RECORD HIGH INFLATION IN THE EUROZONE

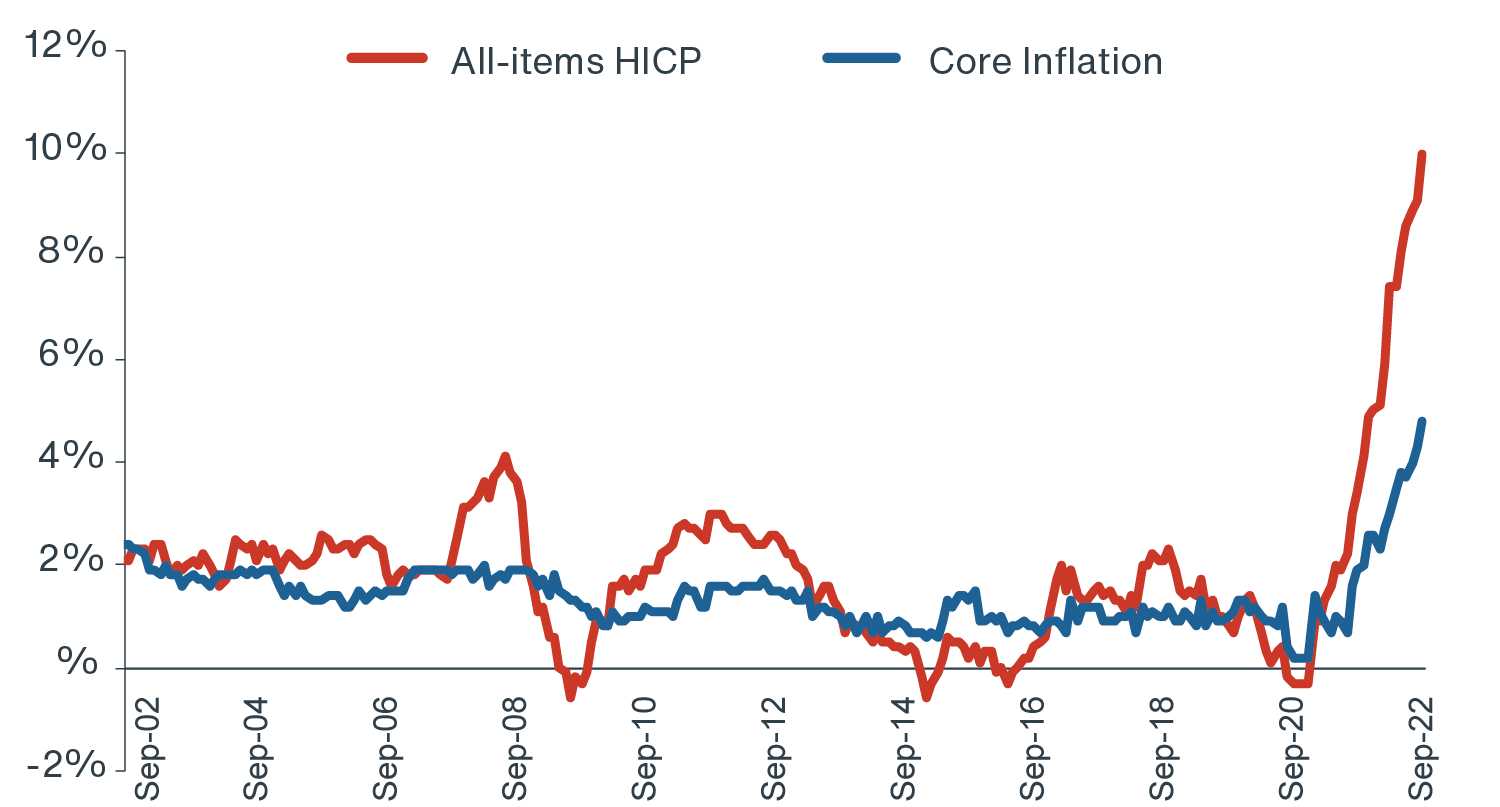

Europe, much like other parts of the world, is grappling with inflation levels not seen since the oil shocks of the 70s. In September 2022, inflation in the Eurozone reached 10.0%, up from 9.1% in August 2022 and 3.4% in September 2021 (Figure 1). Core inflation, a closely watched indicator of price stability, edged higher to 4.8% in September 2022, up from 4.3% in August 2022. The closest total inflation reached these levels in recent times was during the commodity boom in 2008, when inflation was running at 4% year-over-year.

FIGURE 1: EUROZONE HARMONISED INDEX OF CONSUMER PRICES (HICP) AND CORE INFLATION

Source: Eurostat, Clarion Partners Investment Research, October 2022.

