growing production, supply chain infrastructure, and strong local and regional consumption bases.

BASELINE CASE: NEAR-TERM UNCERTAINTY BUT LONG-TERM STRENGTH

Industrial fundamentals have cooled as (1) the sector works through excess supply built up following the pandemic and (2) absorption softens as occupiers normalize to long-term trends and/or remain wary of macro risks. While demand indicators remain broadly positive and we are beginning to see green shoots in certain submarkets and size segments, headline rents are declining in some key markets, including Southern California. These market dynamics are raising questions among investors, especially as industrial now represents the largest portion of diversified indices (the expanded NPI’s allocation is ~33% as of 2Q 2025).

We believe the current environment reflects a cyclical soft patch within a longer-term structural trend for the sector. Even with only modest economic growth forecast for the U.S., the underlying industrial drivers—ongoing e‑commerce growth and adoption, supply‑chain shifts such as nearshoring, and the need to replace older, less functional properties—should continue to support healthy occupier demand and the next development cycle. Meanwhile, sharply declining new construction is reducing supply risks and setting the stage for healthier rent growth. Vacancy remains below both long-term averages and levels consistent with past periods of sustained negative rent growth, such as the period preceding the Global Financial Crisis.

COOLING FUNDAMENTALS: A TEMPORARY SOFT PATCH

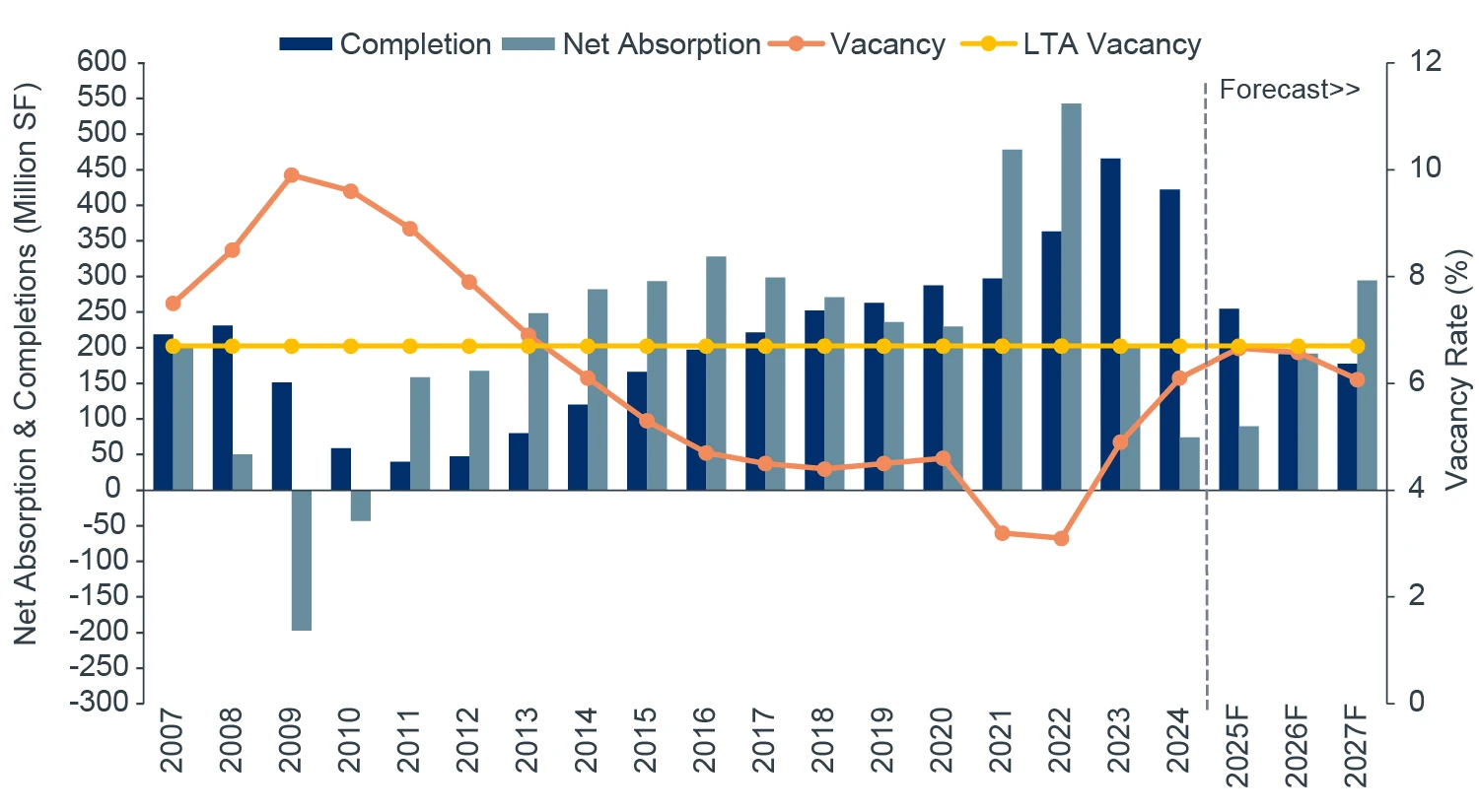

After an unprecedented surge in demand and rent growth from 2020 to 2022, fundamentals have cooled as new supply delivered against moderating demand. As Figure 1 shows, new supply increased substantially to meet record low vacancy during the Covid-19 period. Approximately two years of normal leasing activity (assuming 250 million sf per year) was pulled forward in 2021 – 2022, resulting in a subsequent reduction in leasing activity beginning in 2023. As economic and geopolitical uncertainty increased, first with inflation and higher interest rates, and later with new geopolitical stresses and tariffs, occupier demand started