Sustainability has become an increasingly significant consideration in European real estate investing and asset management. This shift results from investors’ sustainability targets and growing pressures from occupiers, set against a backdrop of tightening European regulations aimed at decarbonising the built environment.1 These factors are accelerating key trends across all property types, including logistics.

AN EVOLVING LEGISLATIVE FRAMEWORK

The European Union has introduced an expanding body of legislation to meet its ambitious decarbonisation targets and uphold the Paris Agreement’s objective of limiting global temperature rise to 1.5°C above pre-industrial levels in the long-term. However, with this threshold already surpassed in 2024, scientists have cautioned that the target is increasingly unrealistic. Additionally, some European governments have called for delays in the implementation of sustainability reporting and due diligence obligations due to high compliance costs.5 While this pushback underscores the challenges of the climate transition, pressure to reduce carbon emissions is unlikely to abate.

The European Green Deal (2019) outlines a roadmap for the EU to become the first climate-neutral continent by 2050. The European Climate Law (2021) formalised this objective, mandating a 55% reduction in net greenhouse gas (GHG) emissions by 2030 compared to 1990 levels. To achieve these goals, the EU adopted the Fit for 55 package, targeting key sectors such as energy, transport, and buildings.

The EU estimates that the built environment accounts for 40% of the EU’s final energy consumption and 36% of its energy-related greenhouse gas emissions. Yet, 75% of EU buildings are deemed to be energy inefficient.6 As a result, the built environment can be expected to remain a major focus of carbon-reduction efforts across the old continent.

CAPITAL PRESSURES AND ASSET-LEVEL REQUIREMENTS

Institutional investors are increasingly considering sustainability to mitigate climate transition risks and future-proof investments. Although it is challenging to isolate the precise impact of sustainability on investment flows, recognised benchmarks such as GRESB have gained prominence. The number of participating funds in Europe has tripled in a decade, surpassing 1,000 in 2024, during a period in which scoring criteria have become more stringent.7

The most significant regulatory driver for sustainability in European real estate is the EU’s policy to decarbonise building stock by 2050. Modern logistics portfolios are well-positioned to navigate these evolving regulatory requirements. The Revised Energy Performance of Buildings Directive (EPBD), adopted in May 2024, introduces high-level energy performance standards for residential and non-residential buildings, including logistics assets, for all EU member states.

Key provisions include the requirement for all new non-residential buildings to be zero-emission by 2030 and the enforcement of Minimum Energy Performance Standards (MEPS), primarily through Energy Performance Certificates (EPCs). Although EPC rating systems vary across Europe, the European Commission is actively promoting harmonisation in this area. Some countries have already set specific targets for EPC performance and energy consumption reduction.

-

England and Wales: Since April 2023, non-residential buildings with an EPC rating below E cannot be leased. The government aims to raise this threshold to C by 2027 and B by 2030. As of 2024, 66% of UK warehouse stock holds a rating of C or below, underscoring the sector’s retrofitting challenge.8

-

France: The "Décret Tertiaire" sets energy consumption targets for existing buildings, requiring a 40% reduction (against a reference year from 2010 to 2019) by 2030, increasing to 50% by 2040 and 60% by 2050.

EV CHARGING AND SOLAR GO MAINSTREAM

The EPBD mandates that logistics assets integrate electric vehicle (EV) charging points and solar installations. According to a recent survey, 37% of occupiers identified solar PV installation as their preferred sustainability improvement.9 While presently PV installation is required only “if technically suitable and economically and functionally feasible”, there is growing recognition that having a PV-ready roof in new buildings is desirable for future-proofing assets given regulatory risk and costs associated with retrofitting roof structures. That said, new more lightweight technology is being trialled – such as solar foils – that could reduce the strain of solar installations on roofs and CapEx needed to increase load-bearing capacity in the future.

