INTRODUCTION

2022 was a year of change for the European economy and European commercial real estate (“CRE”). The European Central Bank ("ECB") joined other central banks across the globe and reversed a multi-decade long policy of low interest rates and “cheap” money in a bid to bring ramping inflation under control. Investors and occupiers have had to adjust quickly to this new regime of higher financing costs and lower liquidity, against a backdrop of slowing economic growth. A significant correction in CRE values has ensued.

In this challenging environment, Clarion Partners believes that defensive real estate strategies such as net lease/sale-leasebacks can provide an attractive opportunity for CRE investors. These strategies can enable investors to access stable, more secure and inflation-linked cashflows in a volatile market environment, in addition to longer-term capital appreciation potential and diversification benefits. This paper reviews the drivers of the European net lease property market, and explains why, perhaps now more than ever, it is a good time to invest in this asset class in Europe.

WHAT IS NET LEASE?

Net lease property typically consists of real estate let on long-dated, inflation-linked leases. These leases are typically double/triple net, whereby the tenant is contractually obligated to pay for most or all of property related expenses, insulating income from unforeseen increases in these costs. A key characteristic of net lease property is that a significant portion of returns is derived from contractually fixed income instead of more volatile capital growth.

For this reason, net lease investments are often regarded as the most “bond-like” type of CRE investments. Like fixed income, the net lease sector is sensitive to movements in interest rates. However, unlike most fixed income investments with similar return profiles, net lease can offer effective inflation protection through CPI-indexed leases, which help grow/preserve the value of investment. With inflationary pressures expected to remain elevated, this investment attribute is particularly desirable.

A LARGE AND GROWING MARKET

Net lease property is typically sourced via sale-leasebacks (”SLB”) or build-to-suit structures (“BTS”). The European SLB market has grown substantially over the past decade. EMEA corporate disposals reached a post-GFC high of €29.2 billion across 670 disposals during 20211, roughly double the volume in 2010. Overall, Clarion Partners estimates the European corporate-owned real estate market to be worth €5.7 trillion2. SLBs can offer some significant advantages for corporates:

-

Full monetization of real estate value: corporates can realize 100% of the value of their assets (vs. typically <60% raised through a mortgage) and reinvest the proceeds in more productive/efficient ways aligned to their core business.

Eliminates refinancing risks: SLB is a one-off event that eliminates risks from debt refinancing and the costs associated with it.

-

Capital efficiency: corporates tend to have a relatively higher cost of capital compared to real estate investment funds. By selling CRE to an investor, the corporate can replace its own “expensive” capital with “cheaper” fund capital and focus resources on higher-returning purposes within its core business.

-

Retain operational control: typical triple-net SLBs allow corporate sellers to retain operational control of the asset.

WHY THE MARKET IS GROWING

Going forward, there is a strong argument that an increasing number of corporates will turn to SLBs as an alternative financing method due to the following reasons:

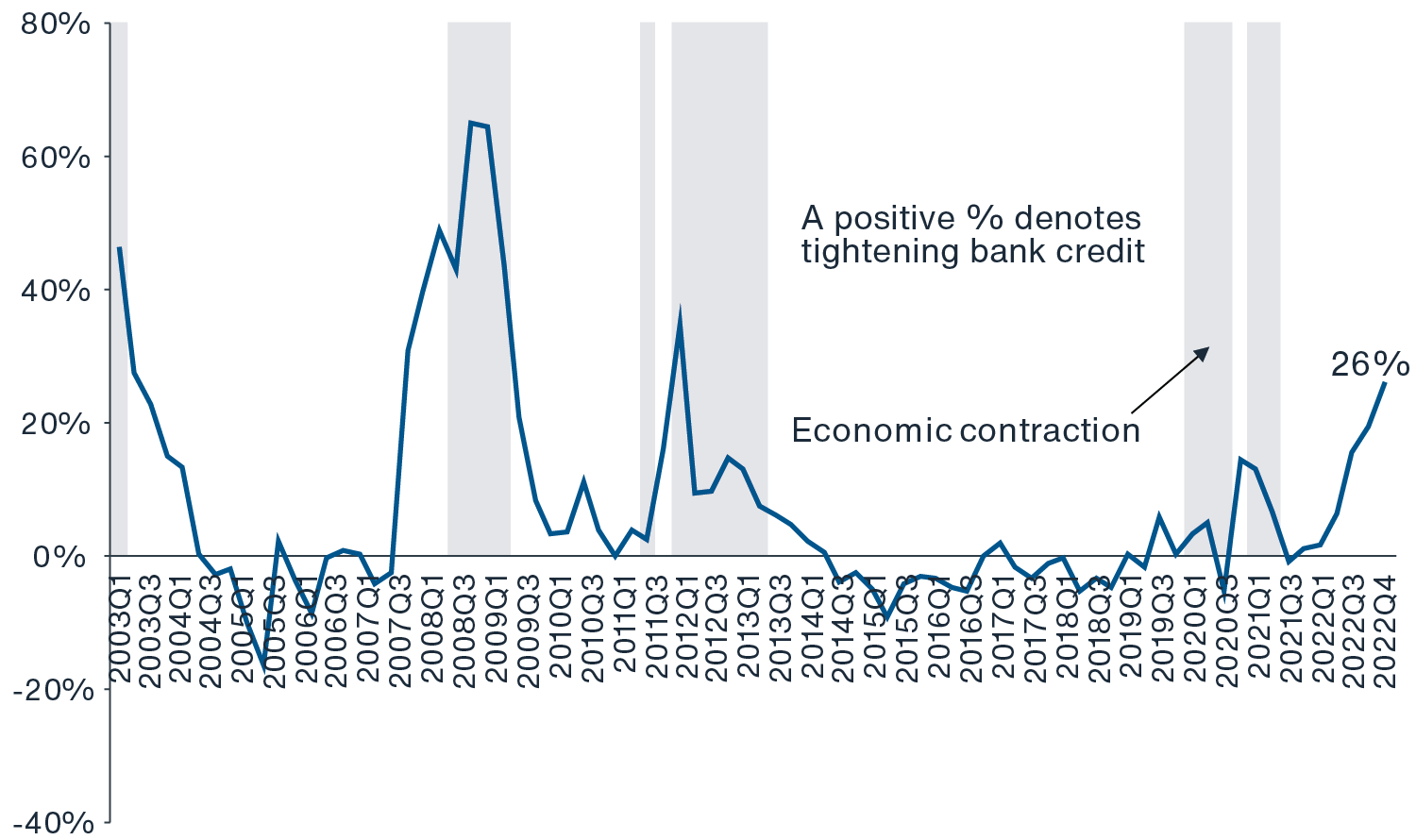

FIGURE 1: EUROPEAN BANKS ARE TIGHTENING CREDIT STANDARDS

Source: ECB, Clarion Partners Investment Research, January 2023.

Lower bond market liquidity: Bond financing may also prove less attractive for corporates due to rising interest rates, while the uncertain inflation outlook coupled with prospects of further interest rate hikes have dampened investors’ appetite for corporate bonds. These two forces played out in a sharp reduction in high-yield bond issuance during 2022. Only €18 billion were raised through BB+ (and below) rated bonds during Q4 2022, compared to €45 billion raised during Q4 2021. Between 2021 and 2022, the average yield-to-maturity for B-rated European corporate bonds increased to 7.52%, from 5.15%.4

ECB’s balance sheet reduction: On 15 December 2022, the ECB set out the road map for its balance sheet reduction programme. Under the plan, the ECB will allow bonds worth €15 billion (monthly average), acquired under its Asset Purchase Programme, to expire without reinvesting them. In doing so, the ECB will suck further liquidity out of the system, possibly further incentivising corporates to seek alternative financing channels.