to soften. Not surprisingly, this has led to either flattening—or even downward pressure—on rents in some markets. Importantly though, net absorption has remained positive to date, and is considerably stronger for newer, Class A properties, consistent with the long-term flight to quality experienced in the sector during past market slowdowns.

FIGURE 1: U.S. INDUSTRIAL HISTORY AND FORECAST

Source: CBRE-EA, Clarion Partners Global Research, 3Q 2025. Net absorption is based on quarterly change in occupied stock using vacancy rate. Yellow line is LTA vacancy rate from 2002 to 2024.

At the same time, new industrial construction has been declining, as construction starts have dropped significantly due to tighter financing conditions, uncertain rent and valuation metrics, and cooling occupier demand. Although project deliveries remain somewhat elevated in the near term as late-cycle developments reach completion, the overall active development pipeline has shrunk two-thirds from the 2022 peak – and even more if we exclude large-scale manufacturing build-to-suit projects underway currently. This reduction in new construction has helped constrain the increase in vacancy to date and should result in tighter occupancy and positive rent growth going forward.

INDUSTRIAL REMAINS IN A SECULAR DEMAND CYCLE

For investors who look at the current softer phase to potentially reassess their sectoral exposure and view, we argue that the industrial market is experiencing a cyclical adjustment from the excess demand during the pandemic. However, the strategic ballast of the sector to the economy remains unchanged in our opinion given the deep structural underpinnings of demand. Demand is stabilizing, not vanishing, and we see three structural drivers underpinning the sector going forward:

-

E‑commerce: Requires a broader, denser logistics footprint across infill last‑mile, regional distribution, and large scale bulk.

-

Nearshoring/onshoring/friendshoring: Lifts throughput at border markets and in nodes between gateways and points of consumption, including inland intermodal hubs; tenants value resiliency alongside cost.

-

Tenant behavior and growing obsolescence: More selective expansions; preference for newer build-outs.

