Executive Summary

As the new European real estate cycle takes shape, we continue to see logistics as one of the more attractive investment propositions, underpinned by three pillars:

- Sturdy occupier fundamentals - Demand remains broad-based across markets and sectors, supported by the ongoing need for efficient distribution space.

- Positive investor sentiment and robust liquidity - Transaction activity has picked up, with logistics continuing to command a large share of institutional allocations.

- Long-term structural drivers - The expansion of e-commerce, adoption of ESG standards, and the modernization of supply chains all provide enduring support to the sector.

Economic risks have risen, but Europe’s economy has proved resilient to date, and the trajectory of monetary policy remains broadly favourable. Against this backdrop, we believe investors should focus on modern, high-specification assets—those increasingly favoured by occupiers for their efficiency, sustainability credentials, and technological readiness. In our view, these attributes will be critical for delivering liquidity and income durability through the next cycle.

A NEW CYCLE BEGINS

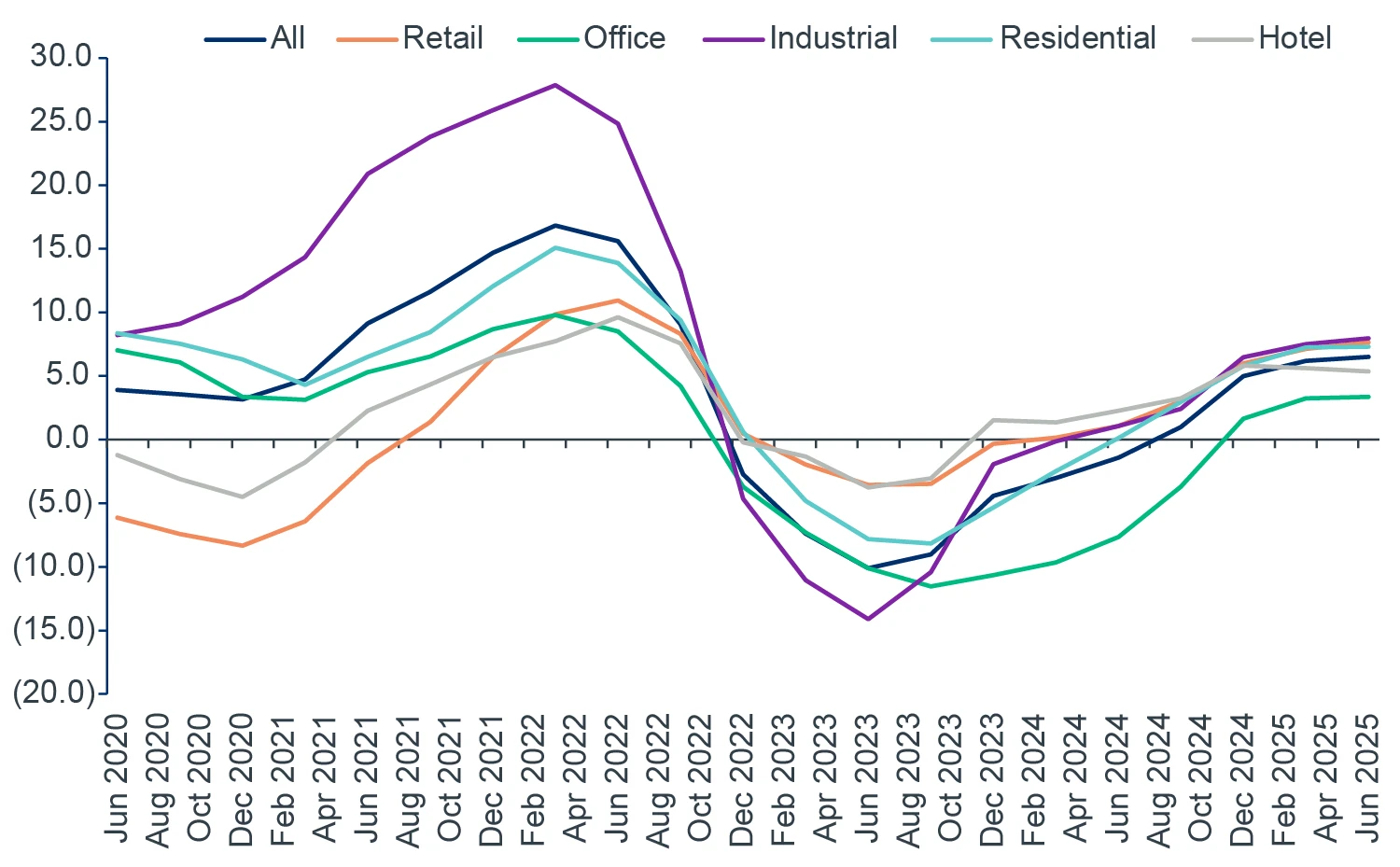

Capital markets in European logistics remain in solid shape. Transaction volumes in H1 2025 were around 5% higher than the same period last year,1 underscoring both liquidity and ongoing investor confidence. MSCI’s Quarterly Index data show logistics as the best-performing major property type over the 12 months to June 2025—albeit (Figure 1) by a narrow margin—highlighting the sector’s resilience even in a challenging macro backdrop.

FIGURE 1: TOTAL ANNUAL RETURN (%)

Source: MSCI, as of 2Q 2025.

