THE HEALTH ECONOMY

In recent years, purpose-built commercial space for life sciences research and development (R&D) has been an outperforming alternative property type more frequently pursued by real estate investors. Clarion Partners believes life sciences industry clusters are creating more prosperous U.S. cities, while occupancy and rent growth trends have been robust for property owners.

A few powerful economic and demographic factors are driving a significant acceleration of capital investment into the life sciences sector.

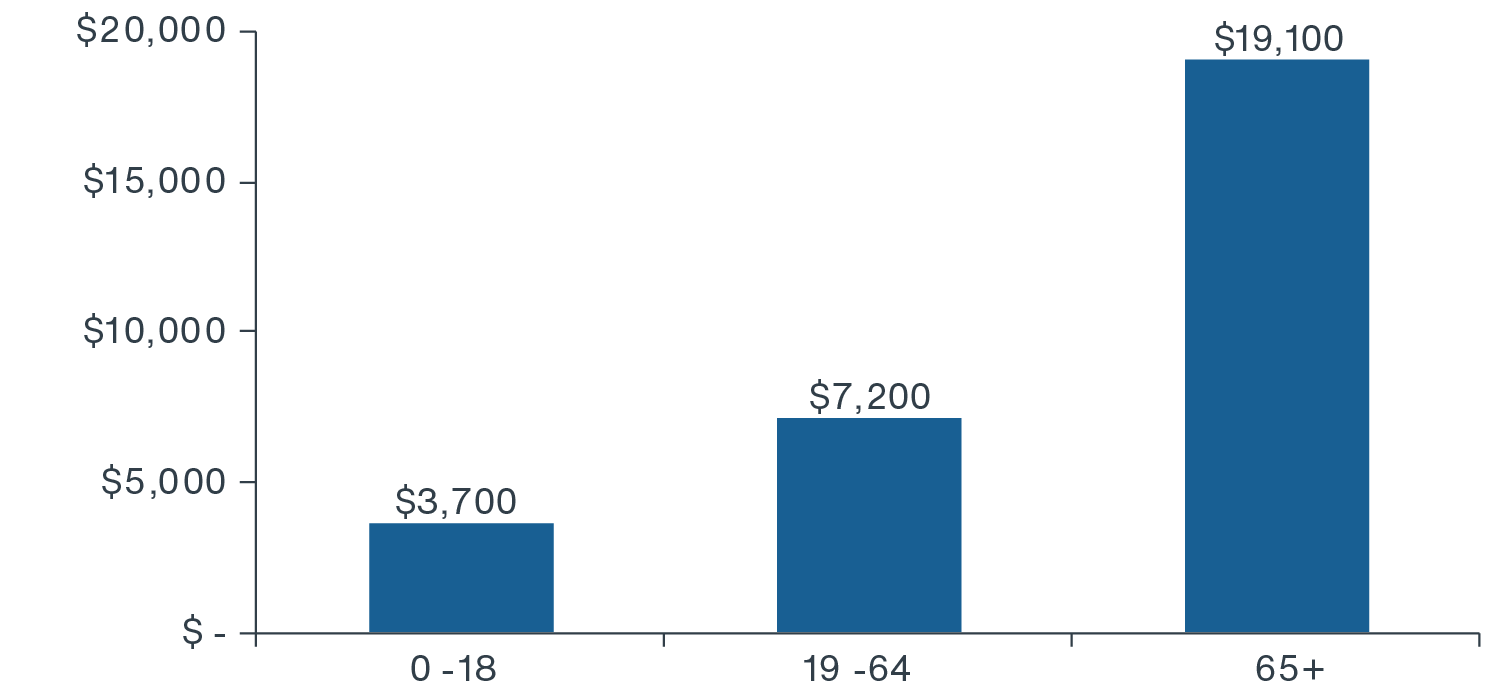

- An Aging Population. Seniors account for a rising share of the U.S. population. The cohort now represents about 16% of Americans and has been forecasted to grow to over 20% by 2030.1 At the same time, average life expectancy increased from 72.6 years in 1975 to 78.9 years in 2019. On average, seniors spend over $19K per annum on healthcare.2

U.S. SENIOR POPULATION GROWTH FORECAST

U.S. PER CAPITA HEALTH CARE SPENDNG BY AGE COHORT

- Rising Health Care Spending. Over the next decade, national health care spending is projected to grow at an average rate of 5.5% per year and is likely to rise as a percentage of U.S. GDP to about 20% by 2028, up from about 18% in 20203.