E-COMMERCE EXPANSION IS NOT DONE YET

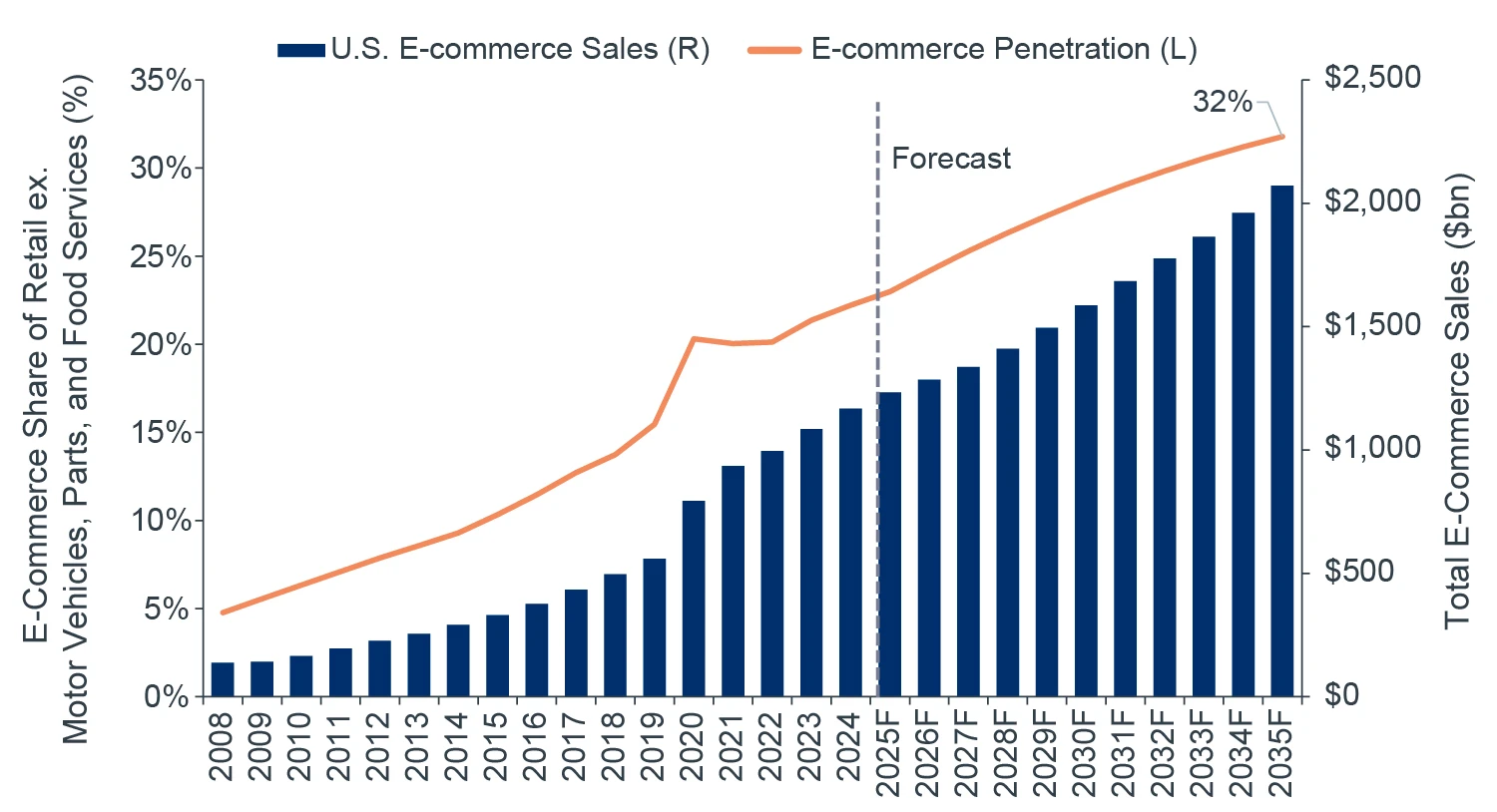

The meteoric rise in e-commerce has been a key driver of the outperformance of the industrial sector over the past 15 years. Penetration rates estimated at 20-25% of core retail sales are expected to climb to 32% by 2035 (and potentially further beyond 2035). The pace of e-commerce growth has settled back to pre-Covid rates and e-commerce sales continue to outpace brick-and-mortar retail sales.

As a common rule of thumb: for each $1 billion of new e-commerce sales, an additional 1.0 million sf of distribution space is required.1 Therefore, the estimated $280 billion in additional e-commerce sales projected over the next five years could alone require 280 million sf of new space, which is roughly 1.7% of current industrial market stock.

FIGURE 2: FORECAST GROWTH IN E-COMMERCE

Source: Moody’s Analytics, CBRE-EA. U.S. Census Bureau, Clarion Partners Global Research, October 2025. Note: E-commerce penetration growth forecast was from CBRE-EA as of 3Q 2025.

NEARSHORING, ONSHORING & FRIENDSHORING

Increased manufacturing in the U.S. and in neighboring countries should increase demand for traditional warehouse/logistics properties. We expect the most direct impact from advanced manufacturing (purpose built, high spec, large capex, multi-phase campuses). These manufacturing processes should have a multiplier effect (1x to 5x depending on the industry)2 as inputs to the manufacturing process and finished goods work through the supply chain in warehouse facilities. Warehouse properties near manufacturing facilities and cross-border logistics should see the most significant increase in demand. In terms of geographic implications, we expect growth in both new and existing manufacturing clusters in Arizona, Texas, Southeast states, and California. A secondary effect of manufacturing expansion will be to remove competitive land for potential industrial development from the market, reducing the threat of new competitive supply and supporting rent growth for existing properties.

