As interest rates have been rising, the Fund has been borrowing less, investing more creatively

NEW YORK, (April 3, 2023) – The Clarion Partners Real Estate Income Fund Inc. (“the Fund”), an Investment Company Act of 1940 tender offer fund designed to provide individual investors access to a portfolio of deeply researched, high-quality commercial real estate holdings, has raised its monthly distribution1 on Class I shares from $0.054 per share to $0.067 per share, which is a 24% increase and now equal to annualized distribution rate of 6.5% as of March 31, 2023.

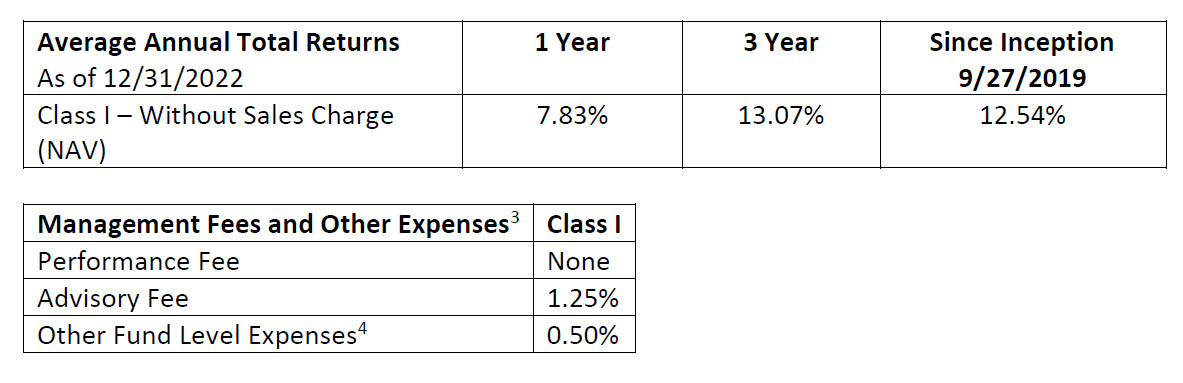

Actively managed by Clarion Partners, which for more than 40 years has been a leader in building and managing private real estate portfolios for some of the world’s largest institutional investors, the Clarion Partners Real Estate Income Fund provides investors and advisors access to an institutional-quality2 portfolio of direct real estate holdings and structured investments comprising preferred equity and mezzanine debt.

“As interest rates rise, banks are stepping back from providing liquidity to the private real estate space. Thanks to our highly flexible investment structure and the deep research we bring to every potential investment we have been able to identify and take advantage of a number of attractive structured equity and debt opportunities,” said Richard Schaupp, Clarion Partners Managing Director and Portfolio Manager for the Fund. “These investments have been delivering significant yields, which we are now able to pass on to our shareholders in the form of this distribution increase.”

Similar to Clarion’s overall portfolio composition built with decades of experience, the Fund’s investment strategy is focused on sectors in which Clarion has high conviction and present growth opportunities, specifically industrial warehouse and multifamily apartment.

“A disciplined investment approach is essential when it comes to sourcing opportunities,” added Janet Souk, Managing Director and Portfolio Manager. “It is even more important in markets such as the one in which we find ourselves today, where rates are rising, volatility is heightened, and investors are searching for new ways to add income, that we keep close eye on risk. We’re very proud of the track record we have built at Clarion and with the Clarion Partners Real Estate Income Fund, and we’re thrilled that our efforts are allowing us to announce this new, increased monthly distribution for our shareholders.”

For more information about the Clarion Partners Real Estate Income Fund, please visit https://www.cpreif.com/.

Clarion Partners Real Estate Income Fund Inc. is distributed by Franklin Distributors, LLC.

- END -