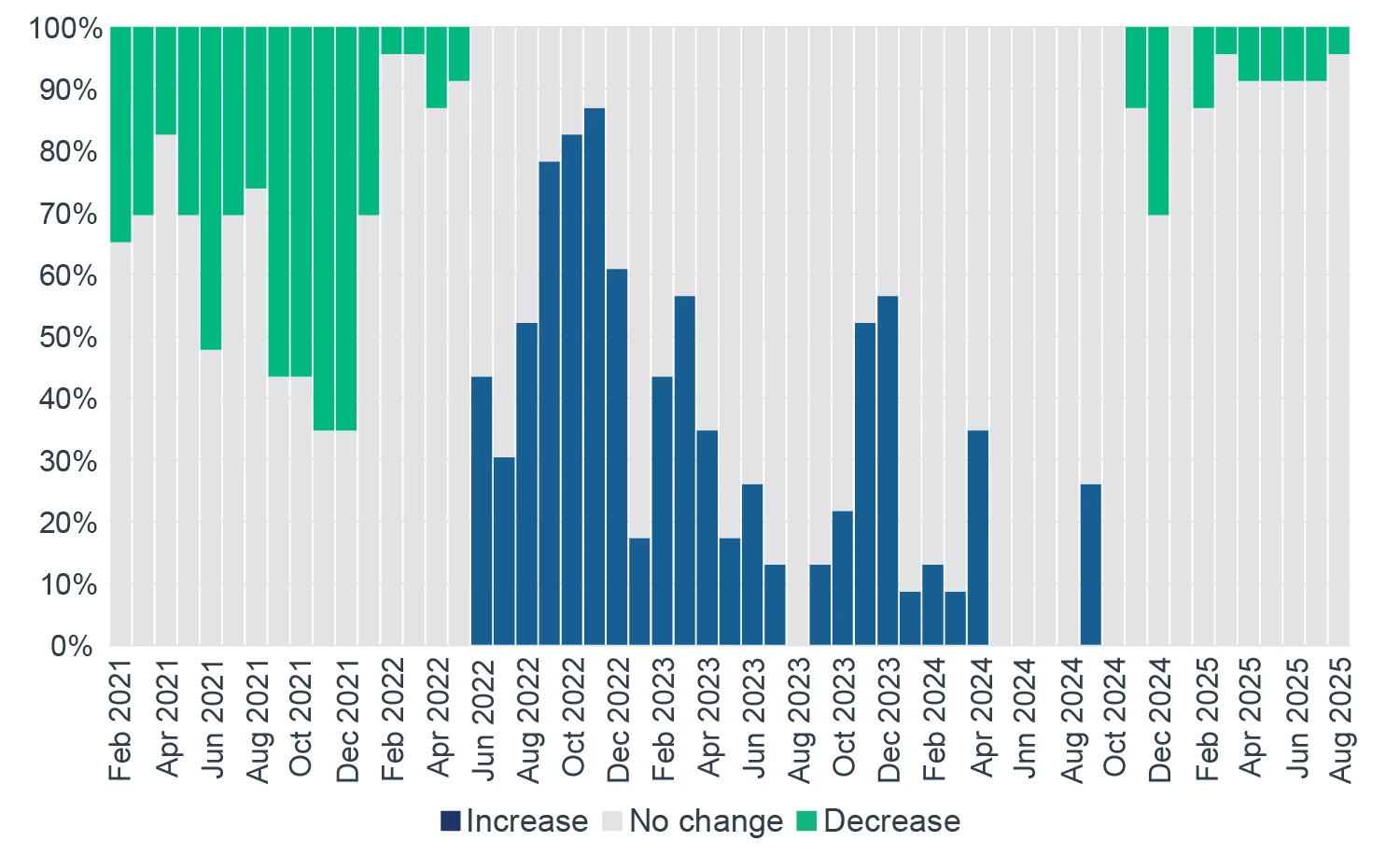

Performance in this early stage of the cycle has been underpinned primarily by higher entry yields and sustained net operating income (NOI) growth. We expect these drivers to remain a defining feature of this phase, placing heightened importance on careful market and asset selection. CBRE yield data suggest stabilization across most markets, with the first signs of compression emerging in select locations (Figure 2). Perfectly timing the market is always elusive, but the recent repricing has created a compelling window for capital deployment. We continue to see attractive upside for investors allocating to European logistics today.

FIGURE 2: YIELD CHANGE FOR 22 EUROPEAN LOGISTICS MARKETS

Source: CBRE, Clarion Partners Global Research, as of August 2025.