U.S. HEALTH CARE SPENDING FORECAST

- The Coronavirus Epidemic. The global COVID-19 pandemic will likely be a boost for life sciences funding and fuel new medical and drug treatments for commercialization. This follows three consecutive years of FDA novel drug approvals from 2017 to 2019 well-above the long-term average.

FDA NOVEL DRUG APPROVALS 2006-2019

Source: Moody’s Analytics, Centers for Medicare and Medicaid Services, Clarion Partners Investment Research. Q2 2020. Note: Senior population growth and healthcare spending forecasts from Moody’s Analytics as of September 2020.

- More Synergy between Health Care and Technology. At the same time, there are more and more crossovers between health care and technology innovation. This synergy has spurred tremendous growth across the U.S., which has been hyper-concentrated in certain high-cost markets and is now spreading to new growth centers.4

INVESTABLE UNIVERSE GROWING FAST ALONG WITH MORE CAPITAL FLOWS

Today, the approximate market cap of publicly-traded REIT managed life sciences real estate is about $30.4 billion. Currently, there is one pure-play listed REIT - Alexandria Real Estate (ARE) and two with partial exposure - Healthpeak (PEAK) and Ventas (VTR). Top private owners include Biomed/ Blackstone, Clarion Partners and a few others.5 The investable universe for life sciences real estate is estimated at $10 billion, which is growing rapidly.6

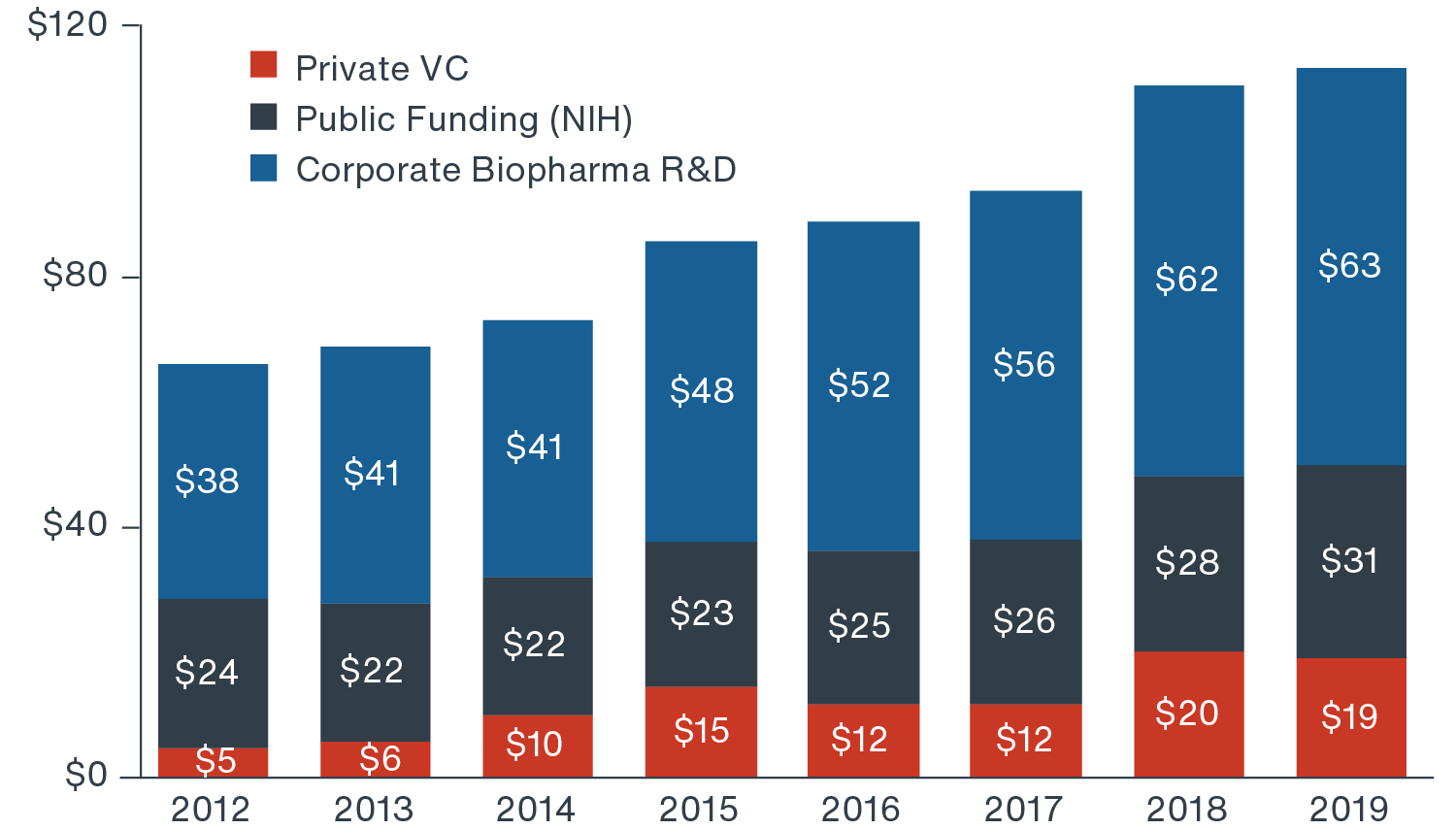

Three major sources of capital are driving R&D in the life sciences sector and are all at a record high:

- Private life sciences venture capital (VC) funding;

- Public funding from National Health Institute (NIH);

- Corporate biopharma capital

TOTAL U.S. LIFE SCIENCES R&D CAPITAL INVESTMENT BY SOURCE ($ BILLIONS)

Source: National Institute of Health, PitchBook, PhRMA, Clarion Partners Investment Research. Q3 2020

Over the past five years, sizeable socioeconomic tailwinds have driven average annual growth rates between 5% and 20% in each of these funding categories.

R&D spending by corporations and large pharmaceutical companies is by far the biggest source of funding. Major companies like Johnson & Johnson, Roche, Pfizer, Novartis, and Merck are investing heavily in life-saving technologies and therapeutics.

Annual life sciences R&D spending in biopharma is even comparable to that of big tech giants, such as Amazon, Alphabet, Microsoft, and Apple.7

LIFE SCIENCES CLUSTERS

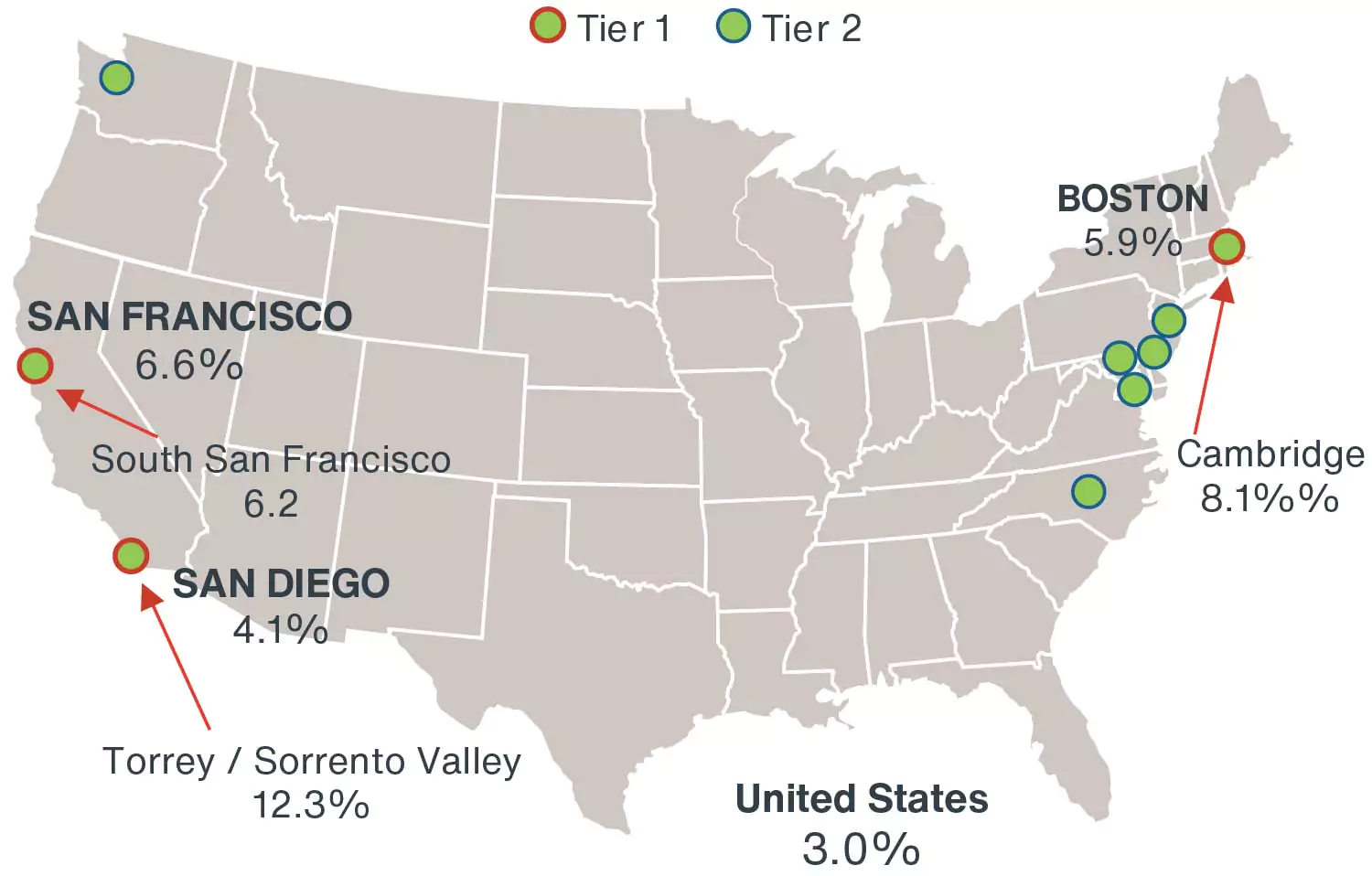

Locational “clustering” is a dominant theme in life sciences. The clustering effect is due to the intrinsic benefits of the locational convergence of large hospitals, leading universities, research institutions, life sciences and biotechnology companies, highly educated work forces, and capital funding. The three most established and booming life sciences centers are Boston/ Cambridge, San Francisco, and San Diego, all of which have large inventories of highly-specialized purpose-built lab and R&D facilities.

Clarion Partners believes there are two tiers of target investment markets based on the count of highly specialized lab inventories:

Tier 1:

- Boston/Cambridge, Longwood Medical, Seaport and surrounding submarkets;

- SF/South San Francisco, Mission Bay, Mid-Peninsula, Emeryville/Berkley;

- San Diego/Torrey Pines, University Towne Center, and Sorrento Valley

Tier 2:

- NYC/NJ

- Raleigh-Durham (Research Triangle)

- Seattle

- Maryland/DC

- Philadelphia

In top life sciences clusters, there is generally low new supply and strong demand for Class A inventory, which has led to low vacancy levels and strong rent growth. Occupiers are willing to pay high rents for the best locations and facilities. Tier 1 markets reported 5-year average effective office rent growth of 8.9%, well above the U.S. office average of 3.0% (as of Q4 2019).