The causes of this surge in inflation have been well-documented. Part of the record savings amassed by consumers during lockdowns (~ €1 trillion in Eurozone according to the IMF) have found their way quickly back into the economy as restrictions have been lifted, while the supply side of the equation has taken much longer to respond, causing bottlenecks and a spike in prices along the supply chain. The conflict in Ukraine and fresh Covid lockdowns in China have exacerbated these inflationary pressures by further disrupting supply lines and the energy market. In particular, the energy component of the Eurozone HICP increased by 40.8% year-over-year in September 2022, partially driven by sanctions against Russian energy.

GDP GROWTH, INFLATION, AND LOGISTICS REAL ESTATE

From a property perspective, inflation could be positive to the extent that it is associated with economic growth and positive levels of occupier sentiment (the so-called “demand-pull" inflation): rising economic activity leads to an increase in the demand for goods and services which in turn bolsters consumption, sales, and wages in a virtuous cycle. In such conditions, businesses typically require more space and landlords are generally able to pass on higher costs in the form of higher rents to tenants.

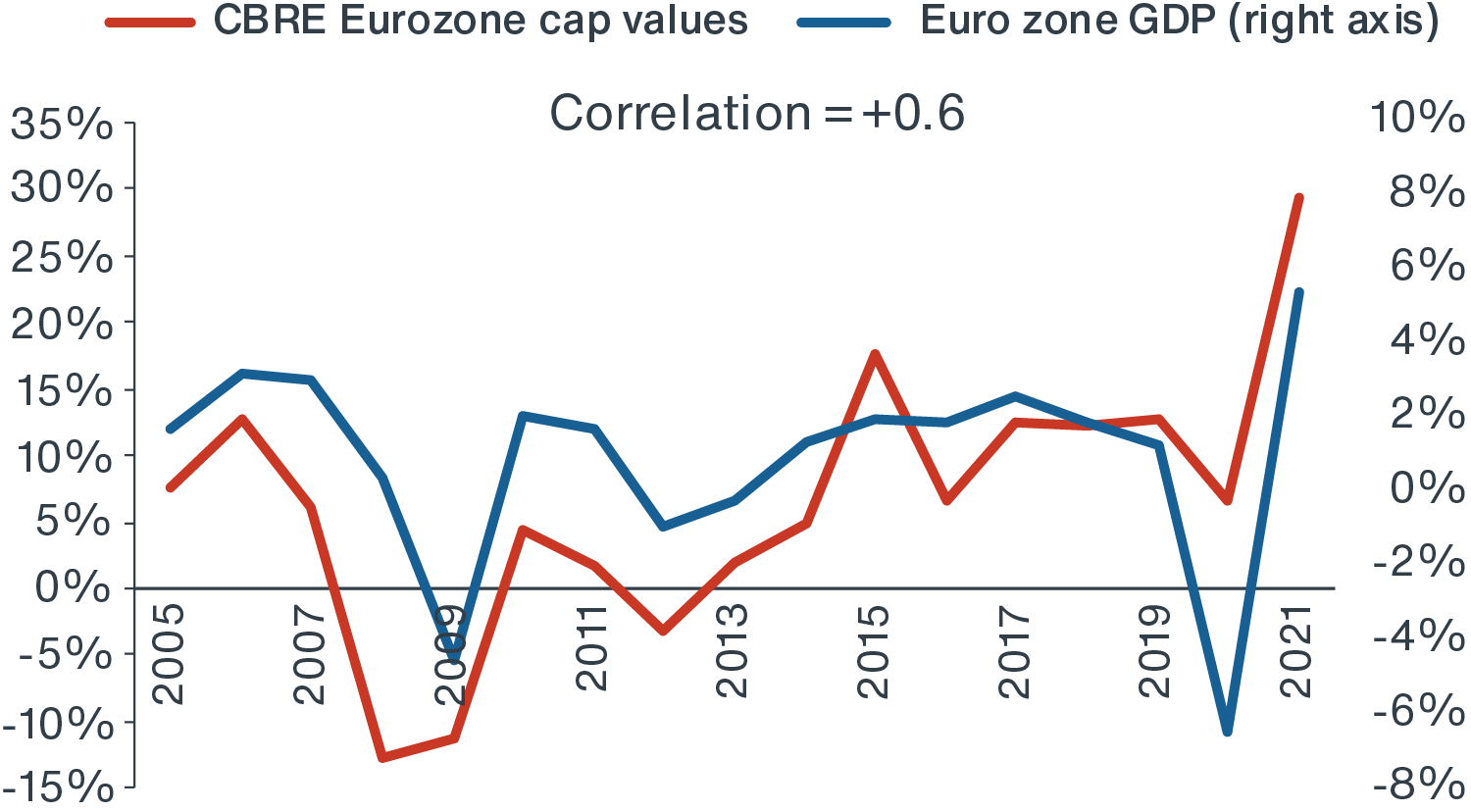

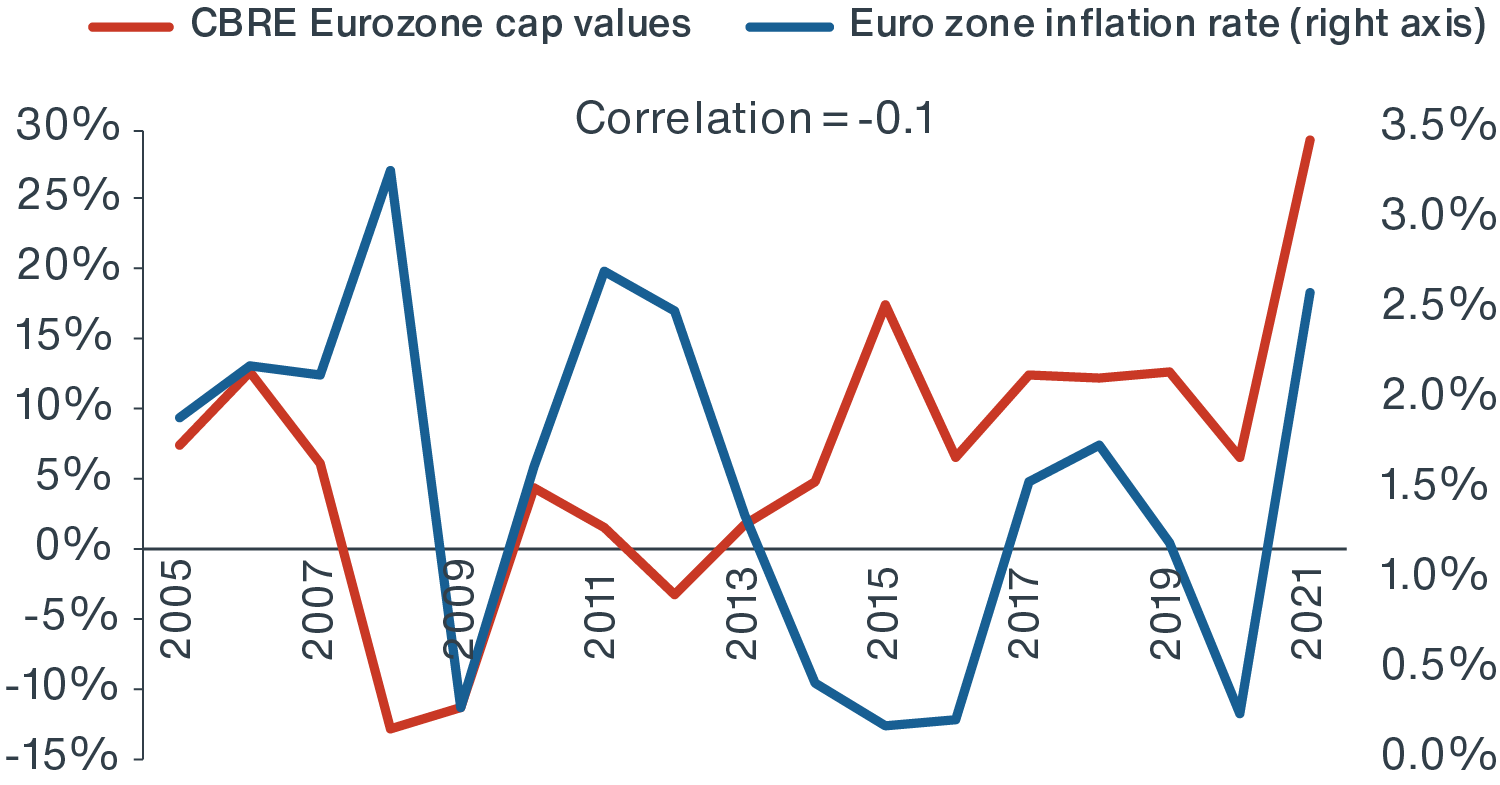

Historically, logistics capital values have tended to correlate relatively strongly with GDP growth (much less so with inflation), although since the mid-2010s this correlation appears to have weakened

(Figures 2-3). This partial decoupling could be explained by the rise of e-commerce across Europe, which has helped to insulate the European logistics market from macroeconomic fluctuations, as seen during the pandemic. As a result, going forward, GDP might be a less reliable predictor for activity levels and returns in European logistics real estate because of the secular e-commerce demand driver.

Despite this decoupling, if current high levels of inflation were to significantly depress economic activity and business profitability (and turn into “stagflation"), landlords would presumably find their ability to recoup higher costs through rents diminished – all other things being equal. In other words, inflation can negatively impact demand for logistics space to the extent that it increases expenses and hurts business profitability and consumer sentiment (“cost-pull" inflation).