The cost of solar panels has also decreased in recent years – making solar a more cost-effective source of energy – whilst helping reduce carbon-emissions. Moreover, by December 2029, all new roofed car parks adjacent to buildings will also need to be equipped with solar panels. Member states are transposing the directive at different paces. For example, France will require 50% of parking spaces larger than 10,000 sqm to be covered by solar canopies by July 2026. Whilst technology and regulatory factors all point to increased adoption of solar in logistics buildings, infrastructure and limited grid capacity continue to represent barriers to deployment in some cases.

THE FLIGHT TO QUALITY & RISK OF OBSOLESCENCE

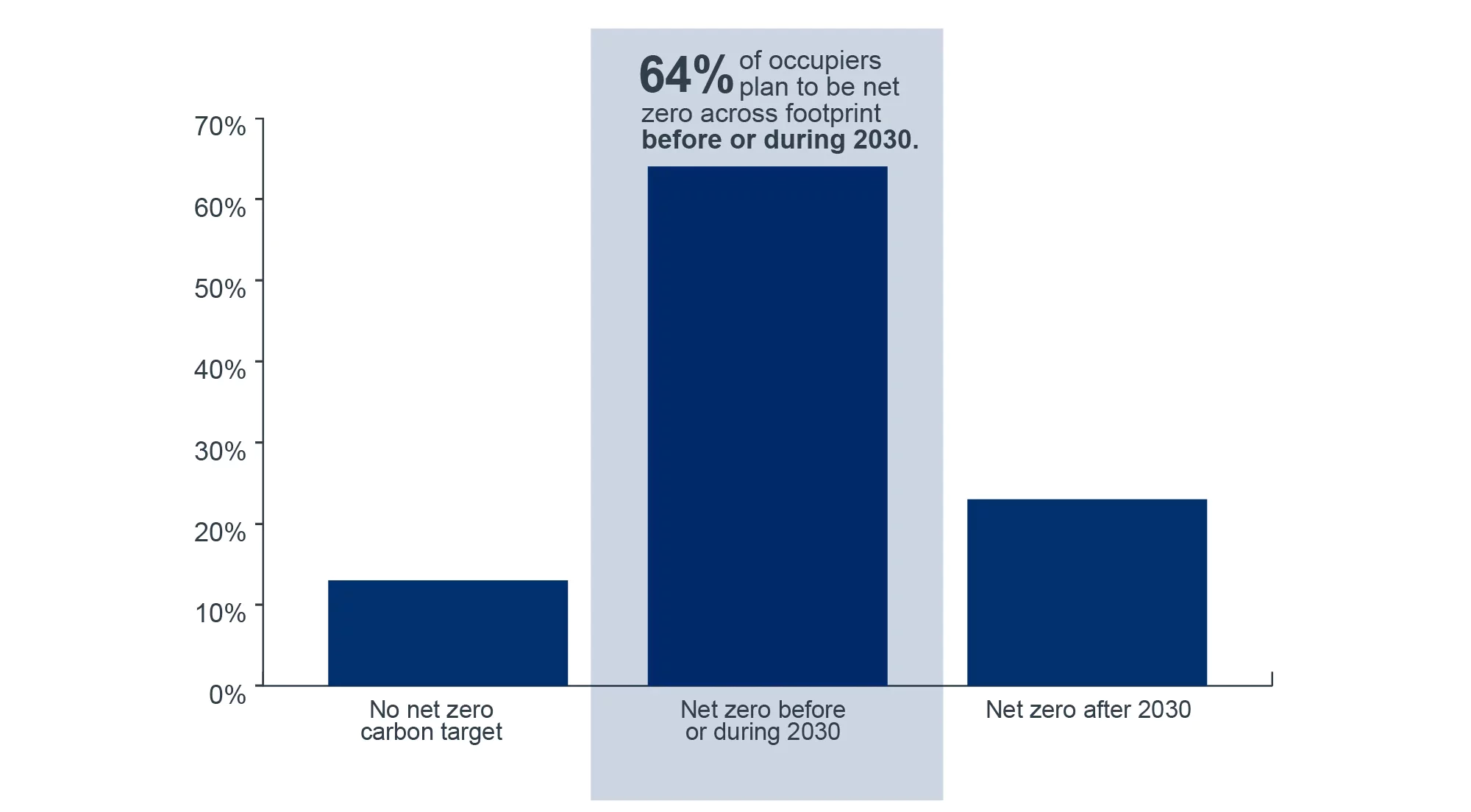

Regulatory pressures, corporate sustainability commitments, and greater choice in building stock are driving occupiers towards higher-quality assets. The number of companies with science-based carbon reduction targets has risen significantly, with firms representing 60% of European market capitalisation adopting such commitments.10 The sustainability rating of a warehouse is becoming a more important factor in building selection, with 64% of occupiers planning to be net zero across their property footprint by 203011 (Figure 1).

FIGURE 1: PERCENTAGE OF OCCUPIERS BASED ON THE TIMINGS OF THEIR NET ZERO CARBON TARGETS

Source: CBRE and Analytiqa (European Logistics Occupier Survey 2024).