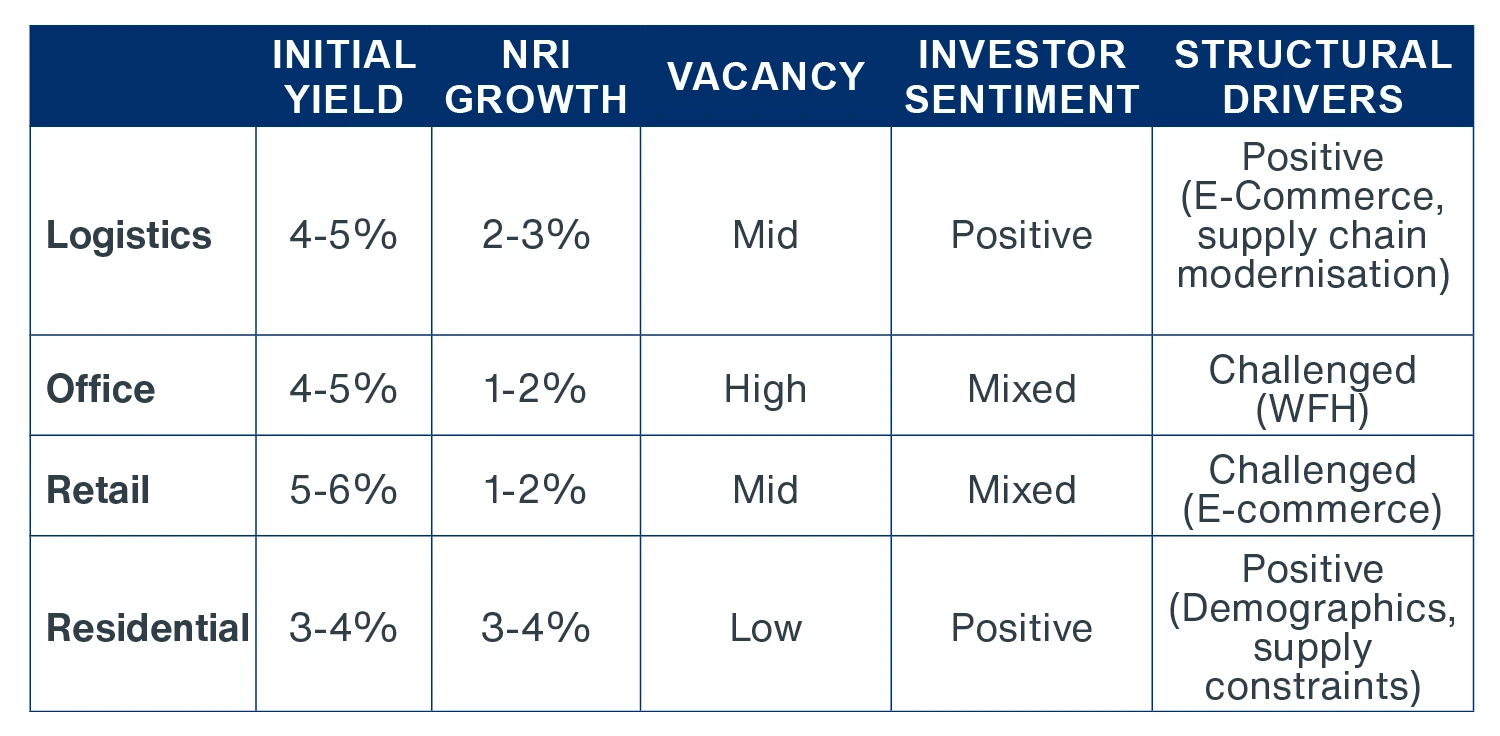

Relative to other major property types, logistics continues to screen well on a risk-adjusted basis, supported by structural demand tailwinds and a healthy balance of supply. The following table illustrates how the sector compares across key performance metrics:

Source: Clarion Partners Global Research based on MSCI (yield and vacancy) and Green Street (NRI growth) data.