At the time of writing, the likelihood of a recession in Europe has increased substantially, albeit most forecasting houses expect it to be relatively short-lived/shallow. A protracted recession would hurt consumer spending and likely weaken demand for logistics space in the near term.

FIGURE 2: EUROZONE GDP GROWTH VS. PRIME LOGISTICS CAPITAL VALUES GROWTH

FIGURE 3: EUROZONE INFLATION RATE VS. PRIME LOGISTICS CAPITAL VALUES GROWTH

Source: Eurostat, CBRE Research, Clarion Partners Investment Research, July 2022.

EUROPEAN LOGISTICS REAL ESTATE AS AN EFFECTIVE HEDGE AGAINST INFLATION

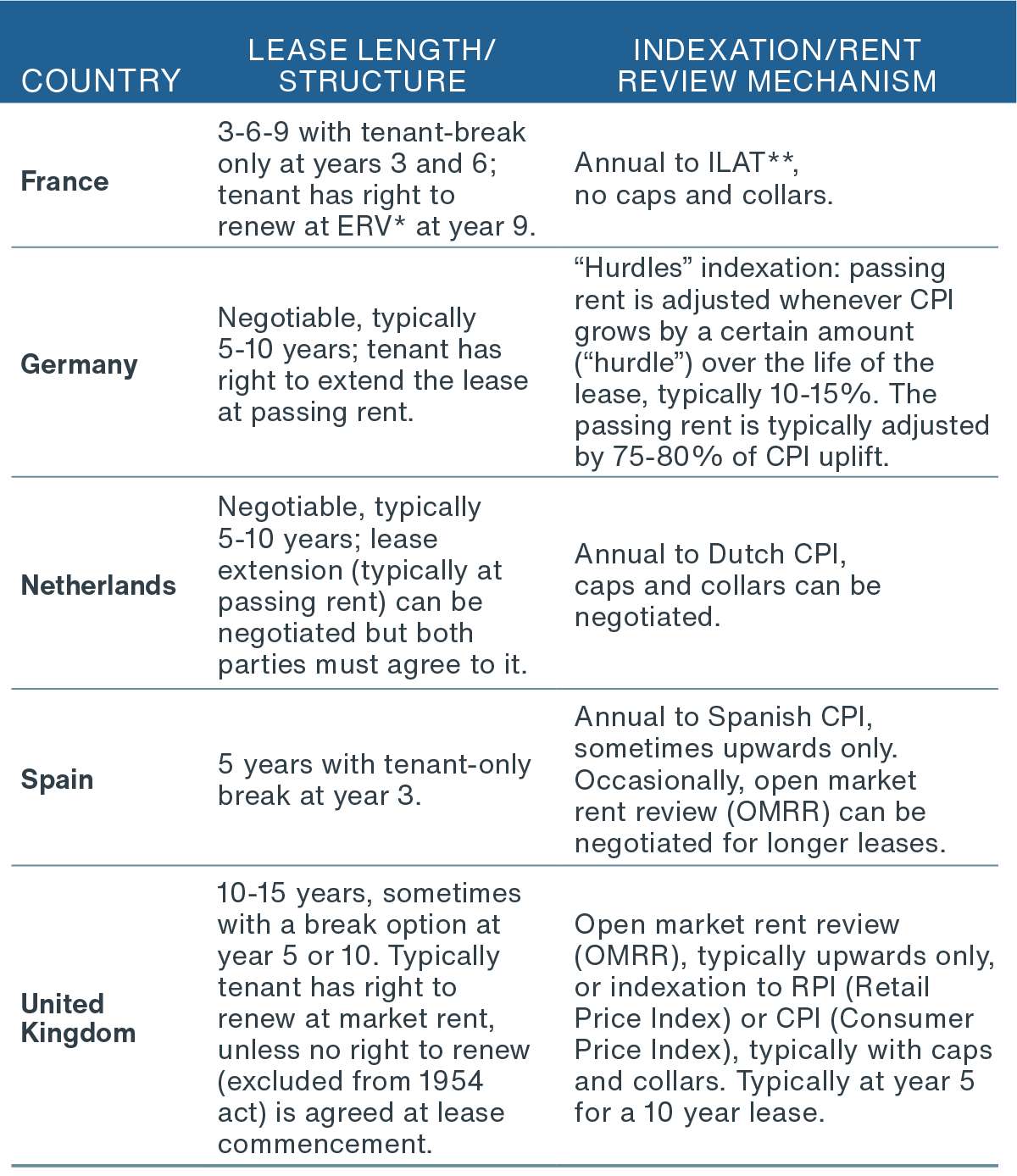

The common wisdom is that as a real asset, property, and logistics property within it, ought to provide a good hedge against inflation, i.e., its income stream/value should keep up with the nominal rate of inflation. This is largely predicated on that most industrial leases in Europe contain rent indexation/escalation mechanisms, typically pegged to the Consumer Price Index (CPI). These mechanisms vary by country (Figure 4) and can sometimes include structures (e.g., caps and collars, limitations on transmission of CPI to rent, hurdle rates, indexation holidays) that can limit the landlord's ability to unconditionally capture CPI growth. Even accounting for these structures, European logistics leases are likely to provide a better inflation hedge than U.S. logistics leases, which most often have fixed annual rent bumps (typically 3.0-3.5%).