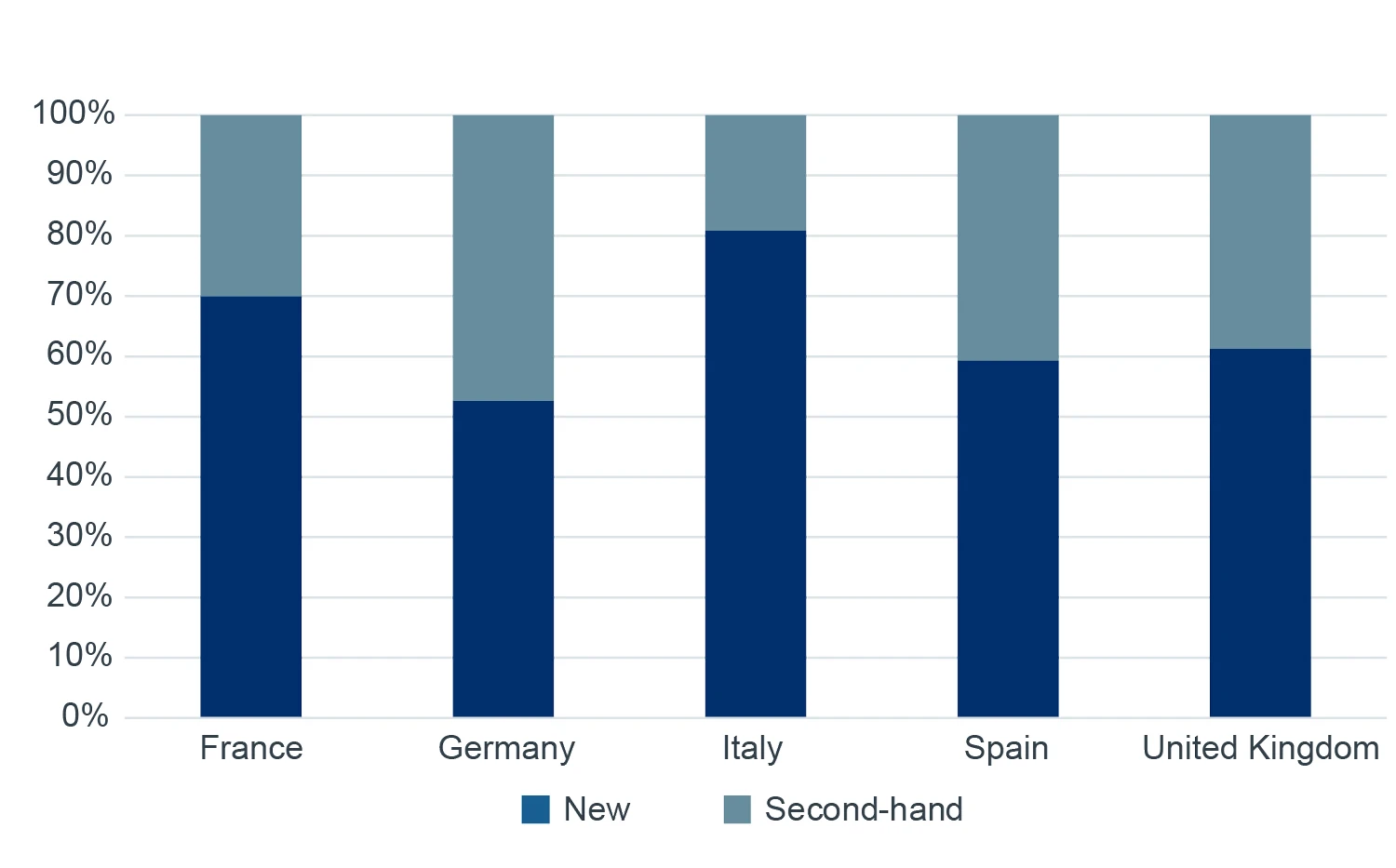

FIGURE 2: SHARE OF 2024 LOGISTICS TAKE-UP

Source: CBRE, Clarion Partners Global Research, Q4 2024.