STURDY FUNDAMENTALS

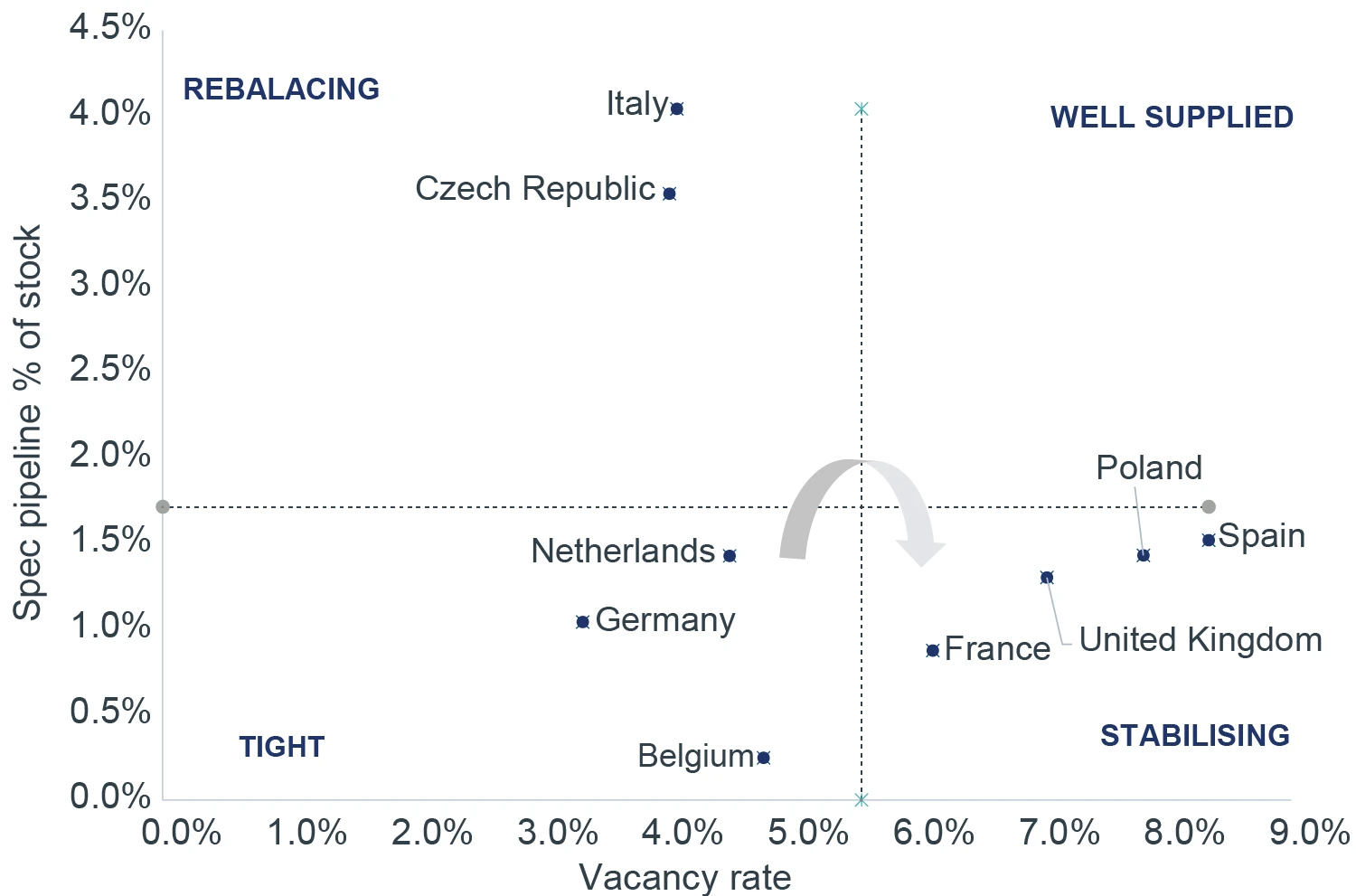

Occupier fundamentals remain the cornerstone of European logistics’ appeal. Since our last note dated March 2025, the market has continued to rebalance, with vacancy standing at 5.3% as of June 2025.2 Core hubs such as Germany and the Netherlands remain particularly tight, underscoring the depth of demand in established locations.

Importantly, active development pipelines suggest that most markets are now approaching peak vacancy levels, pointing to more muted supply-side pressure in the near term. Reinforcing this view, total European stock expanded by just 4% year-on-year in June—the slowest pace of growth in more than a decade. This moderation in new supply provides a constructive backdrop for rental growth and income stability.

FIGURE 3: MARKET CYCLE QUADRANTS

Source: CBRE, Clarion Partners Global Research, as of June 2025.

TWO THEMES FOR THE NASCENT CYCLE

Flight to Quality

A defining theme of this nascent cycle is occupiers’ accelerating flight to quality. Demand is increasingly concentrated in modern, high-specification facilities, with older, less efficient stock struggling to attract tenants. These assets deliver meaningful operational and financial advantages, including:

- Higher clear heights, allowing greater storage efficiency

- Super-flat floors, enabling advanced automation

- Optimized dock door ratios, enhancing throughput

- Stronger floor load capacities, supporting heavier goods

Beyond operational benefits, these attributes align closely with ESG and sustainability objectives. In 2024, 75% of take-up across France, Germany, Italy, Spain, and the UK was in newly built space,3 while 65% of occupiers surveyed by CBRE indicated a willingness to pay a premium for net-zero-ready facilities.4

Performance data reinforce this trend. Grade A vacancy in core markets now sits below 3%, compared with materially higher levels in secondary stock.5 Meanwhile, speculative pipelines remain modest—just 1.0–1.5% of stock under construction in Germany, France, and the Netherlands—suggesting vacancy should remain low and rental growth resilient.6

We forecast rental growth of 2–3% annually over the next five years. With average lease expiries still rolling at 10–15% below market levels, there is clear potential for meaningful NOI growth from mark-to-market opportunities.