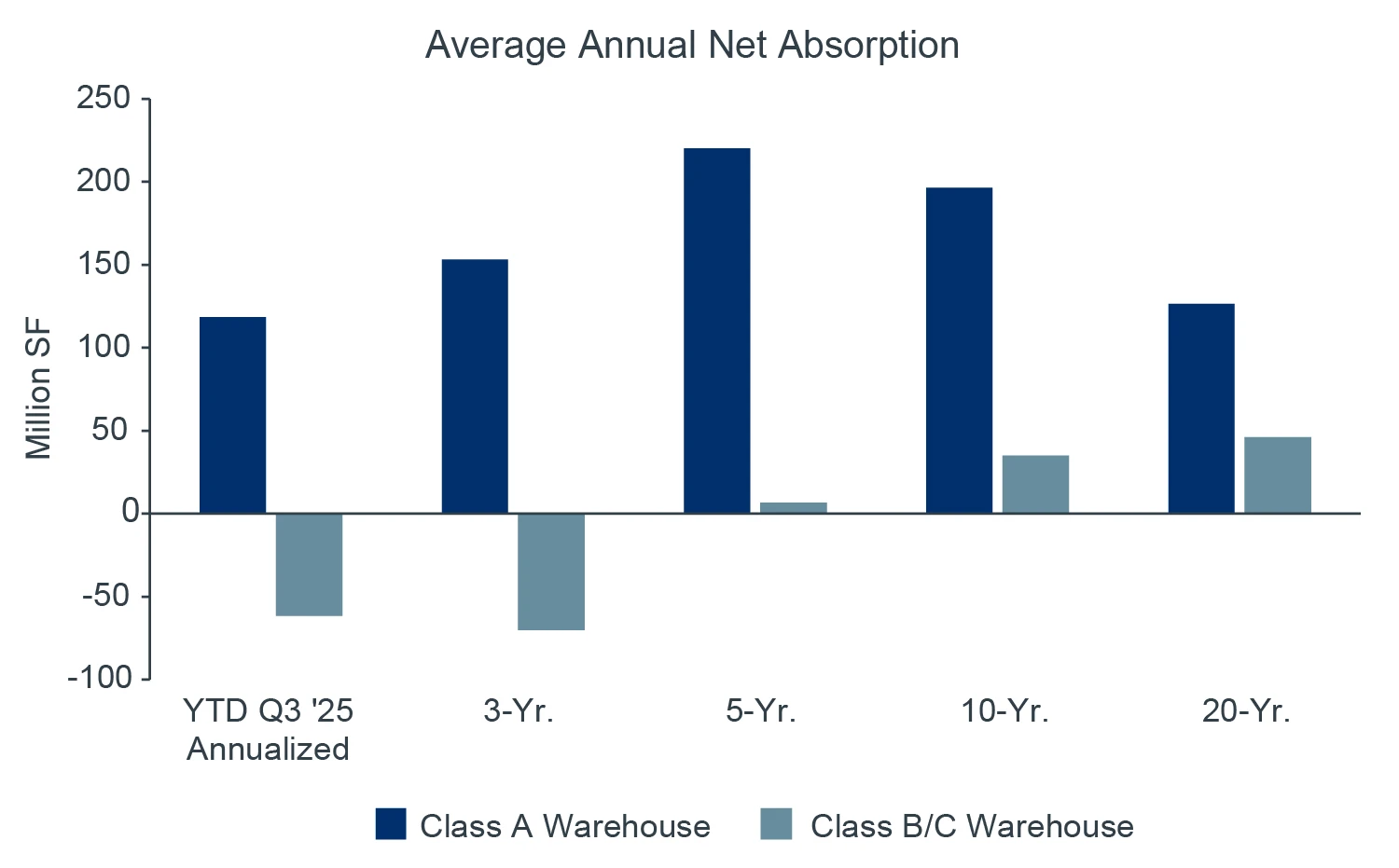

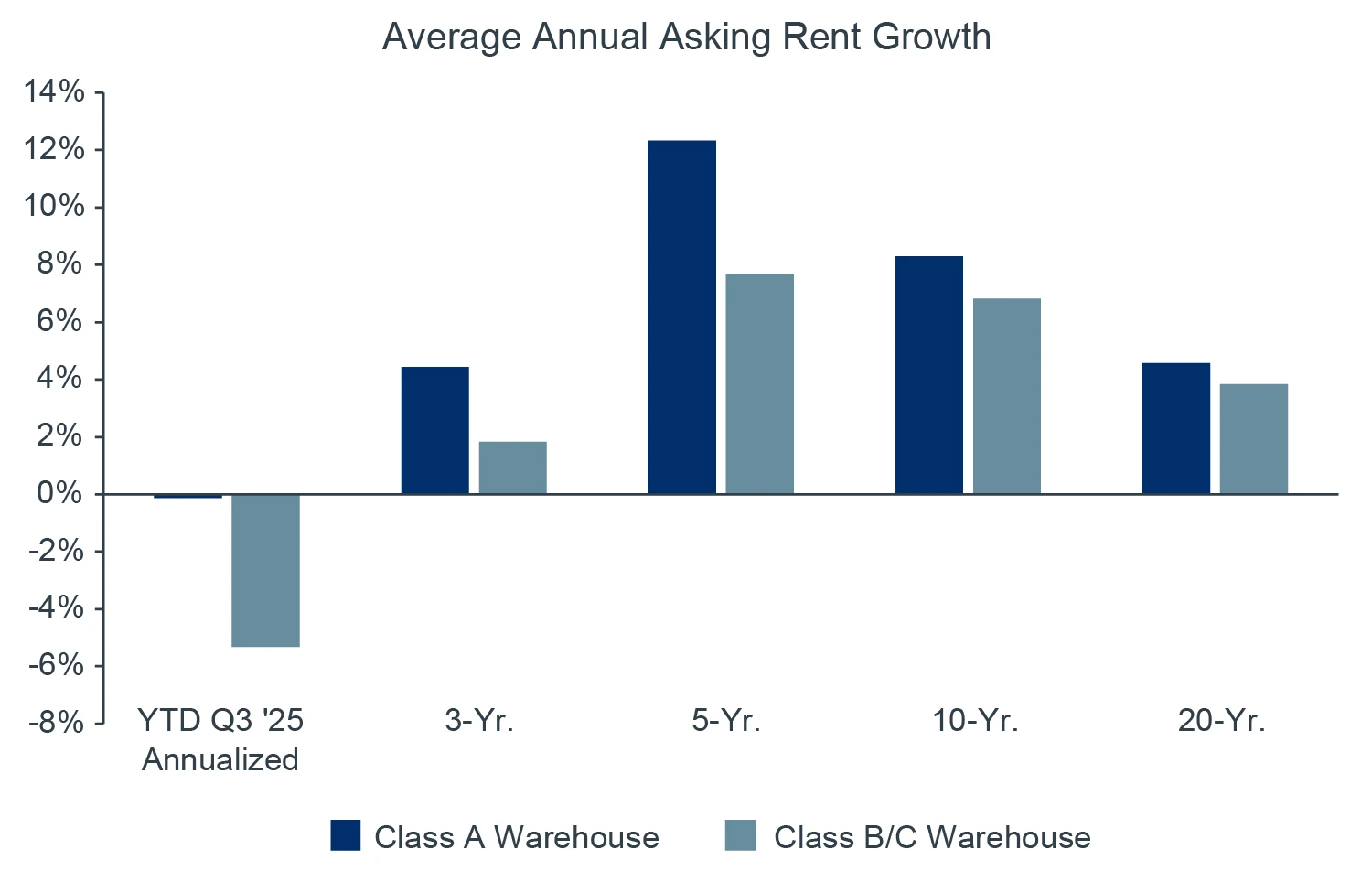

TENANTS CONTINUE TO PREFER NEWER ASSETS

Product obsolescence has become a significant challenge in the sector; legacy warehouses often lack the infrastructure to support advanced automation and cannot accommodate the larger vehicles or increased throughput requirements demanded by modern e-commerce and nearshoring supply chains. As technology and tenant requirements evolve, older buildings face declining demand and lower rents, while modern facilities offer the flexibility and scalability needed for efficient operations, making them much more attractive to tenants seeking resiliency and cost-effectiveness.

Modern Class A industrial warehouses—characterized by features such as 36-foot or higher clear heights, a high ratio of dock doors to square footage, abundant trailer and employee parking, ESFR sprinkler systems, robust power capabilities, and locations and building amenities that allow for competitive labor recruitment and retention—are increasingly attracting the majority of creditworthy tenants and commanding higher rents compared to older, legacy facilities. The shift toward automation-ready buildings and locations offering efficient access to labor pools, rooftops, and key logistics nodes is further driving a widening rent gap.

FIGURE 3: NET ABSORPTION AND RENT PREMIUM OF CLASS A VERSUS B/C

Source: CBRE-EA, Clarion Partners Global Research, 3Q 2025. Based on warehouse product type.