TOP LIFE SCIENCES CLUSTERS: 5-YEAR AVERAGE EFFECTIVE OFFICE RENT GROWTH

Source: CBRE-EA, Clarion Partners Investment Research, Q4 2019. Note: Effective rent growth avg from 2015-2019

At the same time, these innovation nodes have proven to have significant ancillary benefits on local economies and communities. Different industries centered around these hubs have proven to be more productive overall. Innovation clusters have reported outsized median household income levels, wage growth, and home price appreciation.8 In fact, the Brookings Institute reports the regional divergence has reached extreme levels in areas where the U.S. innovation sector has thrived. It states:

“The innovation sector—comprised of 13 of the nation’s highest-tech and R&D “advanced” industries—contributes inordinately to regional and U.S. prosperity.9 Its diffusion into new places would greatly benefit the nation’s wellbeing. However, far from diffusing, the sector has been concentrating in a short list of superstar metropolitan areas.

Most notably, just five top innovation metro areas—Boston, San Francisco, San Jose, Seattle, and San Diego—accounted for more than 90% of the nation’s innovation-sector growth during the years 2005 to 2017… increasing their share of the nation’s total innovation employment from 17.6% to 22.8% since 2005.”

In the years ahead, Clarion Partners believes there will likely be a greater dispersion into the aforementioned “Tier 2” markets, largely due to the high cost of business occupancy and living overall in top clusters.

PURPOSE-BUILT LAB FACILITIES

Typical purpose-built life sciences research lab facility requirements are highly specialized, driven by the handling, managing, and storage of chemicals and scientific equipment. The initial development costs for lab office are therefore generally higher than those of traditional office

They often have features such as:

- High ceilings (optimally 15’-16’ slab to slab);

- High-powered base building HVAC systems;

- Individualized exhaust system & emergency generator power;