Return of E-Commerce

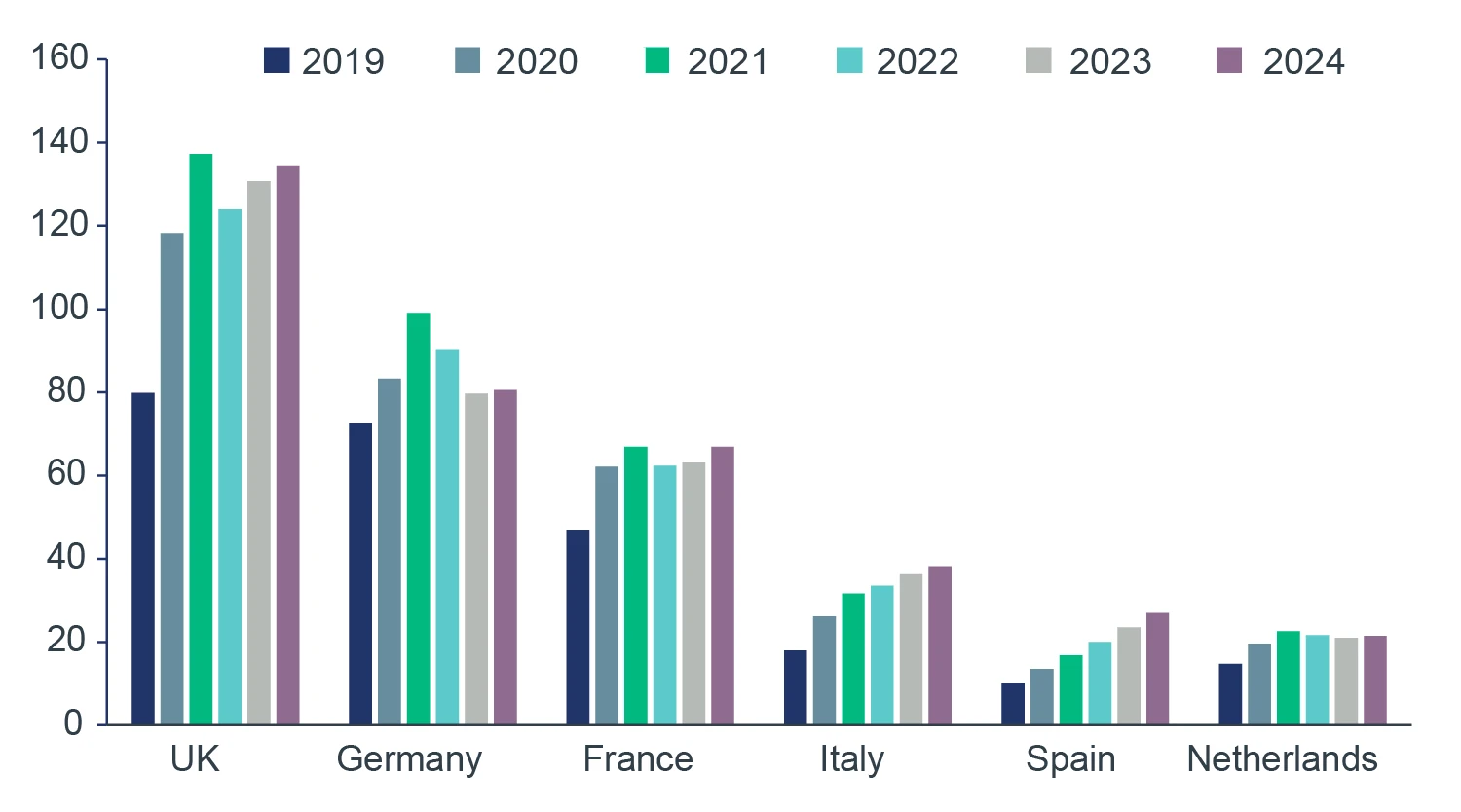

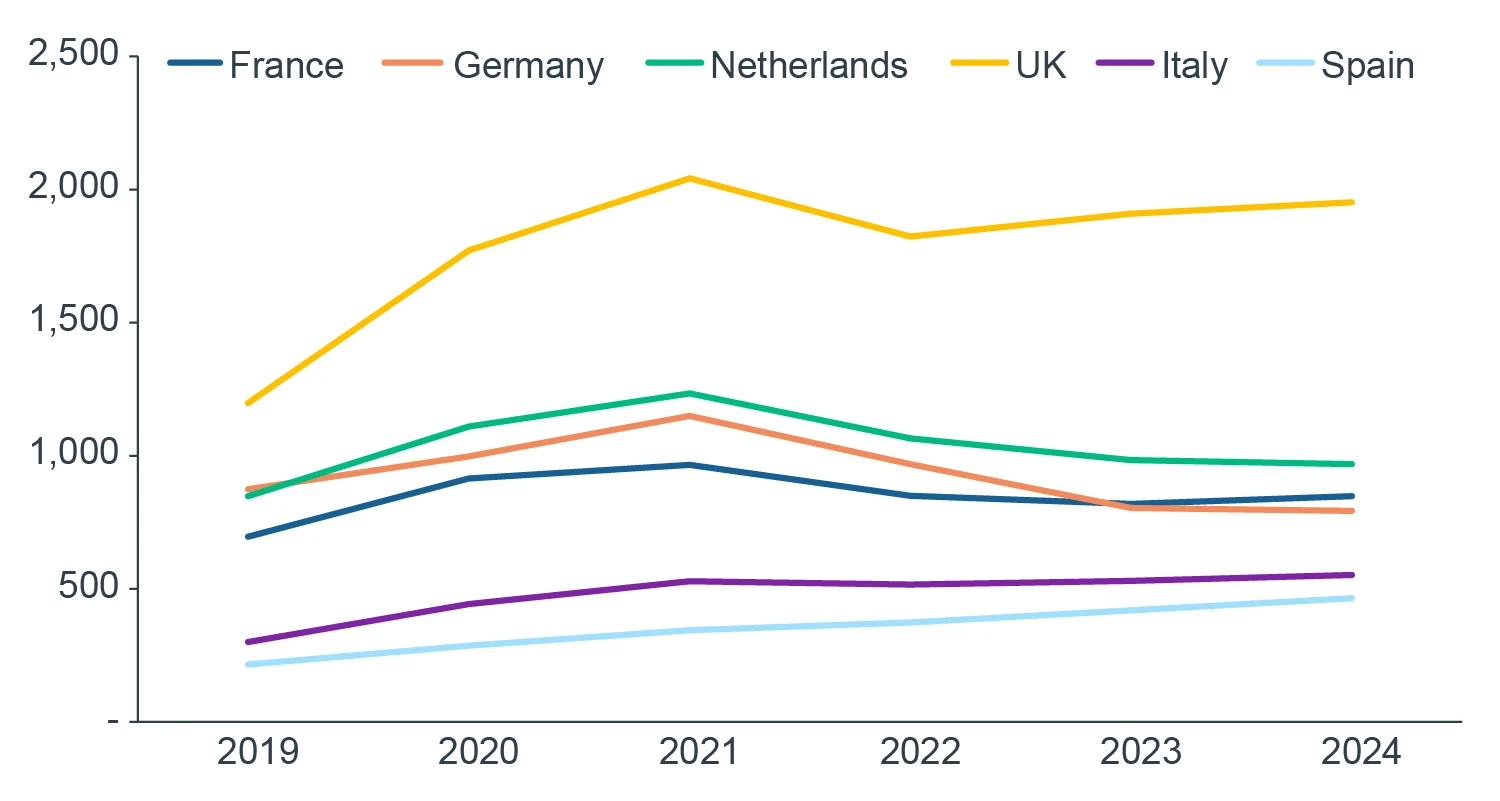

After two years of relative inactivity, e-commerce occupiers have staged a welcome return to the leasing market. Online sales in France rebounded to pandemic-era peaks in 2024, while volumes in the UK and the Netherlands are nearing similar highs (Figure 4). Southern Europe continues to offer additional upside, with sales per capita still low relative to more mature markets (Figure 5).