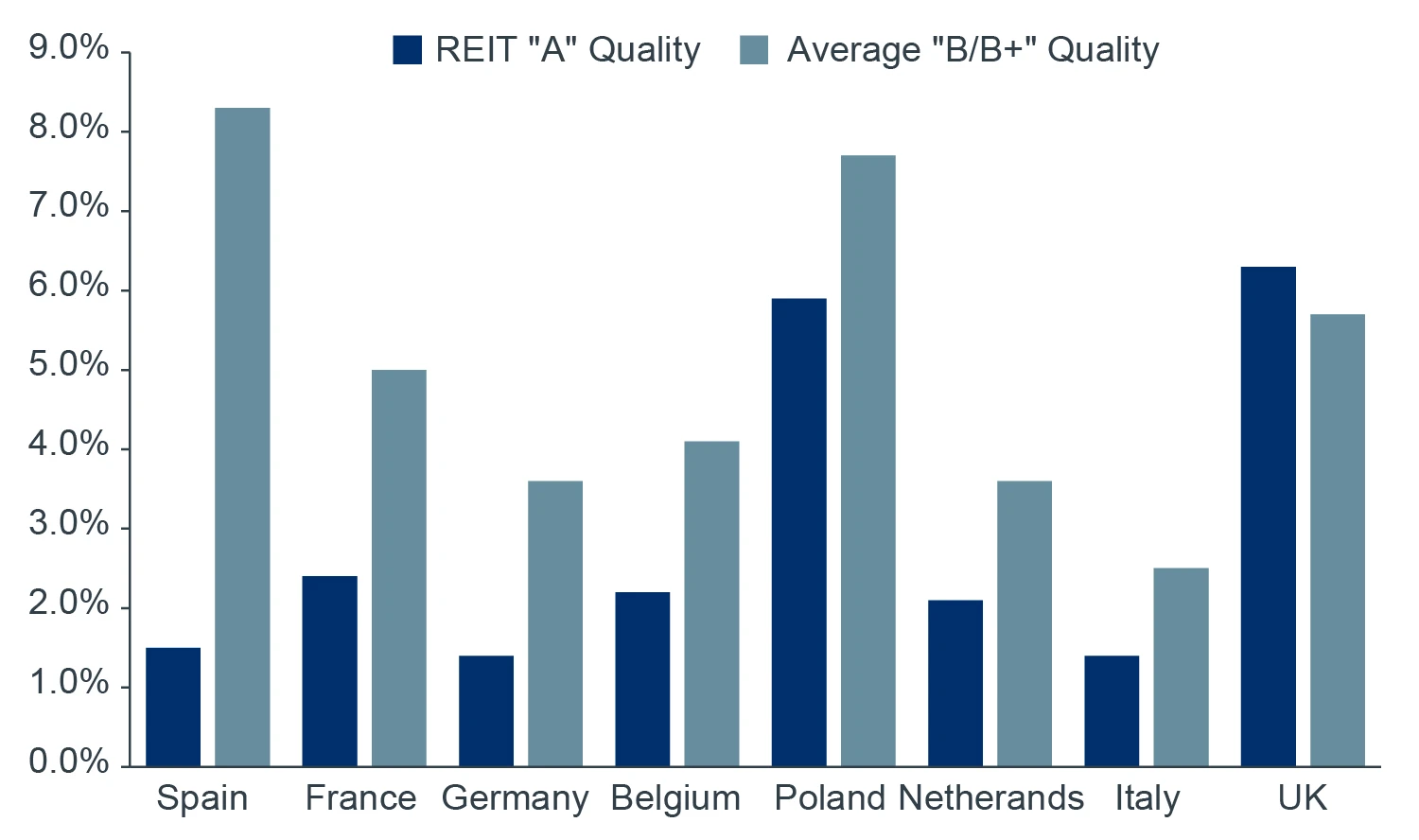

The preference for new, sustainable warehouses is already evident, with for example more than 80% of take-up in Italy in 2024 directed towards newly completed buildings (Figure 2). Occupiers have a greater selection of buildings available and are more discerning about the quality of space they want. This trend is leading to a bifurcated market where younger vintages of buildings boast superior occupancy: recent data from Green Street shows that Grade A buildings have lower vacancy than equivalent Grade B buildings in all major markets except the UK which experienced a more pronounced development cycle12 (Figure 3). The majority of occupiers indicate they are willing to pay a premium for sustainable, energy-neutral warehouses13 and more generally for switching to green sources of energy – enabling them to reduce total operating costs.14 The simple replacement of conventional lighting (such as metal halide or fluorescent) with LED, combined with smart lighting controls, can result in substantial savings in energy and maintenance costs, as well as reductions in carbon emissions.

New data is emerging on the “green premium”/ “brown discount” in asset values, too. While there is no consensus on the subject, research finds a directionally positive impact of sustainability features. A recent study from C&W suggests an average pricing premium of 19% for High Rating logistics assets compared with Low/No Rating assets, while most respondents to a recent DTRE survey believe green premium amounts to 10-30bps in yield terms,15 or 6% at current average prime asset valuations. Moreover, sustainable properties16 can secure more attractive financing terms, with Green Loans typically offering a 5-10 bps discount margin.

FIGURE 3: LOGISTICS/INDUSTRIAL VACANCY RATES

Source: Green Street, February 2025.