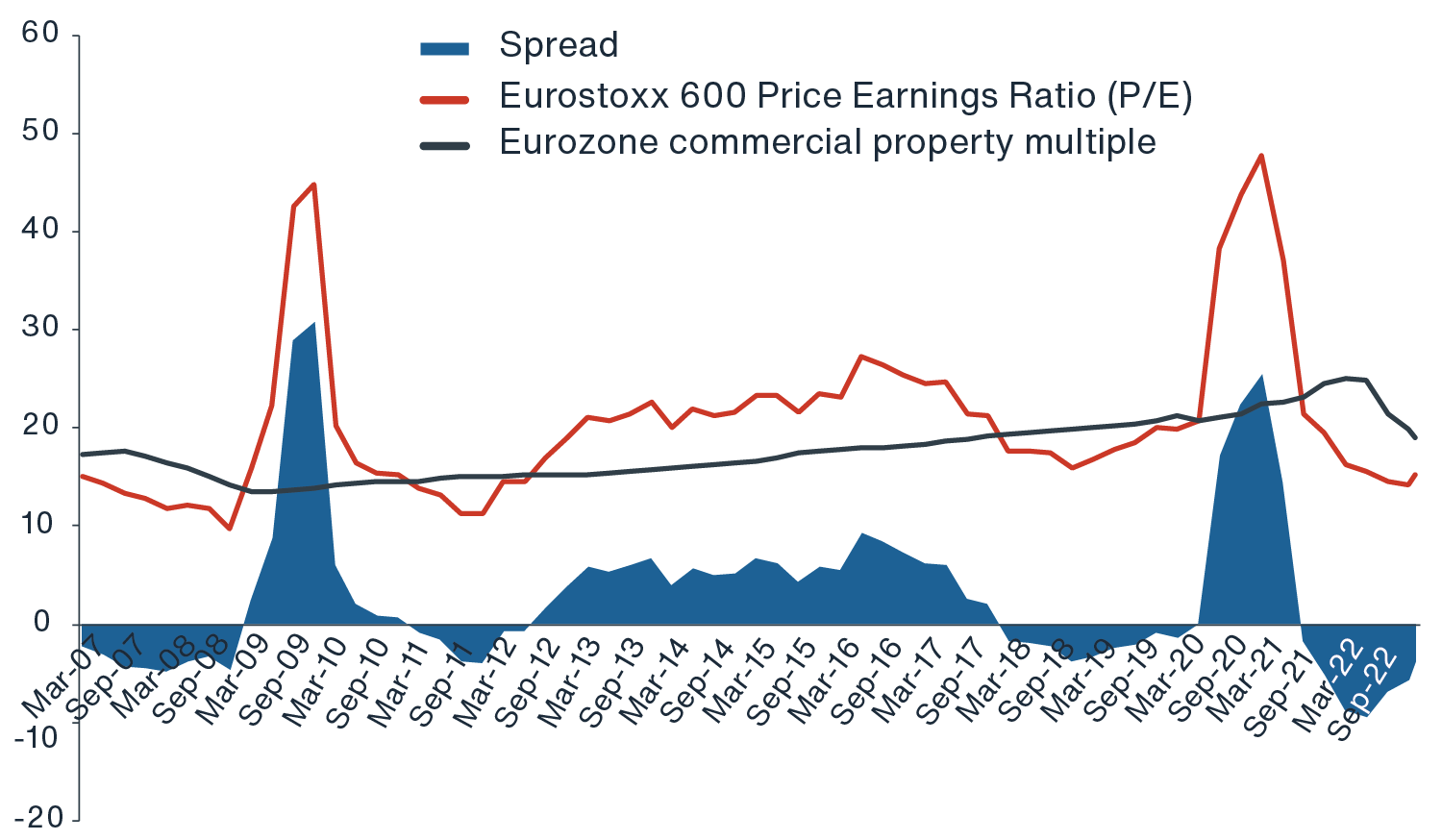

M&A opportunities: M&A activity has traditionally been a catalyst for SLBs, whereby the acquiring entity sells out all or part of the real estate of the target company (or of its own balance sheet) to finance the acquisition. While M&A activity has slowed in the second half of 2022 as cost of debt has increased and the economic outlook has darkened, the current spread between P/E and real estate multiples remains historically attractive (Figure 2).

FIGURE 2: M&A ARBITRAGE OPPORTUNITY REMAINS ATTRACTIVE

Source: Bloomberg, Green Street Advisors, Clarion Partners Investment Research, January 2023. Note: European commercial property multiple has been derived from an unweighted average of Green Street Advisors European economic cap rates for the office and industrial sector.

Source: Bloomberg, Green Street Advisors, Clarion Partners Investment Research, January 2023. Note: European commercial property multiple has been derived from an unweighted average of Green Street Advisors European economic cap rates for the office and industrial sector.

WHY INVEST IN NET LEASE IN EUROPE?

Historically, net lease property has delivered attractive risk-adjusted returns relative to balanced CRE portfolios. The appeal of net lease strategies in Europe can be traced back to several factors:

-

Less volatile, income-driven returns: A key benefit of net lease investments for investors stems from the fact that virtually the totality of return tends to come from secure contractual income and contractual CPI increases. Returns are therefore, typically, more stable and predictable as opposed to strategies where return depends on capital growth which is driven by “uncertain” market factors such as market rental growth, development capex, re-leasing and exit yields. Data5 shows that net lease strategies have also generally tended to outperform the wider market during downturns given secure rental income. The predictability and security of these income streams may particularly appeal to liability-driven investors such as pension funds.