FIGURE 4: E-COMMERCE SALES OF GOODS (€BN)

FIGURE 5: E-COMMERCE SALES OF GOOD PER CAPITA (€)

Source: (Figure 4,5): Bevh, Fevad, ONS, Osservatorio eCommerce B2C, Thuiswinkel, CNMC, Clarion Partners Global Research, as of Dec 2024.

According to JLL, e-commerce take-up reached approximately 1 million sqm in H1 2025, up 7% year-on-year and accounting for around 9% of total activity.7 Notably, Amazon has announced plans to build four new fulfilment centres and additional delivery stations in the UK as part of a £40 billion investment programme spanning 2025–2027.8 This follows earlier reports of a $15 billion U.S. warehouse expansion tied to the company’s “regionalisation” strategy. Meanwhile, Chinese marketplaces are sharpening their focus on European expansion, driven by rapid platform growth, tightening domestic regulation, and ongoing tariff uncertainties.

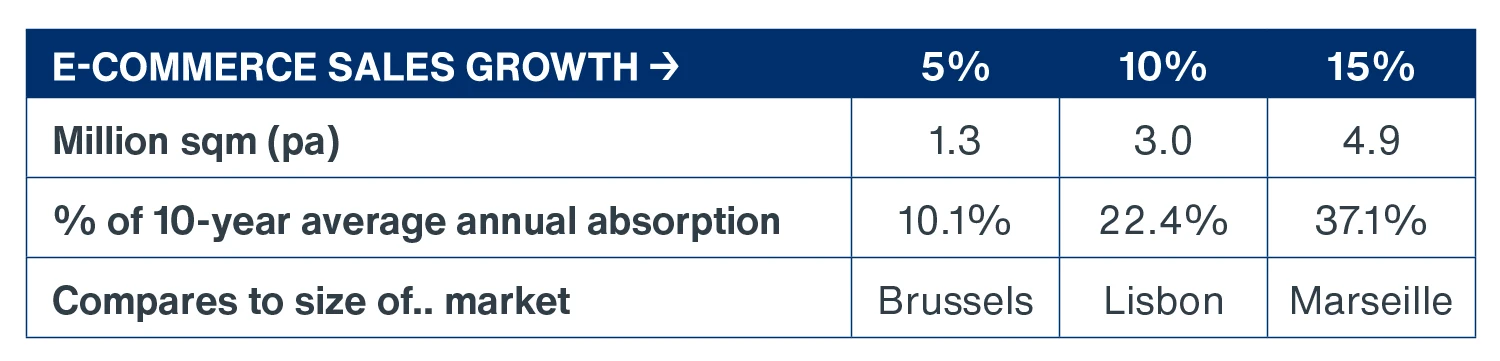

E-commerce growth remains a powerful structural driver for logistics and a cornerstone of our high conviction in the sector. Even under a conservative scenario of 5% annual sales growth and assuming ~70,000 sqm of additional space for every €1bn of sales, we estimate incremental demand of roughly 1.3 million sqm per year across Europe’s six largest markets—equivalent to about 10% of historical annual absorption. In a more sustained 10% growth scenario, that figure could rise to more than 22% of absorption.

ESTIMATED INCREMENTAL DISTRIBUTION SPACE REQUIREMENTS

FROM E-COMMERCE IN FR/DE/IT/ES/NL/UK

Source: Clarion Partners Global Research estimates based on national e-commerce statistics and CBRE data.

CONCLUSIONS

European logistics remains underpinned by strong fundamentals and a resilient rental growth profile, providing a solid foundation for long-term performance. With asset values stabilising, liquidity improving, and occupier demand showing signs of recovery, we think this is an opportune time to allocate to the sector and capitalise on its enduring strengths.

To fully capture the opportunities of this cycle, investors should look forward—prioritising modern, newly-built facilities that deliver state-of-the-art distribution capabilities. As supply chains become increasingly technology-driven, a forward-looking logistics portfolio will be essential for both resilience and growth. We believe that the sector is at a turning point. Investors who align portfolios with evolving occupier requirements today should be best positioned to benefit from a recovery and secure superior long-term returns.