In today's world, there are a number of global macro trends rapidly impacting the way we live, work, and invest. These include changing demographics, technological advancements, and deglobalization. As a research-driven investment firm, Clarion Partners focuses on these trends to identify sources of real estate demand and drive performance. One area that the CP Investment Research team has been particularly focused on is deglobalization, which has disrupted global supply chains and challenged how we do business across regions. Evolving rules and regulations, as well as heightened geopolitical tensions, have had a direct impact on logistics patterns in the United States, which has in turn impacted industrial warehouse demand.

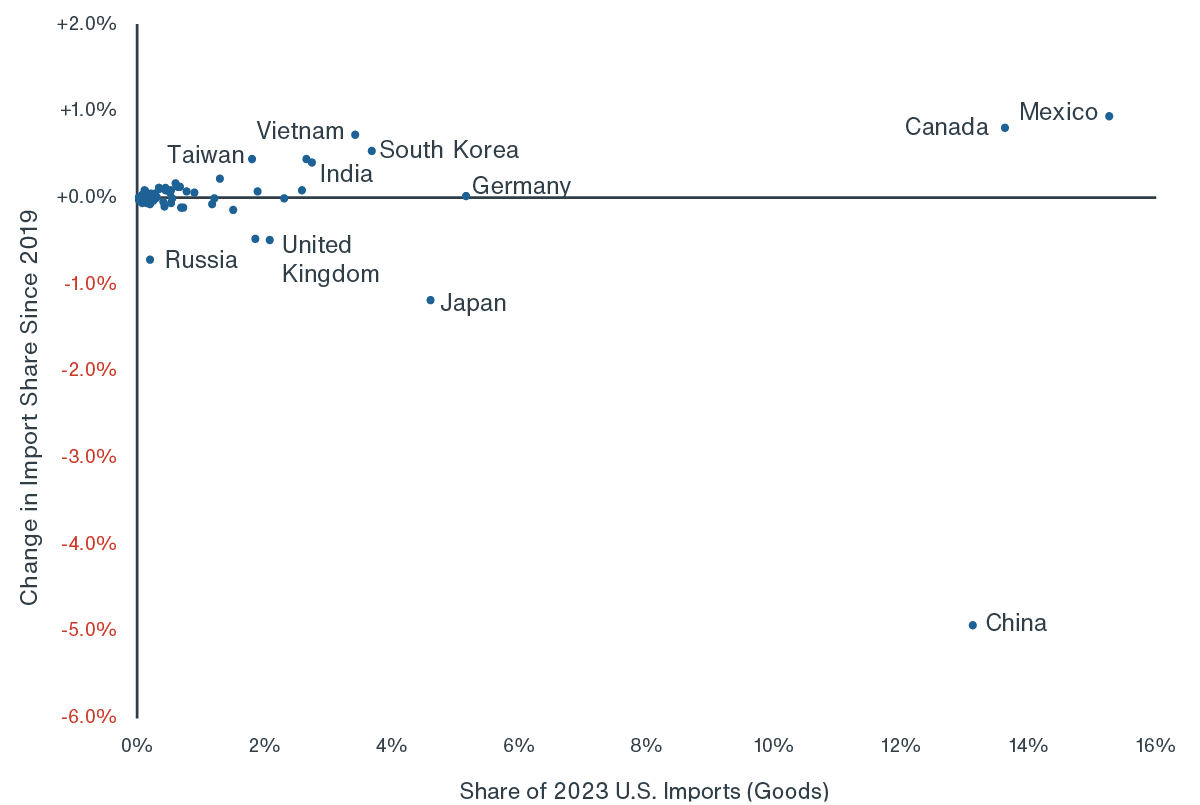

One example is the shift in manufacturing and trade away from China and toward Mexico. Trade data shows Mexico now accounts for the largest share of all merchandise imports to the U.S. after seeing a 5.4 percent growth year-over-year in dollar volumes during first half 2023 compared to China’s 25 percent decline. Overall, imports from Mexico were also 32 percent higher compared to the same period in 2019 (pre-Covid).1 The recent supply chain shocks, elevated wage and transportation costs, ongoing U.S. political tensions with China, and shifting consumer trends, including the rise of electric vehicles, have incentivized the regionalization of supply chains, presenting Mexico with an opportunity. As long as costs remain competitive and manufacturing labor pools remain abundant, Mexico is well-positioned to attract manufacturing investment from companies that are looking to move their operations closer to the U.S. This shift is creating an industrial warehouse opportunity along the U.S. southern border. The El Paso, Texas, industrial market, in particular, is one that is benefiting from this trend, and demand for industrial warehouse space has accelerated here over the past two years, causing an upsurge in industrial rents.

SOURCES OF U.S. IMPORTS

The meeting point between west Texas, southern New Mexico and northern Mexico, known as the North American Borderplex region, serves as the logistics hub for the established manufacturing cluster in Ciudad Juárez, Mexico. Due to its location at the midpoint of the border between the U.S. and Mexico, the Borderplex region serves as a transborder conurbation known for its scale of manufacturing infrastructure. This is the continent’s seventh largest manufacturing region, offering a significant competitive advantage for manufacturers given the area’s access to multinational supply chains, an abundance of skilled labor, and fast access to U.S. consumers.

Clarion Partners’ research group identified this trend early on, leading the team to acquire Rojas East Distribution Center in El Paso in August 2022. The property is well located within El Paso’s largest and fastest growing east industrial submarket, and it is 100 percent leased to two tenants that rely on cross-border trade for their businesses. Clarion Partners believes that the strategic investment is well-positioned to benefit from deglobalization and the ongoing shift in logistics from China to Mexico driving industrial warehouse demand in the region in both the near and long-term.

In conclusion, global macro trends and real estate demand in the U.S. are inextricably linked. Deglobalization, whereby global supply chains are being disrupted and businesses are challenged given changing rules and regulations, is an example of the impact these trends can have on real estate markets and sectors. Clarion Partners’ research and data-driven investment process allows the firm to both analyze these global macro themes and identify markets, submarkets and sectors that may be positioned to outperform as a result, thereby identifying opportunities that others may overlook.