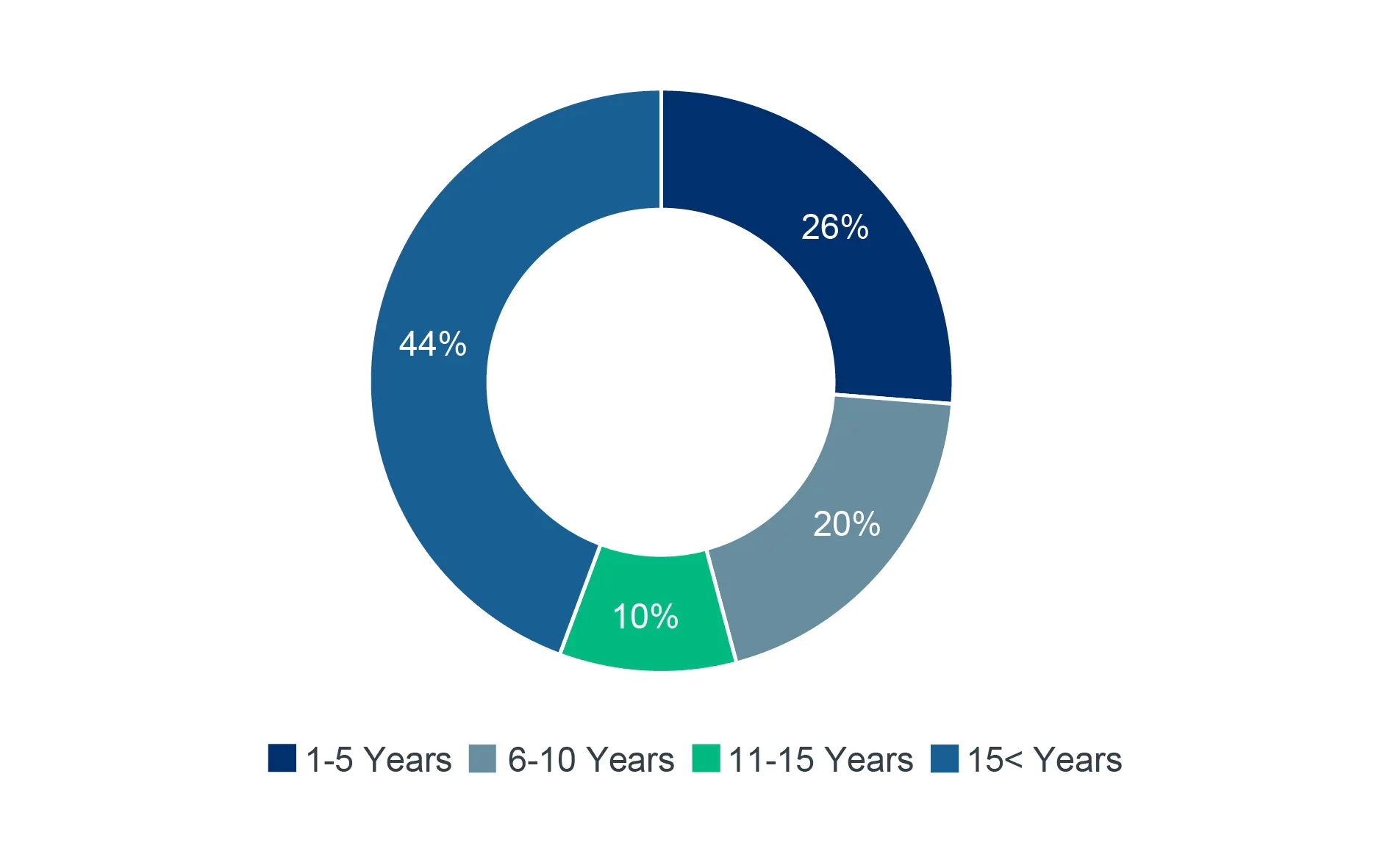

FIGURE 4: AGE OF EUROPEAN LOGISTICS STOCK

Source: CBRE, Clarion Partners Global Research, Q4 2024.

With sustainability requirements rapidly evolving, and with 44% of European logistics stock over 15 years old (Figure 4), a substantial amount of stock is at risk of obsolescence. Retrofitting older portfolios may require significant capital expenditure. At the same time, deep renovation projects and new construction will increasingly need to account for embodied carbon — the carbon emissions associated with materials and construction processes throughout a building’s lifecycle — in addition to operational carbon. While EU-level policy wording remains vague and non-prescriptive, some member states are leading the way. The Netherlands, for example, has capped whole-life emissions in new construction projects since 2018, requiring designers to assess and balance both operational and embodied emissions to secure approval.17 Benchmarking is also evolving to capture this dimension. In 2023, GRESB introduced a new indicator to measure embodied carbon emissions from new construction and major renovation projects, and since then participation in its Development Component has increased.18

CONCLUSIONS

Sustainability is now a key consideration in European logistics real estate investment, with tightening regulations, shifting occupier preferences, and evolving capital requirements reshaping market dynamics. The 'flight to quality' is becoming increasingly evident, as demand for modern, energy-efficient buildings rises while older stock faces growing obsolescence risks and unanticipated capital expenditures. Institutional investors who align their portfolios with these structural shifts may find that modern logistics assets demonstrate greater resilience, benefitting from lower vacancy rates, stronger NOI growth, and enhanced long-term value appreciation.