MITIGATING SECTOR RISKS AND STRATEGIES

While we believe industrial will continue to benefit from the secular drivers discussed above, the sector does face some near-term softness from the slowdown in leasing activity. The impacts of tariffs and trade are the foremost concern among investors, and they are also slowing leasing decision-making and new space commitments among tenants. Escalating tariffs and/or constantly changing tariffs could increase costs and uncertainty, leading consumers and businesses to delay spending and capital investments. Thus far, the economy is not showing widespread stress, but the full impact of tariffs has arguably not been seen yet. Trends among tenants to diversify supplier bases, build out optionality and redundancy in their supply chains, and pursue incremental nearshoring strategies can be helpful in mitigating tariffs and will also support increased industrial demand in the future.

The recent slowdown in domestic manufacturing (despite longer-term expectations of expansion) and certain soft spots in the labor market are likely a result of tariff uncertainty and increased costs for some manufacturing inputs. If they continue, tariffs may lead to a deeper-than-expected economic slowdown that may weaken and delay absorption in industrial, as well as other real estate sectors. With an elevated vacancy rate and space overhang in certain market segments and submarkets, the overall recovery for industrial may prove to be more prolonged. To some extent this risk is mitigated by falling construction starts and the pivot towards higher quality space. We believe these risks are likely to create some downward pressure on absorption and rents as supply peaks. We remain confident, however, that with supply falling sharply and key structural demand drivers intact, the industrial sector’s cyclical weakness will ease over the next 6-12 months.

LOOKING AHEAD: OUR INVESTMENT FRAMEWORK

We view the current dislocation in the industrial sector as a temporary imbalance and remain comfortable advocating an equal to overweight stance relative to the ODCE or NPI benchmark (34% and 33%, respectively). That said, we recommend that investors favor modern, automation ready Class A assets that will continue to attract a roster of strong tenants. Despite some softness recently, particularly in Southern California, we also receommend leaning into infill coastal hubs that cater to large and affluent consumption markets and nearshoring-linked corridors. The strong secondary markets benefiting from demographic and economic growth (and therefore spurring continued consumption) are also well-positioned for future performance.

We believe development remains an attractive way to grow an industrial portfolio, particularly through build-to-core strategies in locations where supply/demand dynamics remain in balance for the building size being delivered and where development margins provide a reasonable (20%+) risk-adjusted return. Build-to-suit opportunities can reduce the risk profile further, and we are seeing growing demand from tenants where the existing availability of modern Class A buildings they require remains limited. Importantly, construction costs have remained relatively flat recently for industrial development, and we are not seeing significant cost pressures from tariffs or other factors.

CONCLUSION

The U.S. industrial warehouse market is shifting from a supply-heavy phase to re-balancing: deliveries are peaking, starts are down, and demand, though more selective, is beginning to stabilize, anchored by e-commerce, 3PL outsourcing, and on/near-shoring. We are seeing early signs of a pickup in leasing activity, in the form of increased property tours, tenant Request for Proposals, and an improvement in overall market occupancy across several key markets over the past quarter. Transaction activity remains solid, with most industrial sales seeing an improvement in the number and quality of bidders, and pricing showing stability as the market has adjusted to an environment where the 10-year Treasury hovers in the 4.25% - 4.50% range. However, we expect a bifurcated outcome: modern, well-located Class A assets will likely attract more robust tenant demand, while older or peripheral product faces longer downtime and capex drag. Headline rent growth has clearly moderated from pandemic highs and we expect it to trough within the next 9-12 months depending on the market and size segment. Tenants remain “sticky” in quality properties, resulting in retention rates that are at or above historic levels and providing opportunities for property owners to substantially grow rents upon lease renewals. The mark-to-market rent opportunity remains positive in most markets, even where demand for new leasing is challenging.

With capital constrained, we anticipate new construction will remain limited, laying the groundwork for rent stability and growth as the pipeline tapers. Key risks—goods-sector consumer softness, tariff/United States-Mexico-Canada Agreement policy noise—are likely to remain, but the base case is stable-to-improving fundamentals as supply drops off, led by coastal/infill and nearshoring-linked corridors. We believe that this is a through-cycle, quality-led market—where owning the most suitable locations and leases should help investors over the long run, and that the industrial sector remains a structurally vital piece of the U.S. economy that merits an enhanced weighting to other sectors in well-positioned real estate portfolios.

To learn more, click here to watch our Trends in U.S. Industrial Real Estate video.