FIGURE 4: PREVAILING LEASE STRUCTURES AND INDEXATION MECHANISMS IN KEY EUROPEAN LOGISTICS MARKETS

Source: Clarion Partners Investment Research, July 2022. * Estimated Rental Value. ** Indice des loyers des activités tertiaires (rent Index for tertiary activities).

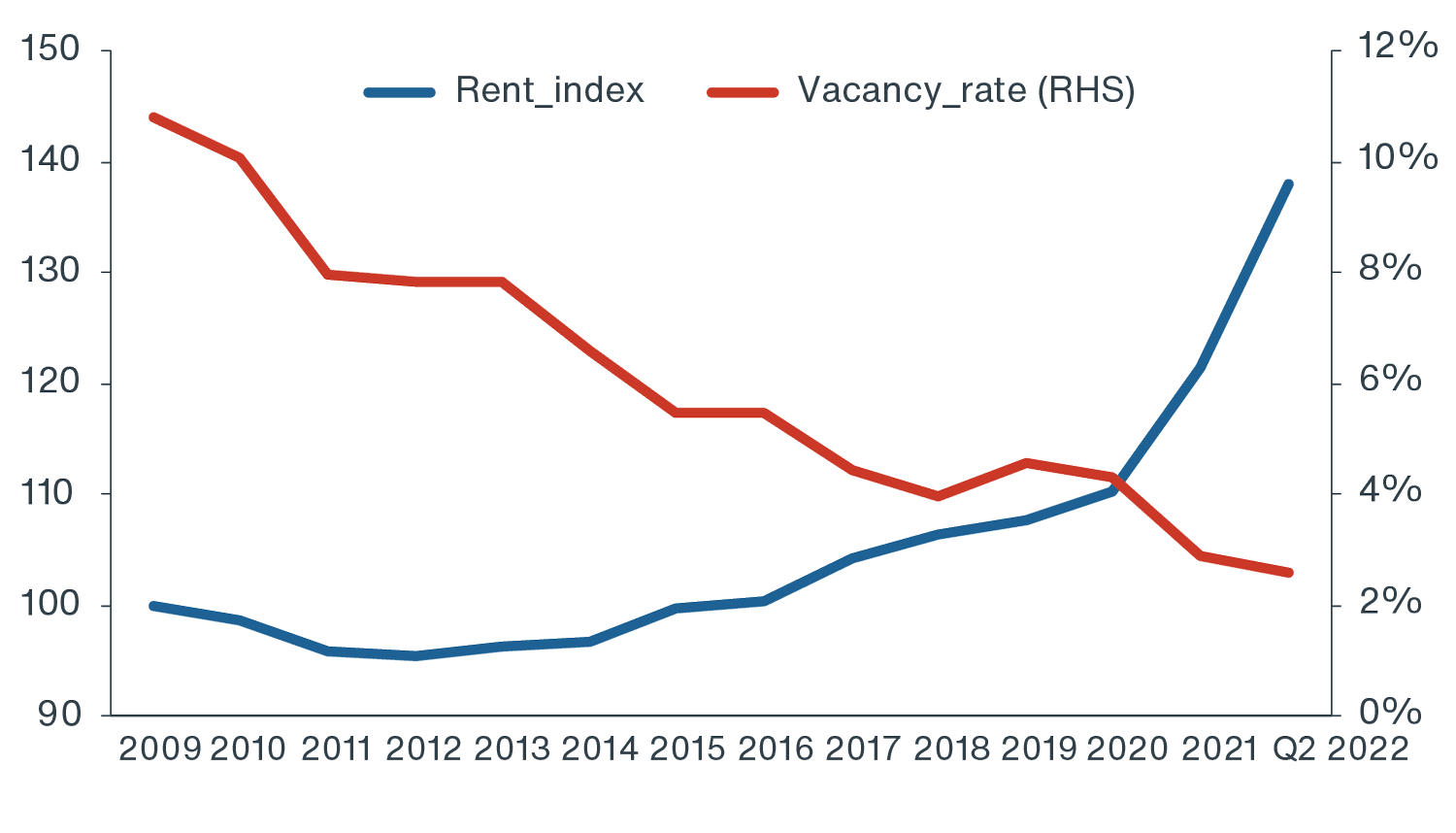

While indexation ensures that gross rental income grows roughly in tandem with inflation, the relationship between logistics market rental values and inflation has historically been less clear-cut. One argument is that inflation – specifically construction cost inflation – drives building values up, and with them, market rents. In reality, inflation is only likely to generate upward pressure on market rents when low vacancies give landlords increased pricing power (Figure 5).