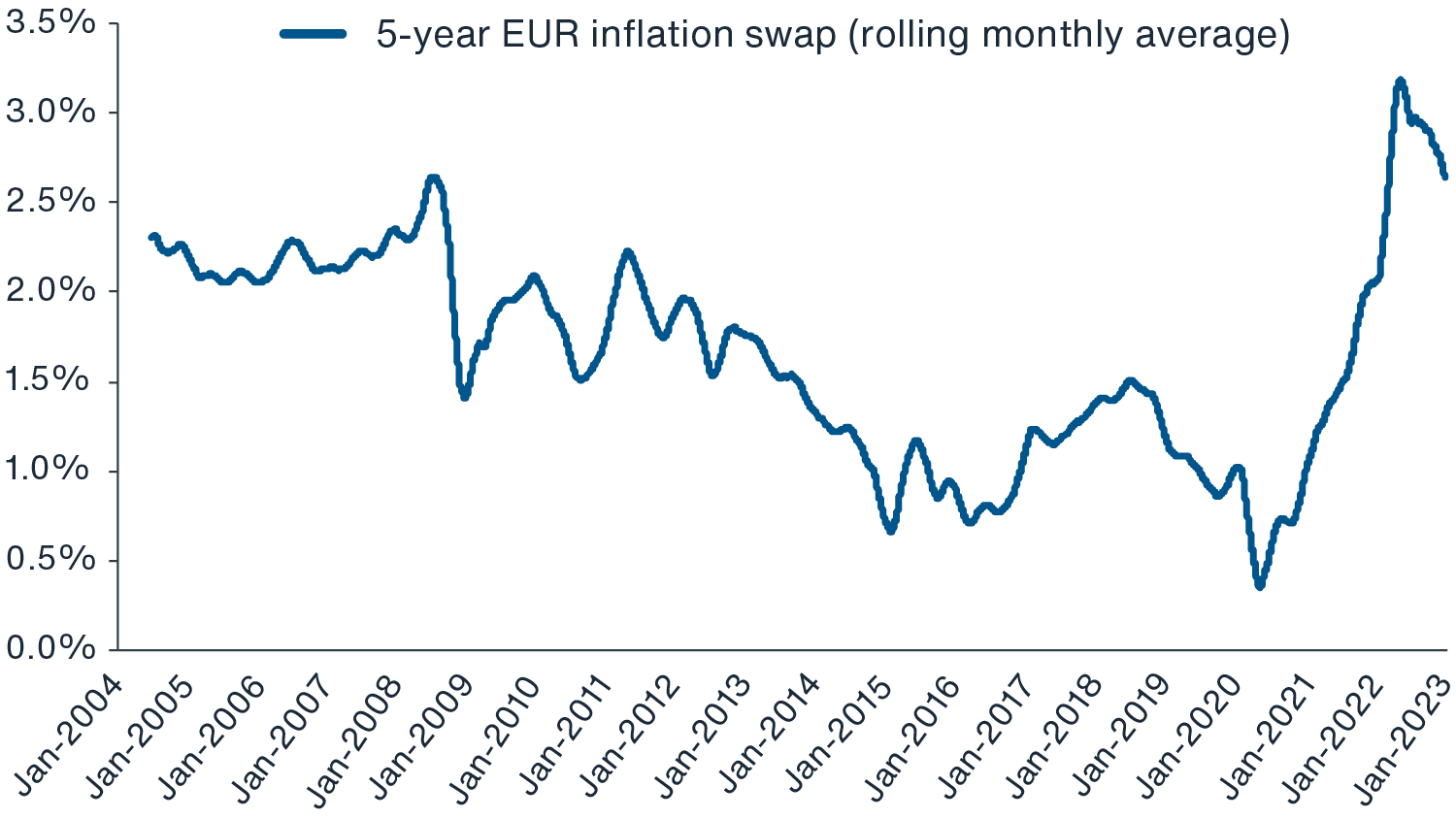

Inflation protection: European net lease cashflows are typically pegged to CPI, offering investors an effective inflation hedge in times of elevated inflation. Moreover, leveraging with fixed-rate debt results in an inflation multiplier effect. Inflation indexation is one of the attributes that sets apart long-let commercial property from typical fixed-income investments with similar return profiles. While inflation in Europe looks to have peaked6, long-term inflation expectations remain historically elevated (Figure 3). Falling and ageing population, tight labour markets, risk of renewed supply chain disruptions, slowing globalisation/de-globalisation, reshoring and the cost of the green transition may all contribute to above-average inflation levels in the years to come even when some of the current inflationary pressures abate.

FIGURE 3: LONG TERM INFLATION EXPECTATIONS HAVE MODERATED BUT REMAIN ELEVATED

Source: Bloomberg, Clarion Partners Investment Research, January 2023.

Untapped opportunity: The European net lease property market remains relatively unexplored, with only a few specialist investors active in the space, mostly focussed on core returns profile. While some US investment managers have been active in this space from as early as the 1970s, it is only in the late 1990s that net lease funds have made their appearance in Europe. These funds have been overwhelmingly UK-focused to date. This presents investors a potential opportunity to secure competitively priced long-income at this point in the property cycle.

CONCLUSION

Inflation and economic volatility and uncertainty are likely to remain features of the European economy during 2023, and possibly beyond. In this environment, Clarion Partners believes that investors should consider capital allocations to defensive income-focused strategies such as net lease.

Reau, France