- Separate elevator shafts/ loading docks

SIGNIFICANT INVESTMENT OUTPERFORMANCE

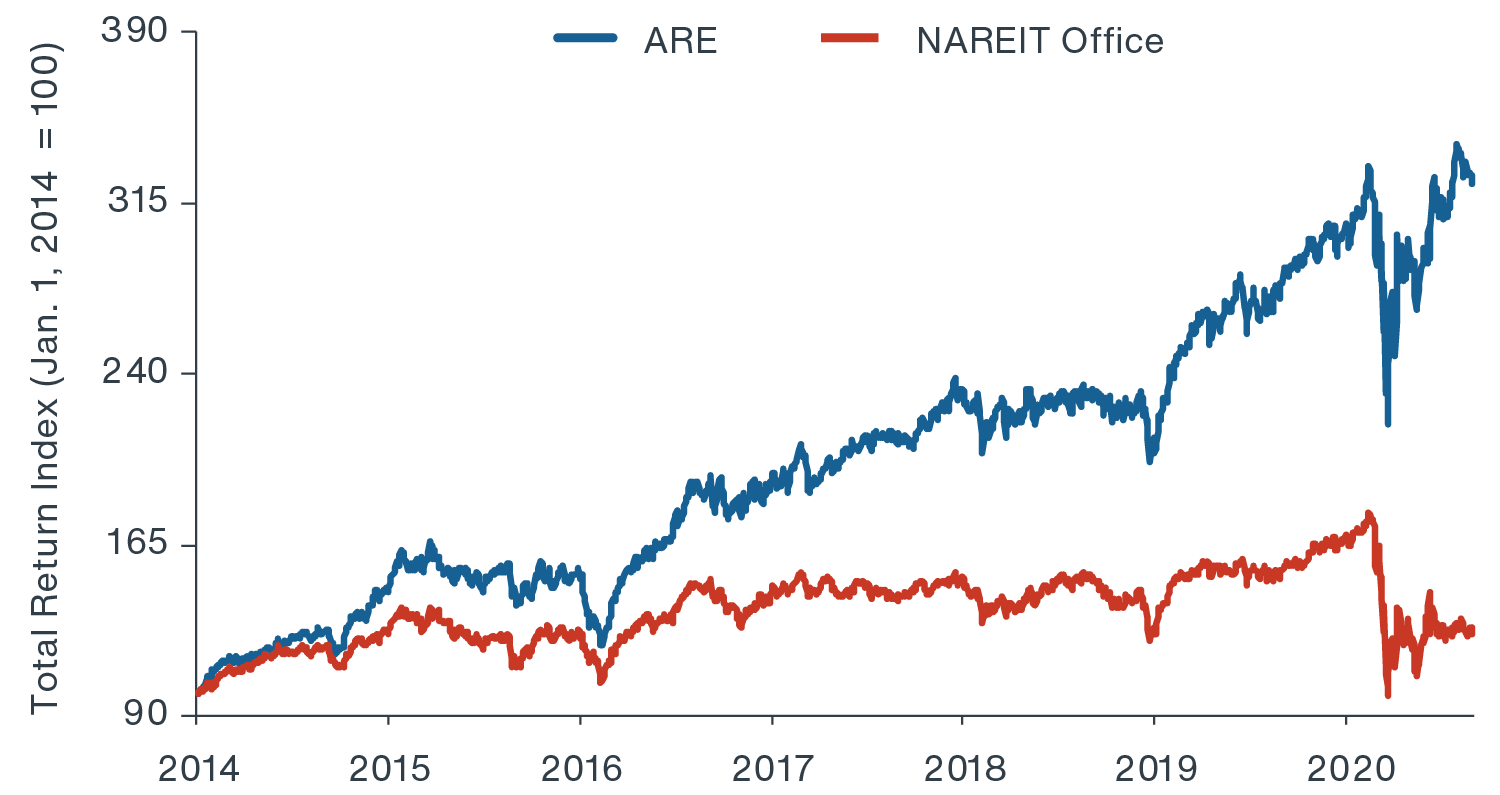

In recent years, the ARE (the only pure-play life sciences REIT tracked by NAREIT) total return investment performance has outperformed that of traditional U.S. office significantly. While the full effects of the COVID-19 pandemic on demand for office space, including life sciences office space, are uncertain, we believe it is an excellent time to concentrate on this segment with a rapidly expanding market size yet with few large institutional players.

LIFE SCIENCES VS. TRADITIONAL OFFICE NAREIT TOTAL RETURN INVESTMENT PERFORMANCE

Source: Bloomberg, Clarion Partners Investment Research, September 2020. Notes: 1) ARE = Alexandria Real Estate Equities Inc. 2) Data is daily as of August 31, 2020.

More and more institutional investors are beginning to pursue life sciences real estate due to the strength of property-level fundamentals that are less correlated to the economic cycle risks due to the more inelastic demand from the health care industry. Overall, high-quality assets have demonstrated core-like investment characteristics, which include:

- Relatively stable cash flow;

- Lower measured risk;

- A large and growing investable market;

- A good track record of higher tenant retention rate (80%) / lower ongoing capital expenditure

Going forward, Clarion Partners believes that life sciences real estate offers attractive risk-adjusted investment opportunities. We recommend a focus on developing and acquiring assets in established and high-growth life sciences clusters with relative supply constraints and durable long-term rent growth.