FIGURE 5: VACANCY RATE AND PRIME LOGISTICS RENTAL INDEX FOR SELECTED EUROPEAN COUNTRIES* (2009=100)

Sources: CBRE Research, Clarion Partners Investment Research, July 2022. *Unweighted average for Belgium, Czech Republic, France, Germany, Italy, Netherlands, Poland, Spain, United Kingdom.

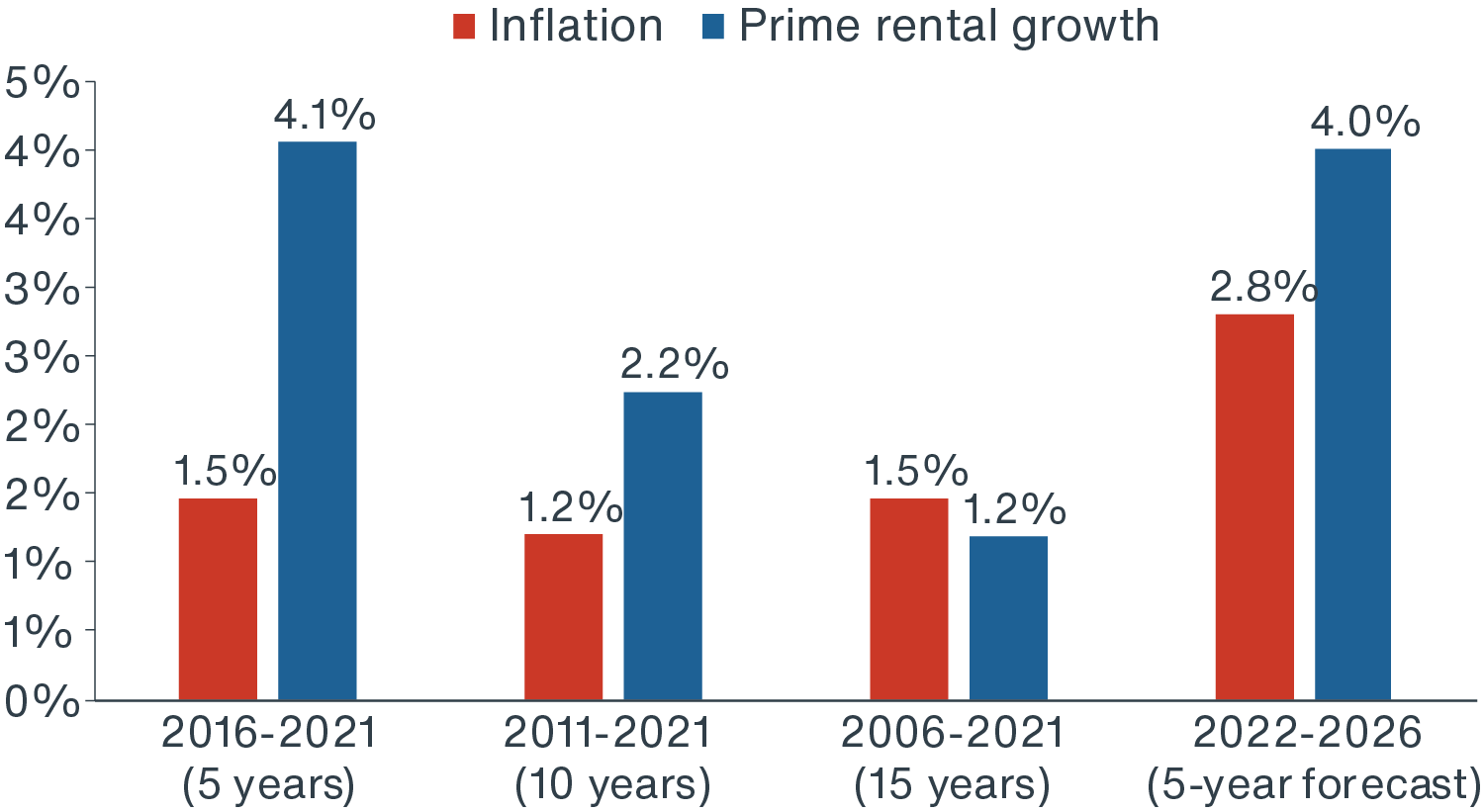

Data for the Eurozone shows that average prime rental growth has comfortably outpaced inflation over the last 5 and 10 years (Figure 6) and it is expected to continue to do so over the 5-year forecasting horizon (2022-2026) despite the current spike in inflation in 2022. Over the longer term (2006-2021), inflation and market rental growth tend to be more closely aligned.

FIGURE 6: INFLATION AND PRIME RENTAL GROWTH IN THE EUROZONE; COMPOUNDED ANNUAL GROWTH

Source: CBRE Research, Green Street Advisors, Moody’s, Clarion Partners Investment Research, July 2022. Note: Prime rental growth forecasts were provided by Green Street as of June 2022: unweighted average of net effective rental growth for 17 Eurozone markets.

Because most logistics leases are largely tied to CPIs, inflation and rental growth dynamics have implications for investment and asset management decisions, as described in the following two scenarios:

Inflation > market rental growth (over the life of a lease): Investors may have an interest in keeping the tenant and taking advantage of CPI uplifts. In this scenario, however, there is a risk of over-renting (i.e., the passing rent paid by the tenant exceeding the market rent), which can impact the profile of exit yields and property values.

Inflation < market rental growth: In this scenario, investors may increasingly be tempted by short-term leases and/or have an interest in getting existing tenants to leave and securing a new occupier at a higher rent. However, this may not always be practically possible due to lease regulations preventing landlords from evicting occupiers at the end of the lease in some jurisdictions.

In general, occupiers' motivations will be symmetrically opposite to the landlords'. That said, transaction and relocation costs, plus other factors (e.g., local availability of labour, how much a tenant has invested in the building, etc.), may make tenants more “sticky" and less sensitive to rental/CPI inflation dynamics than this scenario-analysis suggests.

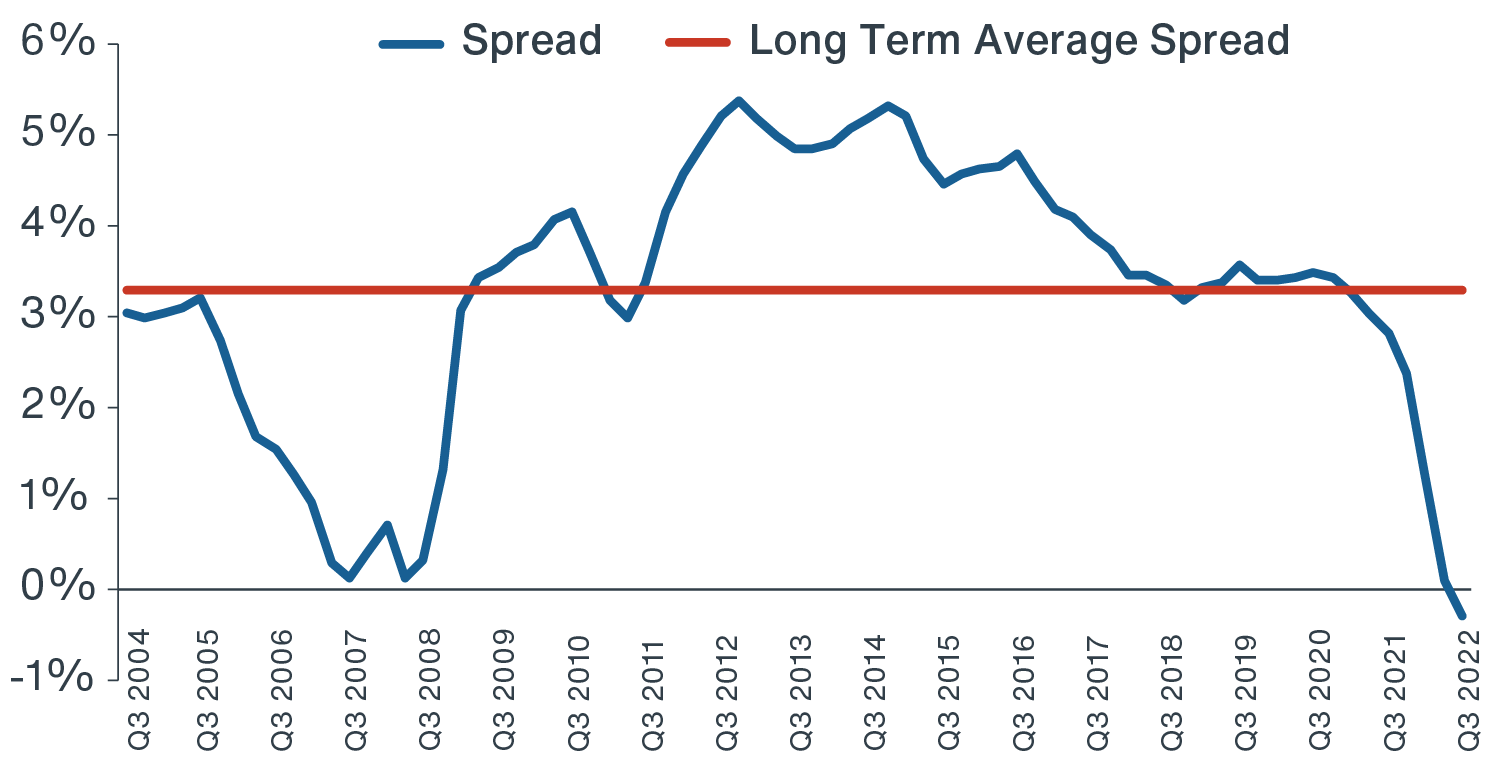

HIGHER FINANCING COSTS

Elevated inflation has substantial (mostly indirect) implications for the cost of capital and levered investors as the inflation outlook influences monetary policy decisions and the cost of debt financing. This is true for all sectors, although logistics is arguably in a stronger position due to its perceived lower risk profile and stronger fundamentals.

Since the beginning of 2022, higher inflation and interest rate expectations have pushed hedging costs (as measured by 5-year fixed rate swap rates) higher – by over ~300 bps at their recent peak in September. As a result, the all-in 5-year fixed-rate mortgage rate for core assets in Western Europe stood around 4.25%-4.75% as at end of September 2022, compared to 0.75%-1.25% at the end of 2021. For reference, the average prime yield in the Eurozone stood at 3.93% at Q2 2022 according to CBRE.

The rising cost of debt has forced many levered investors to the sidelines, restricting the pool of active buyers. Nonetheless, most potential sellers are in no hurry. Some have withdrawn their assets from the market, waiting for uncertainty to abate and more evidence on values to emerge. This price discovery period may potentially result in a market repricing in the short term.

FIGURE 7: EUROZONE AVERAGE PRIME LOGISTICS YIELD VS 3 MONTHS 5-YEAR EURIBOR SWAP, %

Source:

CBRE Research, Chatham Financial, Clarion Partners Investment Research, September 2022. Note: Q3 average prime logistics yield is an estimate. The all-in cost of debt has been estimated by adding 150 bps (bank margin + liquidity cost) to the highest value of the 3-month Euribor 5-year swap rate per quarter.

IMPLICATIONS OF INFLATION FOR REPLACEMENT COSTS AND NEW SUPPLY

The recent spike in inflation also resulted in an unprecedented surge in construction materials costs (and land prices) that was already well underway as economies began reopening in 2021. The following data for Germany, which is representative of other Western European logistics markets, gives a sense of the magnitude of these cost pressures (2021 data):

- Selected construction materials1:

- Solid construction timber: +77.3%

- Rebar steel: +53.2%

- Concrete reinforcing steel mesh: +52.8%

- Industrial/logistics land2: +60.0%

Soaring energy costs and continuing supply disruptions have sent the prices of some materials even higher since the beginning of 2022. The price of corrugated steel as monitored by the Chamber of Commerce of Spain, a reliable gauge for construction cost inflation in the country, has risen by over 55% in the first four months of the year, although prices appear to have cooled off since. This could be partly attributable to an easing of supply chain disruptions and the weaker economic outlook. These cost increases have boosted logistics replacement costs (that until recently had largely lagged valuations) and may squeeze logistics development margins, discouraging some new development projects.

As lenders reappraise risk, reduced availability of development financing combined with higher projected exit yields may also undermine the financial viability of some developments. In this context, the desirability of new development will increasingly depend on the market delivering consistently higher rental growth. According to CBRE Research, prime rents in the Eurozone grew at their fastest annual rate since the early 2000s (+15%) in Q2 2022, supported by strengthening fundamentals.

Modelling done by Clarion Partners Europe for logistics speculative developments in Spain suggests that 10% of hard cost inflation requires approximately 4.5% market rental value growth to practical completion to deliver the same levered IRR3.

Overall, the net impact of continuing cost pressures and rising interest rates is likely to be a reduction in new development starts as developers wait for the storm to pass. This may exacerbate the current lack of space, thereby boosting rental growth.

CONCLUDING REMARKS

European logistics real estate is positioned well to navigate the current high-inflation environment thanks to the inflation hedge offered by CPI indexation and the sector's robust market fundamentals. Under the impulse of rising replacement costs and record-low vacancies, rental growth is expected to remain robust in most European logistics hotspots. These factors should help cushion, at least partially, the impact of rising rates on values/returns.

Moreover, there is no shortage of capital looking at the sector. Logistics came out as investors' preferred asset class in Europe in INREV's latest Investment Intentions Survey (71% of respondents)4.

While lingering economic, political, and financial market uncertainties may cloud investment decisions in the short term, investors should take a longer-term view towards a sector that continues to benefit from secular trends, such as the recent e-commerce boom and supply chain reconfiguration, that are far from reaching exhaustion. We therefore remain optimistic that European logistics real estate should continue to perform well on a relative basis going forward.